Greenville, SC Office Spaces for Rent

Find your best Greenville, SC office space among 143 for rent listings, which average an asking price of $24.3 per square foot.

-

355 South Main Street 1st & 2nd Floor, Greenville, SCServices

355 South Main Street 1st & 2nd Floor, Greenville, SCServices- Virtual Office

- Open Workspace

- Private Office

- Dedicated Desk

Amenities -

800 Pelham Rd, Overbrook, Greenville, SCProperty

800 Pelham Rd, Overbrook, Greenville, SCProperty- Office

- 46,932 SF

Availability- 1 Space

- 13,147 SF

Year Built- 1985

For Lease Contact for pricing -

131 Commonwealth Drive, Overbrook, Greenville, SCProperty

131 Commonwealth Drive, Overbrook, Greenville, SCProperty- Office

- 62,724 SF

Availability- 2 Spaces

- 3,942 SF

Year Built- 2000

For Lease Contact for pricing -

116 N Markley St, Payne-Logan, Greenville, SC

116 N Markley St, Payne-Logan, Greenville, SC -

10 Enterprise Blvd., Overbrook, Greenville, SCProperty

10 Enterprise Blvd., Overbrook, Greenville, SCProperty- Office

- 45,200 SF

Availability- 1 Space

- 3,230 SF

Year Built- 1987

For Lease- $25.00/SF/YR

-

110 Frederick Street, Nicholtown, Greenville, SCProperty

110 Frederick Street, Nicholtown, Greenville, SCProperty- Office

- 47,615 SF

Availability- 2 Spaces

- 16,253 SF

Year Built- 1962

For Lease Contact for pricing -

777 Lowndes Hill Road, Overbrook, Greenville, SCProperty

777 Lowndes Hill Road, Overbrook, Greenville, SCProperty- Office

- 72,094 SF

Availability- 7 Spaces

- 36,985 SF

Year Built- 1984

For Lease- $23.50 - $24.50/SF/YR

-

130 S Main St, Downtown Greenville, Greenville, SCProperty

130 S Main St, Downtown Greenville, Greenville, SCProperty- Office

- 31,685 SF

Availability- 1 Space

- 2,137 SF

For Lease- $28.00/SF/YR

-

109 Laurens Rd, Arcadia Hills, Greenville, SCProperty

109 Laurens Rd, Arcadia Hills, Greenville, SCProperty- Office

- 7,000 SF

Availability- 1 Space

- 2,319 SF

Year Built- 1991

For Lease- $20.00/SF/YR

-

10 Falcon Crest Drive, Overbrook, Greenville, SCProperty

10 Falcon Crest Drive, Overbrook, Greenville, SCProperty- Office

- 81,400 SF

Availability- 1 Space

- 1,804 SF

Year Built- 1994

For Lease- $21.00/SF/YR

-

556 Perry Avenue, West Greenville, Greenville, SCProperty

556 Perry Avenue, West Greenville, Greenville, SCProperty- Office

- 66,597 SF

Availability- 1 Space

- 1,579 SF

Year Built- 1997

For Lease Contact for pricing -

109 W Antrim Dr, Nicholtown, Greenville, SCProperty

109 W Antrim Dr, Nicholtown, Greenville, SCProperty- Office

- 1,000 SF

Availability- 1 Space

- 1,000 SF

For Lease- $1,600.00/MO

-

203 Rutherford Rd, Brutontown, Greenville, SC

203 Rutherford Rd, Brutontown, Greenville, SC -

104 South Main Street, Greenville, SC

104 South Main Street, Greenville, SC104 South Main Street

Thrive CoworkingServices- Virtual Office

- Meeting Room

Amenities -

11 Brendan Way, Overbrook, Greenville, SCProperty

11 Brendan Way, Overbrook, Greenville, SCProperty- Office

- 39,504 SF

Availability- 1 Space

- 1,400 SF

Year Built- 2001

For Lease- $24.75/SF/YR

-

130 South Main Street, Downtown Greenville, Greenville, SCProperty

130 South Main Street, Downtown Greenville, Greenville, SCProperty- Office

- 32,500 SF

Availability- 2 Spaces

- 4,287 SF

Year Built- 1918

For Lease- $28.00/SF/YR

-

414 Pettigru St, Pettigru Street, Greenville, SCProperty

414 Pettigru St, Pettigru Street, Greenville, SCProperty- Office

- 2,500 SF

Availability- 1 Space

- 2,500 SF

Year Built- 1988

