Colorado Springs, CO Office Spaces for Rent

Find your best Colorado Springs, CO office space among 406 for rent listings, which average an asking price of $23.04 per square foot.

-

6760 Corporate Drive, Colorado Springs, COServices

6760 Corporate Drive, Colorado Springs, COServices- Virtual Office

- Open Workspace

- Private Office

- Dedicated Desk

Amenities -

6860 Campus Drive, Falcon Estates, Colorado Springs, COProperty

6860 Campus Drive, Falcon Estates, Colorado Springs, COProperty- Office

- 140,583 SF

Availability- 3 Spaces

- 141,126 SF

Year Built- 1982

For Lease- $9.50 - $17.00/SF/YR

-

5525 Erindale Dr ste 100, Colorado Springs, CO

5525 Erindale Dr ste 100, Colorado Springs, COMyBuddiesCoworking Erindale

My Buddies Coworking and Shared Office SpaceServices- Private Office

Amenities -

1365 West Garden of the Gods Road, Kissing Camels, Colorado Springs, COProperty

1365 West Garden of the Gods Road, Kissing Camels, Colorado Springs, COProperty- Office

- 64,122 SF

Availability- 1 Space

- 5,219 SF

Year Built- 1981

For Lease Contact for pricing -

.jpg?width=450) 1130 inverness st colorado springs, Eastborough, Colorado Springs, CO

