Pittsburgh, PA Office Spaces for Rent

Find your best Pittsburgh, PA office space among 679 for rent listings, which average an asking price of $28.08 per square foot.

-

6425 Living Place #200, Pittsburgh, PAServices

6425 Living Place #200, Pittsburgh, PAServices- Virtual Office

- Open Workspace

- Private Office

- Dedicated Desk

Amenities -

1501 Reedsdale St, Chateau, Pittsburgh, PA

1501 Reedsdale St, Chateau, Pittsburgh, PA -

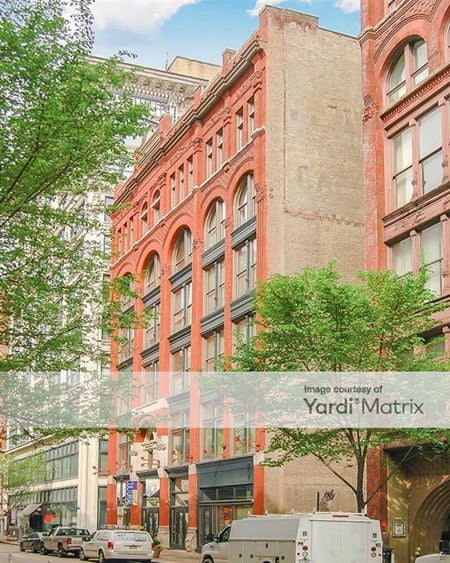

211 26th Street, Strip District, Pittsburgh, PAProperty

211 26th Street, Strip District, Pittsburgh, PAProperty- Office

- 56,642 SF

Availability- 2 Spaces

- 19,137 SF

Year Built- 1920

For Lease Contact for pricing -

260 Forbes Avenue, Downtown Pittsburgh, Pittsburgh, PAProperty

260 Forbes Avenue, Downtown Pittsburgh, Pittsburgh, PAProperty- Office

- 400,000 SF

Availability- 1 Space

- 6,330 SF

Year Built- 2016

For Lease Contact for pricing -

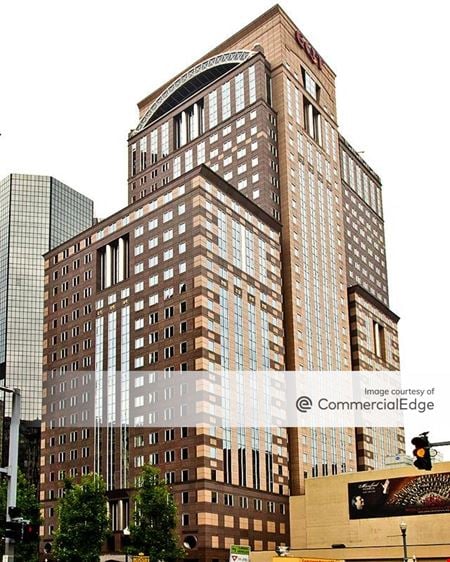

603 Stanwix Street, Downtown Pittsburgh, Pittsburgh, PAProperty

603 Stanwix Street, Downtown Pittsburgh, Pittsburgh, PAProperty- Office

- 320,395 SF

Availability- 24 Spaces

- 42,155 SF

Year Built- 1952

For Lease- $27.50/SF/YR

-

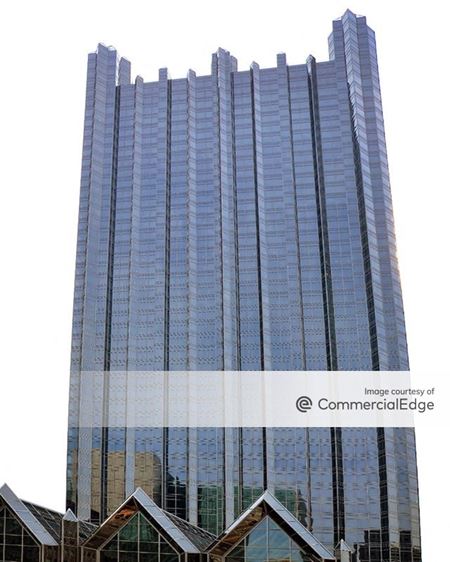

6 PPG Place, Downtown Pittsburgh, Pittsburgh, PAProperty

6 PPG Place, Downtown Pittsburgh, Pittsburgh, PAProperty- Office

- 300,000 SF

Availability- 10 Spaces

- 80,130 SF

Year Built- 1983

For Lease Contact for pricing -

141 South Saint Clair Street, East Liberty, Pittsburgh, PAProperty

141 South Saint Clair Street, East Liberty, Pittsburgh, PAProperty- Office

- 306,978 SF

Availability- 3 Spaces

- 56,096 SF

Year Built- 2022

For Lease- $47.50/SF/YR

-

750 Holiday Dr, Green Tree, Pittsburgh, PA

750 Holiday Dr, Green Tree, Pittsburgh, PA -

4215 5th Avenue, North Oakland, Pittsburgh, PAProperty

4215 5th Avenue, North Oakland, Pittsburgh, PAProperty- Office

- 130,000 SF

Availability- 6 Spaces

- 66,914 SF

Year Built- 1911

For Lease- $50.00/SF/YR

-

3347 Forbes Ave, South Oakland, Pittsburgh, PAProperty

3347 Forbes Ave, South Oakland, Pittsburgh, PAProperty- Mixed Use

- 19,050 SF

Availability- 2 Spaces

- 11,000 SF

For Lease- $24.00 - $30.00/SF/YR

-

4035 Liberty Avenue, Bloomfield, Pittsburgh, PAProperty

4035 Liberty Avenue, Bloomfield, Pittsburgh, PAProperty- Office

- 42,000 SF

Availability- 1 Space

- 8,500 SF

Year Built- 1948

For Lease Contact for pricing -

11 Parkway Center, Ridgemont, Pittsburgh, PAProperty

11 Parkway Center, Ridgemont, Pittsburgh, PAProperty- Office

- 70,000 SF

Availability- 6 Spaces

- 33,295 SF

Year Built- 1989

For Lease- $18.95/SF/YR

-

2403 Sidney Street, Southside Flats, Pittsburgh, PA

2403 Sidney Street, Southside Flats, Pittsburgh, PA -

