Colorado Springs, CO Commercial Real Estate for Lease and Sale

Explore 540 listings of Colorado Springs commercial real estate to find the best space for your business.

-

227 Bonfoy Ave, Knob Hill, Colorado Springs, COProperty

227 Bonfoy Ave, Knob Hill, Colorado Springs, COProperty- Retail

- 2,010 SF

Year Built- 1981

For Sale- $545,000

-

5525 Erindale Dr ste 100, Colorado Springs, CO

5525 Erindale Dr ste 100, Colorado Springs, COMyBuddiesCoworking Erindale

My Buddies Coworking and Shared Office SpaceServices- Private Office

Amenities -

4325 N Nevada Ave, Garden Ranch, Colorado Springs, COProperty

4325 N Nevada Ave, Garden Ranch, Colorado Springs, COProperty- Office

- 6,061 SF

Availability- 1 Space

- 4,416 SF

Year Built- 1988

For Lease- $16.50/SF/YR

-

%20Colorado%20USA%20Coworking%20-%20Briargate%20Office%20Center.jpg?width=450) 1755 Telstar Drive 3rd Floor, Colorado Springs, CO

1755 Telstar Drive 3rd Floor, Colorado Springs, COBriargate

RegusServices- Virtual Office

- Open Workspace

- Private Office

- Dedicated Desk

Amenities -

What type of listing property are you looking for?

-

3920 North Union Blvd, Garden Ranch, Colorado Springs, COProperty

3920 North Union Blvd, Garden Ranch, Colorado Springs, COProperty- Office

- 100,081 SF

Availability- 3 Spaces

- 10,918 SF

Year Built- 2000

For Lease- $20.00/SF/YR

-

4302 Austin Bluffs Parkway, Wagon Trails, Colorado Springs, COProperty

4302 Austin Bluffs Parkway, Wagon Trails, Colorado Springs, COProperty- Retail

- 5,593 SF

Year Built- 1987

For Sale- $1,494,130.29

-

910 Pinon Ranch View, Pinecliff, Colorado Springs, COProperty

910 Pinon Ranch View, Pinecliff, Colorado Springs, COProperty- Office

- 14,467 SF

Year Built- 2007

For Sale- $2,600,000

-

175 South Union Blvd, Spring Creek, Colorado Springs, COProperty

175 South Union Blvd, Spring Creek, Colorado Springs, COProperty- Office

- 225,600 SF

Availability- 8 Spaces

- 80,400 SF

Year Built- 1999

For Lease- $21.00/SF/YR

-

6071 East Woodmen Road, Ridgeview, Colorado Springs, COProperty

6071 East Woodmen Road, Ridgeview, Colorado Springs, COProperty- Office

- 85,250 SF

Availability- 2 Spaces

- 9,492 SF

Year Built- 2007

For Lease- $26.00/SF/YR

-

2 North Nevada Avenue, Old North End, Colorado Springs, COProperty

2 North Nevada Avenue, Old North End, Colorado Springs, COProperty- Office

- 257,253 SF

Availability- 7 Spaces

- 30,455 SF

Year Built- 1976

For Lease- $17.00/SF/YR

-

NWC OF AUSTIN BLUFFS PKWY AND WOODMEN ROAD, Wagon Trails, Colorado Springs, COProperty

NWC OF AUSTIN BLUFFS PKWY AND WOODMEN ROAD, Wagon Trails, Colorado Springs, COProperty- VacantLand