1130 inverness st colorado springs, Eastborough, Colorado Springs, CO -

102 N. Cascade Ave, Old North End, Colorado Springs, COProperty

102 N. Cascade Ave, Old North End, Colorado Springs, COProperty- Office

- 69,583 SF

Availability- 6 Spaces

- 29,571 SF

Year Built- 1971

For Lease- $12.00 - $17.00/SF/YR

-

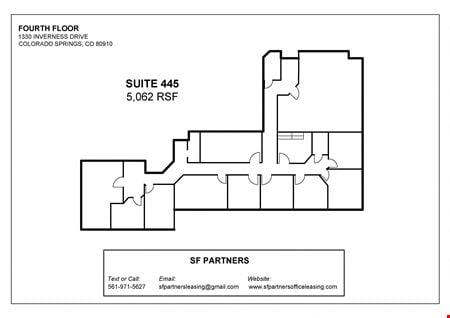

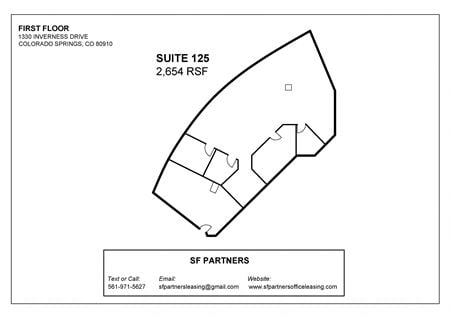

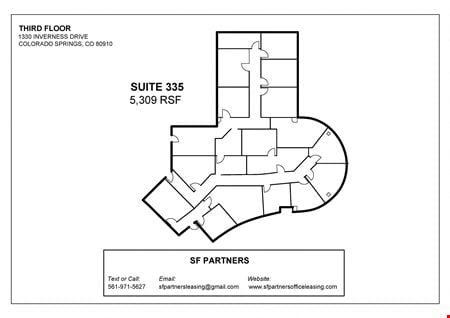

1330 Inverness Drive, Eastborough, Colorado Springs, COProperty

1330 Inverness Drive, Eastborough, Colorado Springs, COProperty- Office

- 113,203 SF

Availability- 11 Spaces

- 52,520 SF

Year Built- 1986

For Lease Contact for pricing -

2020 North Academy Boulevard 2nd Floor, Colorado Springs, CO

2020 North Academy Boulevard 2nd Floor, Colorado Springs, CO2020 N Academy

Workstyle Flexible SpacesServices- Private Office

Amenities -

7222 Commerce Center Drive #220, Colorado Springs, CO

7222 Commerce Center Drive #220, Colorado Springs, COOne Commerce Center

Front Range Coworking Inc.Services- Virtual Office

- Open Workspace

- Meeting Room

Amenities -

8605 Explorer Drive, Pine Creek, Colorado Springs, COProperty

8605 Explorer Drive, Pine Creek, Colorado Springs, COProperty- Office

- 417,445 SF

Availability- 1 Space

- 4,241 SF

Year Built- 1992

For Lease- $15.50/SF/YR

-

910 Pinon Ranch View, Pinecliff, Colorado Springs, COProperty

910 Pinon Ranch View, Pinecliff, Colorado Springs, COProperty- Office

- 14,467 SF

Availability- 1 Space

- 3,581 SF

Year Built- 2007

For Lease- $13.50/SF/YR

-

1975 Research Pkwy, Briargate, Colorado Springs, COProperty

1975 Research Pkwy, Briargate, Colorado Springs, COProperty- Office

- 115,260 SF

Availability- 4 Spaces

- 12,146 SF

Year Built- 1997

For Lease Contact for pricing -

4820 Centennial Blvd, Kissing Camels, Colorado Springs, COProperty

4820 Centennial Blvd, Kissing Camels, Colorado Springs, COProperty- Office

- 50,760 SF

Availability- 3 Spaces

- 40,214 SF

Year Built- 1999

For Lease- $16.00/SF/YR

-

2315 Briargate Pkwy, Pine Creek, Colorado Springs, COProperty

2315 Briargate Pkwy, Pine Creek, Colorado Springs, COProperty- Office

- 125,238 SF

Availability- 3 Spaces

- 62,872 SF

Year Built- 1999

For Lease- $13.50 - $14.50/SF/YR

-

2020 N Academy, East Colorado Springs, Colorado Springs, COProperty

2020 N Academy, East Colorado Springs, Colorado Springs, COProperty- Office

- 67,197 SF

Availability- 15 Spaces

- 13,753 SF

Year Built- 1980

For Lease- $13.00 - $35.23/SF/YR

-

6380 Corporate Centre Circle, Falcon Estates, Colorado Springs, COProperty

6380 Corporate Centre Circle, Falcon Estates, Colorado Springs, COProperty- Office

- 29,712 SF

Availability- 5 Spaces

- 8,590 SF

Year Built- 2007

For Lease- $22.00/SF/YR

-

4775 Centennial Blvd, Pinecliff, Colorado Springs, COProperty

4775 Centennial Blvd, Pinecliff, Colorado Springs, COProperty- Office

- 38,374 SF

Availability- 2 Spaces

- 6,747 SF

Year Built- 1981

For Lease- $14.00/SF/YR

-

7250 Campus Drive, Anderosa, Colorado Springs, COProperty

7250 Campus Drive, Anderosa, Colorado Springs, COProperty- Office

- 74,920 SF

Availability- 1 Space

- 37,460 SF

Year Built- 1998

For Lease Contact for pricing -

707 N Nevada Ave, Old North End, Colorado Springs, COProperty

707 N Nevada Ave, Old North End, Colorado Springs, COProperty- Office

- 9,850 SF

Availability- 1 Space

- 300 SF

Year Built- 1960

For Lease- $700.00/MO

-

618-620 N Tejon St, Old North End, Colorado Springs, COProperty

618-620 N Tejon St, Old North End, Colorado Springs, COProperty- Office

- 12,378 SF

Availability- 3 Spaces

- 5,719 SF

Year Built- 1952

For Lease- $17.00 - $18.00/SF/YR