600 Grant Street, Downtown Pittsburgh, Pittsburgh, PAProperty

600 Grant Street, Downtown Pittsburgh, Pittsburgh, PAProperty- Office

- 2,336,272 SF

Availability- 18 Spaces

- 433,139 SF

Year Built- 1971

For Lease- $35.00/SF/YR

-

210 6th Avenue, Downtown Pittsburgh, Pittsburgh, PAProperty

210 6th Avenue, Downtown Pittsburgh, Pittsburgh, PAProperty- Office

- 637,000 SF

Availability- 4 Spaces

- 146,035 SF

Year Built- 1968

For Lease Contact for pricing -

969 Greentree Rd, Banksville, Pittsburgh, PA

969 Greentree Rd, Banksville, Pittsburgh, PA -

301 Grant Street, Downtown Pittsburgh, Pittsburgh, PAProperty

301 Grant Street, Downtown Pittsburgh, Pittsburgh, PAProperty- Office

- 1,011,109 SF

Availability- 31 Spaces

- 323,021 SF

Year Built- 1983

For Lease- $35.00 - $38.50/SF/YR

-

30 Isabella Street, North Shore Pittsburgh, Pittsburgh, PAProperty

30 Isabella Street, North Shore Pittsburgh, Pittsburgh, PAProperty- Office

- 228,866 SF

Availability- 1 Space

- 10,263 SF

Year Built- 2003

For Lease Contact for pricing -

340 Mansfield Avenue, Green Tree, Pittsburgh, PAProperty

340 Mansfield Avenue, Green Tree, Pittsburgh, PAProperty- Office

- 2,900 SF

Availability- 1 Space

- 2,900 SF

For Lease- $3,300.00/MO

-

375 North Shore Drive, North Shore Pittsburgh, Pittsburgh, PAProperty

375 North Shore Drive, North Shore Pittsburgh, Pittsburgh, PAProperty- Office

- 303,044 SF

Availability- 1 Space

- 12,952 SF

Year Built- 2006

For Lease Contact for pricing -

625 Liberty Avenue, Downtown Pittsburgh, Pittsburgh, PAProperty

625 Liberty Avenue, Downtown Pittsburgh, Pittsburgh, PAProperty- Office

- 615,942 SF

Availability- 25 Spaces

- 337,253 SF

Year Built- 1987

For Lease Contact for pricing -

2403 Sidney Street, Pittsburgh, PAServices

2403 Sidney Street, Pittsburgh, PAServices- Virtual Office

- Open Workspace

- Private Office

- Dedicated Desk

Amenities -

5947 Penn Avenue, East Liberty, Pittsburgh, PAProperty

5947 Penn Avenue, East Liberty, Pittsburgh, PAProperty- Retail

- 46,760 SF

Availability- 2 Spaces

- 2,458 SF

Year Built- 1880

For Lease Contact for pricing -

1500 Penn Avenue, Strip District, Pittsburgh, PAProperty

1500 Penn Avenue, Strip District, Pittsburgh, PAProperty- Office

- 245,678 SF

Availability- 1 Space

- 38,934 SF

Year Built- 1982

For Lease Contact for pricing -

2301 East Carson Street, Southside Flats, Pittsburgh, PAProperty

2301 East Carson Street, Southside Flats, Pittsburgh, PAProperty- Office

- 38,000 SF

Availability- 6 Spaces

- 39,801 SF

Year Built- 1891

For Lease- $22.00 - $25.00/SF/YR

-

1200 Penn Avenue, Downtown Pittsburgh, Pittsburgh, PAProperty

1200 Penn Avenue, Downtown Pittsburgh, Pittsburgh, PAProperty- Office

- 400,000 SF

Availability- 1 Space

- 36,594 SF

