Much like hybrid work, flight to quality seems to be more than just a passing trend as tenant demand for high-quality office space remains strong. For some, this will means top-tier office space with state-of-the-art building systems, the highest-quality furnishings and a bespoke workspace atmosphere. For others — perhaps for most — it means the best possible quality office space that their budget will allow.

As the office sector continues to undergo a reconsideration of its purpose and sustainable size, there are still plenty of businesses looking for either traditional or more flexible office spaces to accommodate their activity. And, while there might still be some challenges ahead, the vast variety of the U.S. office market presents more opportunities than national averages can encapsulate.

With this in mind, we looked at recent CommercialEdge data on average asking rent in 160 U.S. markets to compare how much office space we could hypothetically get for a rental budget of $120,000 per year (or $10,000 per month). Based on this same data (see the methodology section for details), we also included an interactive office space calculator for each property grade tier (one for class A and one for class B), which you can use to run your own estimate.

How much office space can you rent for $10K/month in the 50 largest U.S. cities?

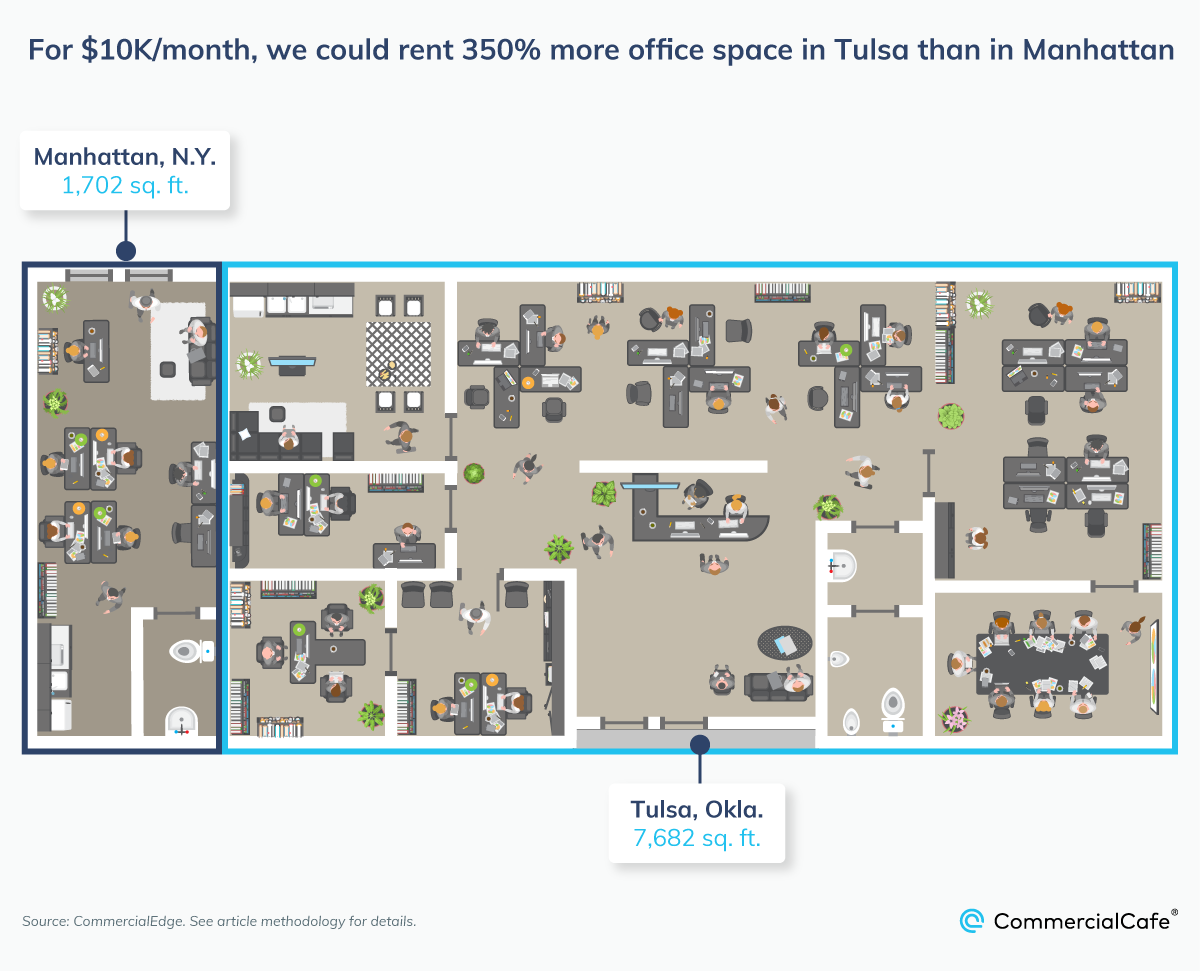

First, we considered average office rents in the 50 largest cities in the country, regardless of property class, and we found that the most office space we could get for our budget would be nearly 7,700 square feet in Tulsa, Okla. This city of more than 300,000 residents also offers several highly walkable downtown districts and is home to one of the largest collections of art deco architecture in the country.