For Sale- $1,380,000

-

3204 E Platte Ave, Knob Hill, Colorado Springs, COProperty

3204 E Platte Ave, Knob Hill, Colorado Springs, COProperty- Industrial

- 45,828 SF

Year Built- 1967

For Sale- $8,675,000

-

101 North Cascade Avenue, Old North End, Colorado Springs, COProperty

101 North Cascade Avenue, Old North End, Colorado Springs, COProperty- Office

- 29,165 SF

Availability- 3 Spaces

- 3,236 SF

Year Built- 1967

For Lease- $16.00 - $18.00/SF/YR

-

888 West Garden of the Gods Road, Pinecliff, Colorado Springs, COProperty

888 West Garden of the Gods Road, Pinecliff, Colorado Springs, COProperty- Office

- 29,639 SF

Availability- 1 Space

- 5,209 SF

Year Built- 1979

For Lease- $12.00/SF/YR

-

2020 N Academy, East Colorado Springs, Colorado Springs, COProperty

2020 N Academy, East Colorado Springs, Colorado Springs, COProperty- Office

- 67,197 SF

Availability- 12 Spaces

- 13,203 SF

Year Built- 1980

For Lease- $13.00 - $35.23/SF/YR

-

412-422 S 8th St, Skyway, Colorado Springs, COProperty

412-422 S 8th St, Skyway, Colorado Springs, COProperty- Retail

- 10,433 SF

Availability- 1 Space

- 2,350 SF

Year Built- 1957

For Lease- $12.00/SF/YR

-

6011 East Woodmen Road, Ridgeview, Colorado Springs, COProperty

6011 East Woodmen Road, Ridgeview, Colorado Springs, COProperty- Office

- 116,367 SF

Availability- 4 Spaces

- 20,587 SF

Year Built- 2007

For Lease Contact for pricing -

%20Colorado%20USA%20Reception%20-%20Alamo%20Corporate%20Center.jpg?width=450) 102 South Tejon Street Suite 1100, Colorado Springs, COServices