Year Built- 1997

For Lease Contact for pricing -

1 Allegheny Square East, Allegheny Center, Pittsburgh, PAProperty

1 Allegheny Square East, Allegheny Center, Pittsburgh, PAProperty- Office

- 158,730 SF

Availability- 3 Spaces

- 55,298 SF

Year Built- 1969

For Lease- $32.00/SF/YR

-

925 Penn Avenue, Downtown Pittsburgh, Pittsburgh, PAProperty

925 Penn Avenue, Downtown Pittsburgh, Pittsburgh, PAProperty- Office

- 45,954 SF

Availability- 1 Space

- 9,334 SF

Year Built- 1904

For Lease- $25.00/SF/YR

-

707 Grant Street, Downtown Pittsburgh, Pittsburgh, PAProperty

707 Grant Street, Downtown Pittsburgh, Pittsburgh, PAProperty- Office

- 432,000 SF

Availability- 1 Space

- 100 SF

Year Built- 1932

For Lease- $32.00/SF/YR

-

100 West Station Square Drive, South Shore Pittsburgh, Pittsburgh, PAProperty

100 West Station Square Drive, South Shore Pittsburgh, Pittsburgh, PAProperty- Office

- 77,299 SF

Availability- 5 Spaces

- 22,276 SF

Year Built- 1900

For Lease- $27.00/SF/YR

-

141 9th St, Downtown Pittsburgh, Pittsburgh, PA

141 9th St, Downtown Pittsburgh, Pittsburgh, PA -

19 35th St, Lower Lawrenceville, Pittsburgh, PA

19 35th St, Lower Lawrenceville, Pittsburgh, PA -

6425 Living Place, Shadyside, Pittsburgh, PAProperty

6425 Living Place, Shadyside, Pittsburgh, PAProperty- Office

- 209,244 SF

Availability- 1 Space

- 100 SF

Year Built- 2016

For Lease- $47.00/SF/YR

-

1133 Penn Avenue, Downtown Pittsburgh, Pittsburgh, PAProperty

1133 Penn Avenue, Downtown Pittsburgh, Pittsburgh, PAProperty- Office

- 43,200 SF

Availability- 2 Spaces

- 13,280 SF

Year Built- 1892

For Lease- $20.00/SF/YR

-

401 Bingham Street, Southside Flats, Pittsburgh, PAProperty

401 Bingham Street, Southside Flats, Pittsburgh, PAProperty- Industrial

- 200,101 SF

Availability- 3 Spaces

- 51,873 SF

Year Built- 1905

For Lease Contact for pricing -

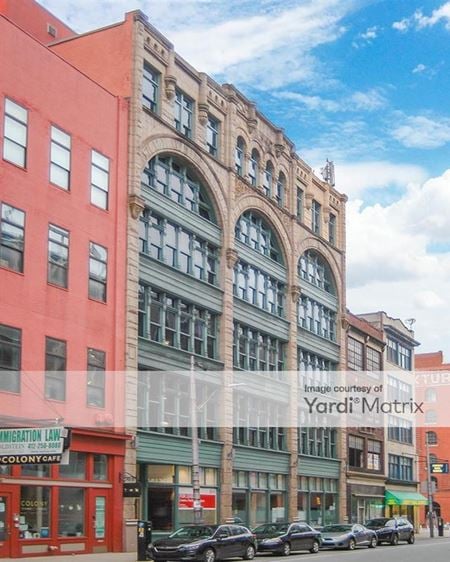

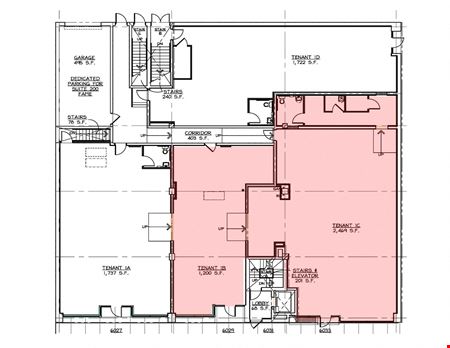

6029-6033 Broad Street, East Liberty, Pittsburgh, PAProperty

6029-6033 Broad Street, East Liberty, Pittsburgh, PAProperty- Office

- 18,000 SF

Availability- 1 Space

- 3,669 SF

For Lease- $22.00/SF/YR

-

925 Liberty Avenue, Downtown Pittsburgh, Pittsburgh, PAProperty

925 Liberty Avenue, Downtown Pittsburgh, Pittsburgh, PAProperty- Office

- 66,000 SF

Availability- 3 Spaces

- 19,800 SF

Year Built- 1891

For Lease- $25.00/SF/YR

-

1 PPG Place, Downtown Pittsburgh, Pittsburgh, PAProperty

1 PPG Place, Downtown Pittsburgh, Pittsburgh, PAProperty- Office

- 900,000 SF

Availability- 16 Spaces

- 105,441 SF

Year Built- 1984

For Lease Contact for pricing -

1789 South Braddock Avenue, Edgewood, Pittsburgh, PAProperty

1789 South Braddock Avenue, Edgewood, Pittsburgh, PAProperty- Office

- 80,140 SF