Our second-most generous option in terms of office footprint would be Cincinnati. The average office space price here would allow our budget to stretch for a little more than 6,230 square feet of space for our business. Famous for its unique culinary culture, Cincinnati is also home to a thriving mix of technology, business services, biohealth and advanced manufacturing.

Memphis, Tenn., landed in third place and not too far behind in terms of space. For $10,000 per month (or $120,000 per year), we could rent an office of about 6,200 square feet at the average market rate in an iconic city that has been ranked among the best in the country for small business growth.

Among the 50 largest cities, we found four other markets where the office space price meant our simulated budget would get us more than 6,000 square feet: Louisville, Ky. (#4 at 6,131 square feet); New Orleans (#5 with 6,119 square feet); Albuquerque, N.M. (#6 at 6,054 square feet); and Kansas City, Mo. (#7 with 6,054 square feet).

Next, Indianapolis placed eighth among our top choices. Here, we could rent just shy of 6,000 square feet for our business in a market that has seen notable revitalization of its office stock, largely driven by tenant flight to quality and in response to the evolving demands of today’s workforce.

Alternatively, we could look to the market in ninth place: The average office space price in Cleveland would allow us to rent a little more than 5,800 square feet of space. Although Cleveland is among the top markets for conversions of office space to other uses, developers have mostly targeted aging office properties. As a result, a substantial overall improvement of the local office market is expected in the future.

Tenth on this list was another Ohio market: For our scenario’s yearly budget of $120,000, we could rent roughly 5,700 square feet in Columbus and draw upon the benefits of a diverse local economy; proximity to one of the largest universities in the country; and a sizeable, highly educated talent pool.

Below, we broke the data down further and looked at what differences in possibilities our budget might hold, depending on the property class we chose to rent.If You’re Flexible on Location, Consider Top-Tier Office Space in Emerging Markets

Class A and A+ office space comes within premier commercial buildings, in highly sought-after locations, with the highest tier of amenities or some combination thereof. Of course, wherever your priorities lie in terms of location versus capacity will likely dictate how much office space you can rent for your budget. As the internal economic and demographic landscape of the country changes, emerging markets gain new advantages and make for interesting business relocation options.

Class A highlights:

- A 7,000-square-foot office at the mouth of the Chesapeake Bay was the most spacious class A office location within our budget in Hampton, Va.

- Michigan stood out as the state with the most markets among the top 50 choices for largest class A office spaces at $10,000 per month.

- It’s hard to sprawl out on a budget in California: Of the top 50 markets where our budget would get the least class A office space, 23 are in the Golden State.

Prestige or Expanse? Office Space Price in Western U.S. Markets Offer Some of the Least-Spacious Class A Options

Granted, renting a class A office in the priciest markets will mean either a large budget or a smaller space. But, just how small? For our budget of $120,000 per year ($10,000 per month), the smallest we could get was just under 1,270 square feet of office space in Mountain View, Calif.

However, suppose we didn’t need to set up our business in the highly competitive Silicon Valley market, but we still wanted to stay in the Golden State. In that case, the best office space price our budget could manage would be in Orange, Calif., where our enterprise could operate out of roughly 4,000 square feet for $10,000 per month.

When looking at the top 50 office markets by asking rent, California accounted for nearly half of that ranking. In fact, except for Manhattan, N.Y. — the third-priciest option on the list — and Boston (seventh), the top 15 locations where our budget would get the least class A office space are all in California.

Conversely, the most class A office space we could rent in the Western U.S. region would be in Sandy, Utah. South of Salt Lake City, our $10,000 per month could stretch for about 5,770 square feet here. Similarly, in Albuquerque, N.M., our proposed budget could get nearly 5,500 square feet of class A office space, whereas it would be about 5,200 square feet in Reno, Nev. Likewise, in Spokane, Wash., or Boise, Idaho, we’d get about the same — nearly 5,000 square feet of class A office space.