102 South Tejon Street Suite 1100, Colorado Springs, COServices- Virtual Office

- Open Workspace

- Private Office

- Dedicated Desk

Amenities -

2221 East Bijou Street, Knob Hill, Colorado Springs, COProperty

2221 East Bijou Street, Knob Hill, Colorado Springs, COProperty- Office

- 300,000 SF

Availability- 4 Spaces

- 63,228 SF

Year Built- 1963

For Lease- $15.00 - $17.00/SF/YR

-

10807 New Allegiance Drive, Interquest, Colorado Springs, COProperty

10807 New Allegiance Drive, Interquest, Colorado Springs, COProperty- Office

- 145,694 SF

Availability- 5 Spaces

- 30,295 SF

Year Built- 2008

For Lease- $24.00/SF/YR

-

517 South Tejon Street, Ivywild, Colorado Springs, COProperty

517 South Tejon Street, Ivywild, Colorado Springs, COProperty- Retail

- 3,825 SF

Availability- 1 Space

- 1,618 SF

Year Built- 1956

For Lease- $22.00/SF/YR

-

6780 North Academy Boulevard, Falcon Estates, Colorado Springs, COProperty

6780 North Academy Boulevard, Falcon Estates, Colorado Springs, COProperty- Retail

- 6,877 SF

Availability- 1 Space

- 2,856 SF

Year Built- 1974

For Lease- $15.00/SF/YR

-

324 E. Pikes Peak Ave., Old North End, Colorado Springs, COProperty

324 E. Pikes Peak Ave., Old North End, Colorado Springs, COProperty- Retail

- 18,305 SF

Availability- 1 Space

- 2,800 SF

For Lease- $14.00 - $24.00/SF/YR

-

128 South Tejon Street, Old North End, Colorado Springs, COProperty

128 South Tejon Street, Old North End, Colorado Springs, COProperty- Office

- 39,618 SF

Availability- 4 Spaces

- 17,409 SF

Year Built- 1900

For Lease- $16.00/SF/YR

-

.jpg?width=450) Property

Property- Office

- 113,203 SF

Availability Contact for availabilityYear Built- 1986

For Lease Contact for pricing -

4745 Town Center Drive, Eastborough, Colorado Springs, COProperty

4745 Town Center Drive, Eastborough, Colorado Springs, COProperty- Industrial

- 7,200 SF

Availability- 1 Space

- 7,200 SF

For Lease- $1.20/MO

-

502 S 8th St, Skyway, Colorado Springs, COProperty

502 S 8th St, Skyway, Colorado Springs, COProperty- Retail

- 3,015 SF

Availability- 1 Space

- 3,015 SF

Year Built- 1955

For Lease- $15.00/SF/YR

-

1426 N Academy Blvd, Knob Hill, Colorado Springs, COProperty

1426 N Academy Blvd, Knob Hill, Colorado Springs, COProperty- Retail

- 2,560 SF

Availability- 1 Space

- 2,560 SF

Year Built- 1985

For Lease Contact for pricing -

5550 Tech Center Drive, Suite 203, Colorado Springs, CO

5550 Tech Center Drive, Suite 203, Colorado Springs, COCoHarbor

CoHarbor CoworkingServices- Meeting Room

- Private Office

Amenities -

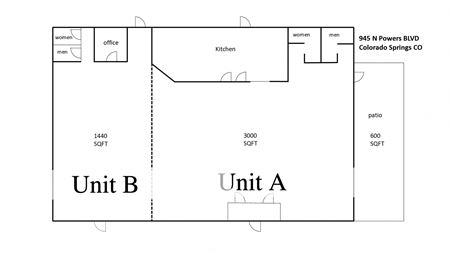

945 North Powers Boulevard, Cimarron Hills, Colorado Springs, COProperty

945 North Powers Boulevard, Cimarron Hills, Colorado Springs, COProperty- Retail

- 16,080 SF

Availability- 3 Spaces

- 8,880 SF

Year Built- 1982

For Lease- $20.00/SF/YR

-

118 N. Tejon Street, Old North End, Colorado Springs, COProperty

118 N. Tejon Street, Old North End, Colorado Springs, COProperty- Office

- 26,371 SF

Availability- 1 Space

- 987 SF

For Lease- $1,480.00/MO

-

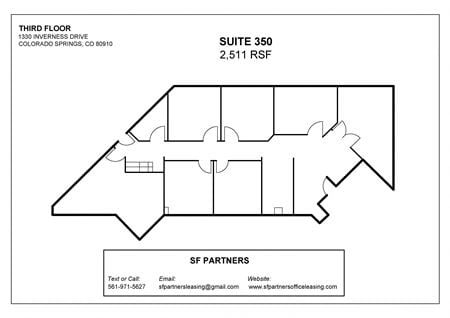

1330 Inverness Drive, Eastborough, Colorado Springs, COProperty

1330 Inverness Drive, Eastborough, Colorado Springs, COProperty- Office

- 2,511 SF

Availability Contact for availabilityYear Built- 1986

For Lease Contact for pricing -

410 South Twenty 6th Street, Skyway, Colorado Springs, COProperty

410 South Twenty 6th Street, Skyway, Colorado Springs, COProperty- VacantLand

For Sale- Subject To Offer

-

1625 Medical Center Point, Cragmoor, Colorado Springs, COProperty

1625 Medical Center Point, Cragmoor, Colorado Springs, COProperty- Office

- 70,045 SF

Availability- 2 Spaces

- 3,085 SF

Year Built- 1992

For Lease- $21.50/SF/YR

-

5825 Delmonico Drive #320, Colorado Springs, CO