-

1050 South Academy Blvd, Spring Creek, Colorado Springs, COProperty

1050 South Academy Blvd, Spring Creek, Colorado Springs, COProperty- Industrial

- 77,700 SF

Availability- 8 Spaces

- 33,067 SF

Year Built- 1981

For Lease- $10.50 - $12.50/SF/YR

-

104 South Cascade Avenue, Old North End, Colorado Springs, COProperty

104 South Cascade Avenue, Old North End, Colorado Springs, COProperty- Office

- 59,000 SF

Availability- 3 Spaces

- 16,569 SF

Year Built- 1978

For Lease- $12.00 - $16.00/SF/YR

-

.jpg?width=450) Property

Property- Office

- 113,203 SF

Availability Contact for availabilityYear Built- 1986

For Lease Contact for pricing -

5775 Mark Dabling Blvd, Falcon Estates, Colorado Springs, COProperty

5775 Mark Dabling Blvd, Falcon Estates, Colorado Springs, COProperty- Office

- 108,349 SF

Availability- 6 Spaces

- 22,204 SF

Year Built- 1984

For Lease- $19.00/SF/YR

-

1755 Telstar Drive, Pine Creek, Colorado Springs, COProperty

1755 Telstar Drive, Pine Creek, Colorado Springs, COProperty- Office

- 156,311 SF

Availability- 3 Spaces

- 10,889 SF

Year Built- 1987

For Lease Contact for pricing -

5450 Tech Center Drive, Pinecliff, Colorado Springs, COProperty

5450 Tech Center Drive, Pinecliff, Colorado Springs, COProperty- Office

- 111,788 SF

Availability- 2 Spaces

- 34,056 SF

Year Built- 1981

For Lease Contact for pricing -

2925 Professional Place, Kissing Camels, Colorado Springs, COProperty

2925 Professional Place, Kissing Camels, Colorado Springs, COProperty- Office

- 70,995 SF

Availability- 1 Space

- 1,368 SF

Year Built- 1999

For Lease Contact for pricing -

1330 colorado springs, Old Colorado City, Colorado Springs, CO

1330 colorado springs, Old Colorado City, Colorado Springs, CO -

8540 Scarborough Drive, Pine Creek, Colorado Springs, COProperty

8540 Scarborough Drive, Pine Creek, Colorado Springs, COProperty- Office

- 42,770 SF

Availability- 1 Space

- 3,086 SF

Year Built- 2007

For Lease- $20.00/SF/YR

-

620 Southpointe Ct, Broadmoor, Colorado Springs, COProperty

620 Southpointe Ct, Broadmoor, Colorado Springs, COProperty- Office

- 20,809 SF

Availability- 2 Spaces

- 2,654 SF

Year Built- 1981

For Lease- $10.00/SF/YR

-

3920 North Union Blvd, Garden Ranch, Colorado Springs, COProperty

3920 North Union Blvd, Garden Ranch, Colorado Springs, COProperty- Office

- 100,081 SF

Availability- 3 Spaces

- 10,918 SF

Year Built- 2000

For Lease- $20.00/SF/YR

-

1130 inverness st. colorado springs, Eastborough, Colorado Springs, CO

1130 inverness st. colorado springs, Eastborough, Colorado Springs, CO -

1355 West Garden of the Gods Road, Kissing Camels, Colorado Springs, COProperty

1355 West Garden of the Gods Road, Kissing Camels, Colorado Springs, COProperty- Office

- 51,256 SF

Availability- 1 Space

- 25,530 SF

Year Built- 1999

For Lease- $16.50/SF/YR

-

985 Space Center Drive, Rustic Hills, Colorado Springs, COProperty

985 Space Center Drive, Rustic Hills, Colorado Springs, COProperty- Office

- 103,183 SF

Availability- 8 Spaces

- 33,149 SF

Year Built- 1989

For Lease- $19.00/SF/YR

-

888 West Garden of the Gods Road, Pinecliff, Colorado Springs, COProperty

888 West Garden of the Gods Road, Pinecliff, Colorado Springs, COProperty- Office

- 29,639 SF

Availability- 1 Space

- 5,209 SF

Year Built- 1979

For Lease- $12.00/SF/YR

-

6 S. Tejon St, Old North End, Colorado Springs, COProperty

6 S. Tejon St, Old North End, Colorado Springs, COProperty- Office

- 51,601 SF

Availability- 7 Spaces

- 17,564 SF

Year Built- 1921

For Lease Contact for pricing -

3505 Austin Bluffs Pkwy, East Colorado Springs, Colorado Springs, COProperty