Virginia Market Tops List of Options for Most Class A Office Space Within Our Budget

Our most generous option in terms of class A office space was in Virginia, where we could rent a little more than 7,000 square feet of office space in Hampton on the mouth of the Chesapeake Bay. Elsewhere in the vicinity, the average local office space price might allow our budget to stretch for a nearly 4,500-square-foot office in nearby Virginia Beach, whereas in Chesapeake, Va., we could set up shop in a little more than 5,000 square feet.

Unlike California, Virginia landed on both sides of this scale as it’s also home to some of the more restrained options of class A office space for rent within our monthly budget. For instance, we could get nearly 2,800 square feet of office space in Alexandria, Va., which is on the doorstep of Washington, D.C. Elsewhere in the capital metro area and not too far upstream along the Potomac, we could be looking at a little more class A room (close to 3,000 square feet at the average office space price) in either McLean or Vienna, Va.

Office Space Prices in Midwestern Markets Offer Great Variety for Top-Tier Space

Also high on the list of top 50 cities where we could get the most class A office space for our budget were several Midwestern U.S. locations. With globally connected logistics and transportation infrastructures; a relatively attractive cost of living; an honest work culture; and growing economic opportunity, emerging Midwestern office markets certainly deserve consideration.

For instance, in Fort Wayne, Ind., we could rent about 6,500 square feet of class A office space and place our business in one of the best Rust Belt comeback stories — one of the few deindustrialized cities where the population increased since 1950.

Or, in Michigan, we could rent around 6,300 square feet of office space in Troy or about 5,200 in Southfield near Detroit. Alternatively, we could opt for a nearly 5,490-square-foot space of a class A office in Detroit itself — the 12th-best market on the list of options for most class A office space within our budget (12th-most affordable average class A office space price).

Pennsylvania Home to Most Accessible Class A Option in Northeastern U.S.

Among the Northeastern markets included in our analysis, the most class A space we could get would be nearly 5,600 square feet of office space in Harrisburg, Pa. Then, the second-most affordable office space price (our second-best option for most room) in the region was Hartford, Conn., where our budget could get roughly 5,300 square feet of space.

As expected, several Northeastern U.S. markets were among those where our budget would stretch for the least class A office space: Manhattan (a little more than 1,300 square feet of class A office space for a yearly budget of $120,000); Boston (roughly 1,600 square feet); and Brooklyn, N.Y. (about 2,100 square feet).

Using the office space calculator included directly below, enter your estimated yearly rental budget and see how much class A office space your budget could get you in any of the markets included in our analysis.

Vintage Vibes: Class B Spaces Offer a Business Address With Unique Character

Class B office space — also referred to as commodity space — is often underrated as it tends to lack the top-tier assortment of bells and whistles that adorn class A and trophy developments. However, while you’re most likely to find commodity space in somewhat older buildings, it can still be a viable, practical, and even pleasantly surprising option. Plus, Class B property still accounts for the largest share of office space in most markets and, consequently, it’s comparatively easier to find a home for your business in this category.

Moreover, office properties in this tier are often the result of adaptive reuse redevelopments of turn-of-the-century buildings. And, depending on the local architectural history of the market, a class B office might come with a grand lobby, generous loft spaces, high ceilings, large windows, and a lot of unique character.

Class B highlights:

- A business base in Oklahoma: Tulsa was the most generous choice for class B office space within our budget.

- The South and Midwest regions accounted for the majority of options among the top 50 markets for most class B office space at $10,000 per month.

- Demand outdoes property class: The priciest markets proved challenging even when renting commodity space.

Albuquerque, Spokane & Colorado Springs Are Top Choices in Western U.S. for a Sprawling Class B Office

In the tightest markets, there can sometimes be relatively little difference between the office space price for class A and class B options. For instance, in Mountain View, Calif., we’d get about 600 more square feet of class B space than class A for our same budget — a total of roughly 1,880 square feet of office space. Additionally, the most class B space we could get in California (based on the average market asking rate data that we compared) would be a little more than 5,150 square feet of office space in Sacramento.

Among the Western U.S. markets we analyzed, the most class B space our budget could get in the region would be roughly 6,670 square feet of office space in Albuquerque, N.M. Alternatively, we could opt for about 6,000 square feet in an office in Spokane, Wash. — a mid-sized city packing considerable quality-of-life potential — or in Colorado Springs, Colo., which recently ranked among the best cities to live in within the U.S.