5825 Delmonico Drive #320, Colorado Springs, CODelmonico Drive

RegusServices- Virtual Office

- Open Workspace

- Private Office

- Dedicated Desk

Amenities -

1755 Telstar Drive, Pine Creek, Colorado Springs, COProperty

1755 Telstar Drive, Pine Creek, Colorado Springs, COProperty- Office

- 156,311 SF

Availability- 3 Spaces

- 10,889 SF

Year Built- 1987

For Lease Contact for pricing -

4465 Northpark Drive, Garden Ranch, Colorado Springs, COProperty

4465 Northpark Drive, Garden Ranch, Colorado Springs, COProperty- Office

- 29,700 SF

Availability- 4 Spaces

- 2,525 SF

Year Built- 1972

For Lease- $650.00 - $1,400.00/MO

-

104 South Cascade Avenue, Old North End, Colorado Springs, COProperty

104 South Cascade Avenue, Old North End, Colorado Springs, COProperty- Office

- 59,000 SF

Availability- 3 Spaces

- 16,569 SF

Year Built- 1978

For Lease- $12.00 - $16.00/SF/YR

-

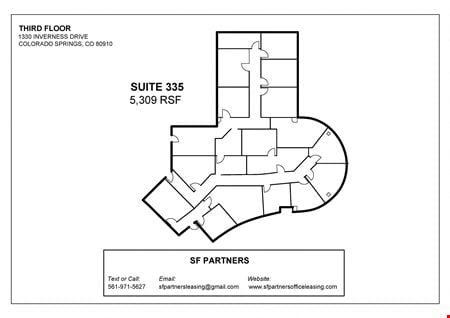

1330 Inverness Drive Colorado Springs, Eastborough, Colorado Springs, CO

1330 Inverness Drive Colorado Springs, Eastborough, Colorado Springs, CO -

2 North Cascade Avenue, Old North End, Colorado Springs, COProperty

2 North Cascade Avenue, Old North End, Colorado Springs, COProperty- Office

- 149,429 SF

Availability- 11 Spaces

- 36,066 SF

Year Built- 1968

For Lease Contact for pricing -

18 E Monument St, Old North End, Colorado Springs, COProperty

- Office

- 2,540 SF

Year Built- 1899

For Sale- $799,000

-

5450 Tech Center Drive, Pinecliff, Colorado Springs, COProperty

5450 Tech Center Drive, Pinecliff, Colorado Springs, COProperty- Office

- 111,788 SF

Availability- 2 Spaces

- 34,056 SF

Year Built- 1981

For Lease Contact for pricing -

7222 Commerce Center Drive #220, Colorado Springs, CO

7222 Commerce Center Drive #220, Colorado Springs, COOne Commerce Center

Front Range Coworking Inc.Services- Virtual Office

- Open Workspace

- Meeting Room

Amenities -

555 North Chelton Road, Knob Hill, Colorado Springs, CO

555 North Chelton Road, Knob Hill, Colorado Springs, CO -

536 Chapel Hills Drive, Pine Creek, Colorado Springs, COProperty

536 Chapel Hills Drive, Pine Creek, Colorado Springs, COProperty- Office

- 90,476 SF

Availability- 1 Space

- 37,295 SF

Year Built- 2000

For Lease- $13.50 - $14.50/SF/YR

-

4625 Town Center Dr, Eastborough, Colorado Springs, COProperty

4625 Town Center Dr, Eastborough, Colorado Springs, COProperty- Industrial

- 12,303 SF

Availability- 1 Space

- 12,303 SF

Year Built- 2001

For Lease- $14.95/SF/YR

-

1155 Kelly Johnson Blvd, Anderosa, Colorado Springs, COProperty

1155 Kelly Johnson Blvd, Anderosa, Colorado Springs, COProperty- Office

- 81,222 SF

Availability- 6 Spaces

- 20,529 SF

Year Built- 1985

For Lease- $20.00/SF/YR

-

1235 Lake Plaza Drive, Broadmoor, Colorado Springs, COProperty

1235 Lake Plaza Drive, Broadmoor, Colorado Springs, COProperty- Office

- 33,072 SF

Availability- 2 Spaces

- 2,083 SF

Year Built- 1976

For Lease- $1,250.00 - $1,950.00/MO

-

1975 Research Pkwy, Briargate, Colorado Springs, COProperty

1975 Research Pkwy, Briargate, Colorado Springs, COProperty- Office

- 115,260 SF

Availability- 4 Spaces

- 12,146 SF

Year Built- 1997

For Lease Contact for pricing -

1370 Interquest Pkwy, Interquest, Colorado Springs, COProperty

1370 Interquest Pkwy, Interquest, Colorado Springs, COProperty- Office

- 60,000 SF

Availability- 1 Space

- 16,169 SF

Year Built- 2023

For Lease Contact for pricing -

345 N Academy Blvd, Eastborough, Colorado Springs, COProperty

345 N Academy Blvd, Eastborough, Colorado Springs, COProperty- Retail

- 42,895 SF

Availability- 1 Space

- 42,895 SF

Year Built- 1995

For Lease Contact for pricing -

1855 Aeroplaza Drive, Gateway Park, Colorado Springs, COProperty

1855 Aeroplaza Drive, Gateway Park, Colorado Springs, COProperty- Other

- 3.1 Acre

Year Built- 2000

For Sale- $10,000,000