PropTech combines property with technology. The word is used to describe technological innovations created for the real estate industry. In its broadest sense, proptech in commercial real estate is used to reduce or eliminate many of the routine CRE tasks in transactions, valuation, property management and leasing.

Most industries are being disrupted by technology, and the commercial real estate sector is no exception. CRE proptech tools are being developed for investors, builders, and developers, for landlords and property managers, and even for governments building out smart cities.

Three Common Examples of PropTech in Commercial Real Estate

While the word ‘PropTech’ might sound new, the use of property technology in commercial real estate has existed for quite some time. Three examples of proptech currently being used in the commercial real estate industry include:

- Property websites that serve as online portals to allow buyers and sellers, brokers and tenants, and property managers to search for market information. Zillow, CommercialCafe, and RENTCafé are three of many examples.

- Commercial real estate software platforms such as Yardi provide property management, asset management, and CRM (customer relationship management) systems to automate and streamline many routine tasks in commercial real estate.

- Virtual tours created with interactive 3D imaging software allow leasing agents and brokers to create online tours of commercial property listed for sale or lease.

Investments in PropTech Are Rapidly Growing

PropTech disruption in commercial real estate is just beginning. Investment in property technology is one of the most rapidly growing global investment sectors. The rise of investments in proptech is fueled in large part by the increasing demand for real-time and transparent information from investors and building managers.

The Global PropTech Confidence Index is published semi-annually and provides the most up-to-date insights on investments in proptech by startup CEOs and capital investors. The most recent Index notes that:

- 96% of investors plan on making the same number or more investments in proptech,

- 57% of investors expect to see more proptech investment opportunities over the next 12 months,

- 44% of CEOs at startup proptech companies say they’ve been operating for at least three years,

- 36% of proptech investments are exceeding customer growth expectations.

Five Recent PropTech Developments in CRE

This dramatic investment growth is creating proptech developments that will continue to disrupt the commercial real estate industry. Five of the most recent property technology developments in CRE include:

- Blockchain technology enabling secure online contract transactions between buyers and sellers, potentially reducing or even eliminating the need for title and escrow companies,

- Internet of Things (IoT) used to create smart technologies such as temperature sensors and predictive maintenance systems in LEED Certified buildings and ENERGY STAR compliant properties,

- Drones to capture aerial images of existing commercial property or projects under development,

- Augmented virtual reality (AVR) headsets that allow buyers or tenants to immerse themselves in 3D property layouts and floorplans instead of trying to interpret traditional two-dimensional blueprints,

- Artificial intelligence (AI) to analyze big data sets used for property appraisals, cost estimating, maintenance planning, and smart city development and management.

Using PropTech to Improve the Tenant Experience

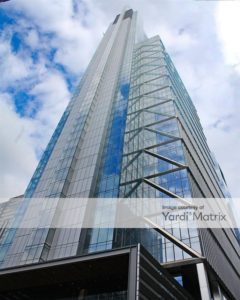

The Comcast Technology Center in Philadelphia is the most technologically advanced building in the U.S., incorporating smart environment readings that allow it to adjust lighting and temperature in real time, state-of-the-art glass that maximizes natural lighting while also helping to regulate inside temperature, and more! (image courtesy of Yardi Matrix)

PropTech innovations can also be used to improve the tenant experience by applying location-aware capabilities to commercial real estate.

Apps such as Uber and Yelp integrate location awareness as a key element of their functionality. PropTech apps for office buildings can do the same thing for commercial real estate by connecting users of space to property managers and landlords. In addition to providing valuable user insights, occupants’ experience will become less generic and more personalized and responsive.

For example, when tenants walk into their office, lighting and temperature will automatically be adjusted to their personal preference, their favorite music playlist will be launched, and conference room availability for the afternoon client meeting will be displayed on their notebook.

Office space is changing from a fixed product to a flexible service. PropTech will accelerate this transformation by playing a key role in meeting the changing demands and expectations of tenants, in a manner similar to the way that coworking space is doing this today.

How PropTech will provide a strategic advantage for the CRE industry

There are two key ways that proptech in commercial real estate will provide a strategic advantage for property owners and managers:

- New construction that integrates property technology into design will command premium prices and force owners of older buildings to upgrade their analog technology with digital systems to remain competitive.

- PropTech systems will provide landlords with valuable real-time information on occupancy and vacancy, energy consumption, and maintenance needs. The use of property technology will remove existing information silos and take the guesswork out of commercial real estate investing and property management.

By improving the experience of users of commercial space and accelerating the use of shared real estate space and services, commercial real estate investments utilizing property technology will become more profitable and provide a competitive edge against building owners that refuse to adapt to the changing marketplace.