3505 Austin Bluffs Pkwy, East Colorado Springs, Colorado Springs, COProperty- Office

- 30,937 SF

Availability- 2 Spaces

- 2,355 SF

Year Built- 1973

For Lease Contact for pricing -

685 Citadel Drive East, Knob Hill, Colorado Springs, COProperty

685 Citadel Drive East, Knob Hill, Colorado Springs, COProperty- Office

- 103,188 SF

Availability- 27 Spaces

- 35,964 SF

Year Built- 1983

For Lease- $11.31 - $25.00/SF/YR

-

2375 Telstar Drive, Briargate, Colorado Springs, COProperty

2375 Telstar Drive, Briargate, Colorado Springs, COProperty- Office

- 95,392 SF

Availability- 3 Spaces

- 29,379 SF

Year Built- 1997

For Lease- $15.50 - $17.00/SF/YR

-

2221 East Bijou Street, Knob Hill, Colorado Springs, COProperty

2221 East Bijou Street, Knob Hill, Colorado Springs, COProperty- Office

- 300,000 SF

Availability- 4 Spaces

- 63,228 SF

Year Built- 1963

For Lease- $15.00 - $17.00/SF/YR

-

1370 Interquest Pkwy, Interquest, Colorado Springs, COProperty

1370 Interquest Pkwy, Interquest, Colorado Springs, COProperty- Office

- 60,000 SF

Availability- 1 Space

- 16,169 SF

Year Built- 2023

For Lease Contact for pricing -

9348 Grand Cordera Pkwy, Wolf Ranch, Colorado Springs, COProperty

9348 Grand Cordera Pkwy, Wolf Ranch, Colorado Springs, COProperty- Office

- 52,314 SF

Availability- 1 Space

- 4,789 SF

Year Built- 2007

For Lease- $20.00/SF/YR

-

1259 Lake Plaza Drive, Broadmoor, Colorado Springs, COProperty

1259 Lake Plaza Drive, Broadmoor, Colorado Springs, COProperty- Office

- 40,827 SF

Availability- 3 Spaces

- 25,704 SF

Year Built- 1986

For Lease- $16.50 - $17.50/SF/YR

-

4325 N Nevada Ave, Garden Ranch, Colorado Springs, COProperty

4325 N Nevada Ave, Garden Ranch, Colorado Springs, COProperty- Office

- 6,061 SF

Availability- 1 Space

- 4,416 SF

Year Built- 1988

For Lease- $16.50/SF/YR

-

%20Colorado%20USA%20Coworking%20-%20Briargate%20Office%20Center.jpg?width=450) 1755 Telstar Drive 3rd Floor, Colorado Springs, CO

1755 Telstar Drive 3rd Floor, Colorado Springs, COBriargate

RegusServices- Virtual Office

- Open Workspace

- Private Office

- Dedicated Desk

Amenities -

1155 Kelly Johnson Blvd, Anderosa, Colorado Springs, COProperty

1155 Kelly Johnson Blvd, Anderosa, Colorado Springs, COProperty- Office

- 81,222 SF

Availability- 6 Spaces

- 20,529 SF

Year Built- 1985

For Lease- $20.00/SF/YR

-

8245 North Union Blvd, Briargate, Colorado Springs, COProperty

8245 North Union Blvd, Briargate, Colorado Springs, COProperty- Office

- 286,650 SF

Availability- 2 Spaces

- 250,584 SF

Year Built- 1984

For Lease- $6.50/SF/YR

-

1330 Inverness Drive Colorado Springs, Eastborough, Colorado Springs, CO

1330 Inverness Drive Colorado Springs, Eastborough, Colorado Springs, CO -

6071 East Woodmen Road, Ridgeview, Colorado Springs, COProperty

6071 East Woodmen Road, Ridgeview, Colorado Springs, COProperty- Office

- 85,250 SF

Availability- 2 Spaces

- 9,492 SF

Year Built- 2007

For Lease- $26.00/SF/YR

-

5825 Delmonico Drive #320, Colorado Springs, CO

5825 Delmonico Drive #320, Colorado Springs, CODelmonico Drive

RegusServices- Virtual Office

- Open Workspace

- Private Office

- Dedicated Desk

Amenities -

19 South Tejon Street,, Old North End, Colorado Springs, COProperty

19 South Tejon Street,, Old North End, Colorado Springs, COProperty- Office

- 41,605 SF

Availability- 6 Spaces

- 20,927 SF

Year Built- 1914

For Lease- $16.00 - $32.26/SF/YR

-

320 East Fontanero Street, Venetian Village, Colorado Springs, COProperty

320 East Fontanero Street, Venetian Village, Colorado Springs, COProperty- Office

- 46,588 SF

Availability- 4 Spaces

- 16,359 SF

Year Built- 1982

For Lease- $18.50/SF/YR