For Lease- $18.00/SF/YR

-

148 River Street, Downtown Greenville, Greenville, SCProperty

148 River Street, Downtown Greenville, Greenville, SCProperty- Office

- 45,100 SF

Availability- 1 Space

- 4,721 SF

Year Built- 1908

For Lease- $28.00/SF/YR

-

30 Patewood Drive, Overbrook, Greenville, SCProperty

30 Patewood Drive, Overbrook, Greenville, SCProperty- Office

- 117,000 SF

Availability- 2 Spaces

- 7,915 SF

Year Built- 1985

For Lease- $25.50 - $26.50/SF/YR

-

55 East Camperdown Way, Downtown Greenville, Greenville, SCProperty

55 East Camperdown Way, Downtown Greenville, Greenville, SCProperty- Office

- 104,040 SF

Availability- 6 Spaces

- 65,656 SF

Year Built- 1992

For Lease- $34.00/SF/YR

-

1429 Augusta St, Augusta Street Area, Greenville, SC

1429 Augusta St, Augusta Street Area, Greenville, SC -

301 Augusta Street , Downtown Greenville, Greenville, SC

301 Augusta Street , Downtown Greenville, Greenville, SC -

220 N Main St, Downtown Greenville, Greenville, SCProperty

220 N Main St, Downtown Greenville, Greenville, SCProperty- Office

- 86,483 SF

Availability- 5 Spaces

- 41,670 SF

Year Built- 1982

For Lease Contact for pricing -

355 South Main Street, Downtown Greenville, Greenville, SCProperty

355 South Main Street, Downtown Greenville, Greenville, SCProperty- Office

- 224,300 SF

Availability- 5 Spaces

- 22,518 SF

Year Built- 2021

For Lease- $47.50/SF/YR

-

135 Commonwealth Drive, Overbrook, Greenville, SC

135 Commonwealth Drive, Overbrook, Greenville, SC -

300 East McBee Avenue, Downtown Greenville, Greenville, SCProperty

300 East McBee Avenue, Downtown Greenville, Greenville, SCProperty- Office

- 165,195 SF

Availability- 4 Spaces

- 15,227 SF

Year Built- 1984

For Lease- $41.50/SF/YR

-

.jpg?width=450) 10 Enterprise Boulevard, Overbrook, Greenville, SCProperty

10 Enterprise Boulevard, Overbrook, Greenville, SCProperty- Office

- 42,709 SF

Availability- 1 Space

- 3,230 SF

Year Built- 1987

For Lease Contact for pricing -

104 S Main St, Downtown Greenville, Greenville, SC

104 S Main St, Downtown Greenville, Greenville, SC -

50 International Drive, Overbrook, Greenville, SCProperty

50 International Drive, Overbrook, Greenville, SCProperty- Office

- 62,363 SF

Availability- 1 Space

- 5,118 SF

Year Built- 1988

For Lease Contact for pricing -

15 Brendan Way, Overbrook, Greenville, SCProperty

15 Brendan Way, Overbrook, Greenville, SCProperty- Office

- 38,921 SF

Availability- 4 Spaces

- 15,339 SF

Year Built- 1988

For Lease- $22.50/SF/YR

-

15 S Main St, Downtown Greenville, Greenville, SC

15 S Main St, Downtown Greenville, Greenville, SC -

50 International Drive, Overbrook, Greenville, SCProperty

50 International Drive, Overbrook, Greenville, SCProperty- Office

- 61,649 SF

Availability- 1 Space

- 20,337 SF

Year Built- 1989

For Lease- $26.50/SF/YR

-

55 Beattie Place, East Park, Greenville, SCProperty

55 Beattie Place, East Park, Greenville, SCProperty- Office

- 248,563 SF

Availability- 5 Spaces

- 38,625 SF

Year Built- 1983

For Lease- $36.50/SF/YR

-

80 International Drive, Overbrook, Greenville, SCProperty

80 International Drive, Overbrook, Greenville, SCProperty- Office

- 103,596 SF

Availability- 1 Space

- 12,083 SF

Year Built- 1990

For Lease- $26.50/SF/YR

-

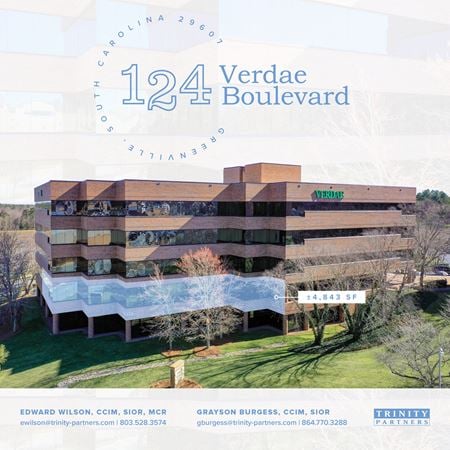

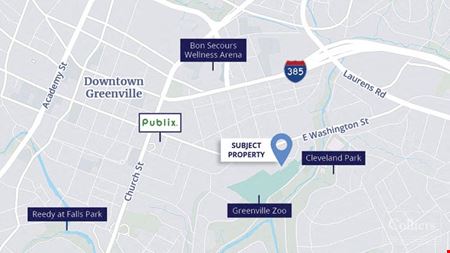

124 Verdae Blvd, Verdae, Greenville, SCProperty

124 Verdae Blvd, Verdae, Greenville, SCProperty- Office

- 101,795 SF

Availability- 1 Space