Tulsa Claims Roomiest Option for Class B Office Space

Notably, the Southern U.S. is home to the largest selection of top 50 markets where our budget would stretch for the most class B office space. In fact, we found one Southern market at the very top of that list — Tulsa, Okla., an attractive metropolitan region with a rich cultural scene, an award-winning economic development organization, and some of the best office space prices. With our hypothetical $10,000 per month here, we could secure nearly 8,300 square feet of class B Tulsa office space for our enterprise. This would be more than 1,700 additional square feet compared to how much class A office space we would rent in the same market for the same budget.

Our second-best option on the list for most class B office space was Winston-Salem, N.C. A gem among emerging Southern U.S. markets, this Piedmont Triad city has been nurturing a promising startup scene by leveraging the high local corporate density and resources with strong collaborative community spirit. In this scenario, our rental budget could place our enterprise in an office of about 7,500 square feet of class B office space in Winston-Salem at the heart of a regional economy that’s seeing new growth industries emerging rapidly.

Other notable Southern U.S. entries among the markets where we could rent the most commodity space included: Hampton, Va. (where we could get about 7,400 square feet); Memphis, Tenn. (6,750 square feet); Oklahoma City; and New Orleans, each of which would allow us roughly 6,600 square feet of class B office space.

Indiana & Michigan Contribute Highest-Ranking Midwestern Markets for Most Commodity Space

For class B office space, Midwestern markets accounted for the second-largest regional group among the top 50 locations for most space within our budget. Highest among them was Fort Wayne, Ind., which was the third-best option for most class B office space, behind Tulsa and Winston-Salem.

Further north, Auburn Hills, Mich., was the second-best-ranking Midwestern market in our search. THe average office space price here meant that our budget could rent nearly 7,000 square feet of class B space. It would also place us in a northern suburb of Detroit that has recently seen significant investment in streetscape and infrastructure improvements, including an outdoor wireless network that’s free to users and accessible across the city’s revitalized downtown area.

Albany, N.Y., Offers Best Class B Office Space Price Among Northeastern U.S. Markets

When looking at the top 50 markets for most class B office space within our budget, we found a total of four Northeastern U.S. locations. The New York state capital ranked best among them in fifth place: Our imaginary budget could rent nearly 7,300 square feet of commodity office space in Albany, N.Y., which would place our enterprise in the oldest continuous settlement from the original English colonies that’s now the academic, cultural and economic center of the capital region of New York state.

Next on the list were two other Northeastern U.S. state capitals — Harrisburg, Pa., and Hartford, Conn. Specifically, we could rent a little more than 6,400 square feet of class B office space in Harrisburg, which is a metropolitan area that’s home to a relatively young population, a wealth of outdoor recreation options and a highly walkable downtown. Not to be outdone, Hartford, Conn., followed relatively closely behind as our budget would get us about 6,200 square feet of class B office space here.

Finally, our hypothetical rental budget could get us nearly 5,700 square feet of class B office space in Pittsburgh, which is home to one of the most eco-friendly office markets in the country. It’s also an economy that has been successfully transitioning from its steel-centered past to a diverse innovation ecosystem.

Using the office space calculator below, enter your estimated yearly rental budget and see how much class B office space your budget could get you in any of the markets included in our analysis.

Certainly, news of large and very large corporate office space users rightsizing their footprints can cast a shadow on the state of the national office market. That said, it’s important to remember that most office properties in the U.S. are smaller; more easily adaptable to the changing current of tenant needs; and perhaps better participants in the creation of the live-work-play communities and viable 15-minute cities — to which the younger, more sustainability-minded generations of workers aspire.Methodology

For this report, we looked at the average market asking rate for office space in 160 U.S. markets using data provided by CommercialEdge. We only considered locations where the asking rate was available for at least three properties and more than 10 spaces listed for rent. Data included herein was as of October 2023.

Disclaimer

While every effort was made to ensure the accuracy of the market asking rate information presented herein, the information is provided “as is” and neither CommercialCafe nor CommercialEdge can guarantee that the information provided is complete. This report is for general informational purposes only and presents hypothetical estimates. It does not constitute and should not be relied upon as a basis for any investment decision. The information presented is also subject to change without notice and may or may not apply depending on the circumstances. Always contact a qualified investment consultant if you need advice regarding buying, selling or otherwise transacting in any investment.