- 4,843 SF

For Lease- $22.50/SF/YR

-

710 Lowndes Hill Rd, Arcadia Hills, Greenville, SCProperty

710 Lowndes Hill Rd, Arcadia Hills, Greenville, SCProperty- Office

- 8,970 SF

Availability- 1 Space

- 1,530 SF

For Lease- $16.50/SF/YR

-

743 Congaree Road, Verdae, Greenville, SCProperty

743 Congaree Road, Verdae, Greenville, SCProperty- Office

- 20,000 SF

Availability- 1 Space

- 4,000 SF

For Lease- $7.00/SF/YR

-

9 Washington Park, McBee Avenue Area, Greenville, SC

9 Washington Park, McBee Avenue Area, Greenville, SC -

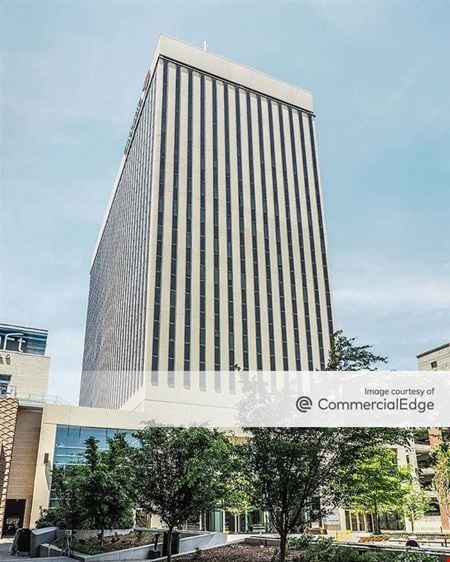

101 North Main Street, Downtown Greenville, Greenville, SCProperty

101 North Main Street, Downtown Greenville, Greenville, SCProperty- Office

- 196,152 SF

Availability- 5 Spaces

- 23,893 SF

Year Built- 1974

For Lease- $31.50/SF/YR

-

200 East Broad Street, Downtown Greenville, Greenville, SCProperty

200 East Broad Street, Downtown Greenville, Greenville, SCProperty- Office

- 108,000 SF

Availability- 1 Space

- 4,510 SF

Year Built- 2002

For Lease- $32.00/SF/YR

-

10 Patewood Drive, Overbrook, Greenville, SCProperty

10 Patewood Drive, Overbrook, Greenville, SCProperty- Office

- 107,274 SF

Availability- 5 Spaces

- 31,122 SF

Year Built- 2000

For Lease- $26.50/SF/YR

-

84 Villa Road, Overbrook, Greenville, SCProperty

84 Villa Road, Overbrook, Greenville, SCProperty- Office

- 42,000 SF

Availability- 8 Spaces

- 27,932 SF

Year Built- 1984

For Lease- $21.50/SF/YR

-

75 Beattie Place, East Park, Greenville, SCProperty

75 Beattie Place, East Park, Greenville, SCProperty- Office

- 185,658 SF

Availability- 10 Spaces

- 83,933 SF

Year Built- 1986

For Lease- $36.50/SF/YR

-

701 Millennium Blvd, Verdae, Greenville, SCProperty

701 Millennium Blvd, Verdae, Greenville, SCProperty- Office

- 185,000 SF

Availability- 2 Spaces

- 62,604 SF

Year Built- 2007

For Lease- $28.00/SF/YR

-

1621 East North Street, Greenline, Greenville, SCProperty

1621 East North Street, Greenline, Greenville, SCProperty- Office

- 1,800 SF

Availability- 1 Space

- 1,800 SF

For Lease- $23.00/SF/YR

-

400 Augusta Street, Green Avenue, Greenville, SCProperty

400 Augusta Street, Green Avenue, Greenville, SCProperty- Office

- 45,810 SF

Availability- 1 Space

- 3,190 SF

Year Built- 1930

For Lease- $28.00/SF/YR

-

220 North Main Street Suite 500, Greenville, SC

220 North Main Street Suite 500, Greenville, SCNOMA Tower

RegusServices- Virtual Office

- Open Workspace

- Private Office

- Dedicated Desk

Amenities -

300 North Main Street, East Park, Greenville, SCProperty

300 North Main Street, East Park, Greenville, SCProperty- Office

- 61,047 SF

Availability- 3 Spaces

- 9,951 SF

Year Built- 1989

For Lease- $28.50/SF/YR

-

101 North Main Street #302, Greenville, SC

101 North Main Street #302, Greenville, SC101 North Main Street

OpenWorksServices- Open Workspace

- Event Space

- Meeting Room

- Dedicated Desk

Amenities -

340 Rocky Slope Rd, Verdae, Greenville, SCProperty

340 Rocky Slope Rd, Verdae, Greenville, SCProperty- Office

- 3,431 SF

Availability- 1 Space

- 3,431 SF

For Lease- $25.00/SF/YR

-

107 East Park Avenue, Greenville, SC

107 East Park Avenue, Greenville, SC107 East Park Avenue

Franklin Real Estate DevelopmentServices- Meeting Room

- Private Office

Amenities -

115 N Brown St, Downtown Greenville, Greenville, SCProperty

115 N Brown St, Downtown Greenville, Greenville, SCProperty- Office

- 9,370 SF

Availability- 1 Space

- 4,820 SF

For Lease- $18.00/SF/YR