Availability- 7 Spaces

- 19,274 SF

Year Built- 1947

For Lease- $18.50 - $21.00/SF/YR

-

4824 Liberty Ave, Bloomfield, Pittsburgh, PAProperty

4824 Liberty Ave, Bloomfield, Pittsburgh, PAProperty- Office

- 20,000 SF

Availability- 4 Spaces

- 16,000 SF

For Lease- $18.00/SF/YR

-

2835 East Carson Street, Southside Flats, Pittsburgh, PAProperty

2835 East Carson Street, Southside Flats, Pittsburgh, PAProperty- Office

- 39,143 SF

Availability- 1 Space

- 9,326 SF

Year Built- 2004

For Lease Contact for pricing -

7 Parkway Center, Green Tree, Pittsburgh, PAProperty

7 Parkway Center, Green Tree, Pittsburgh, PAProperty- Office

- 285,654 SF

Availability- 26 Spaces

- 120,259 SF

Year Built- 1970

For Lease- $25.75/SF/YR

-

1251 Waterfront Place, Downtown Pittsburgh, Pittsburgh, PAProperty

1251 Waterfront Place, Downtown Pittsburgh, Pittsburgh, PAProperty- Office

- 200,000 SF

Availability- 1 Space

- 16,088 SF

Year Built- 2001

For Lease Contact for pricing -

1600 West Carson Street, South Shore Pittsburgh, Pittsburgh, PAProperty

1600 West Carson Street, South Shore Pittsburgh, Pittsburgh, PAProperty- Office

- 300,000 SF

Availability- 1 Space

- 37,130 SF

Year Built- 1960

For Lease- $9.75/SF/YR

-

651 Holiday Drive, Foster Plaza 5 Suite 300, Pittsburgh, PAServices

651 Holiday Drive, Foster Plaza 5 Suite 300, Pittsburgh, PAServices- Virtual Office

- Open Workspace

- Private Office

- Dedicated Desk

Amenities -

922 Penn Avenue, Downtown Pittsburgh, Pittsburgh, PAProperty

922 Penn Avenue, Downtown Pittsburgh, Pittsburgh, PAProperty- Office

- 86,400 SF

Availability- 3 Spaces

- 27,624 SF

Year Built- 1893

For Lease- $28.00/SF/YR

-

2681 Sidney Street, Pittsburgh, PA

2681 Sidney Street, Pittsburgh, PACOhatch - Southside Works

COhatchServices- Meeting Room

Amenities -

960 Penn Avenue, Downtown Pittsburgh, Pittsburgh, PAProperty

960 Penn Avenue, Downtown Pittsburgh, Pittsburgh, PAProperty- Office

- 91,000 SF

Availability- 8 Spaces

- 31,954 SF

Year Built- 1870

For Lease- $28.00/SF/YR

-

350 Technology Dr, South Oakland, Pittsburgh, PA

350 Technology Dr, South Oakland, Pittsburgh, PA -

2 PPG Place, Downtown Pittsburgh, Pittsburgh, PAProperty

2 PPG Place, Downtown Pittsburgh, Pittsburgh, PAProperty- Office

- 179,000 SF

Availability- 3 Spaces

- 105,286 SF

Year Built- 1983

For Lease Contact for pricing -

9 Parkway Center, Green Tree, Pittsburgh, PAProperty

9 Parkway Center, Green Tree, Pittsburgh, PAProperty- Office

- 122,429 SF

Availability- 5 Spaces

- 29,555 SF

Year Built- 1970

For Lease- $24.00/SF/YR

-

436 7th Avenue, Downtown Pittsburgh, Pittsburgh, PAProperty

436 7th Avenue, Downtown Pittsburgh, Pittsburgh, PAProperty- Office

- 356,439 SF

Availability- 9 Spaces

- 55,774 SF

Year Built- 1929

For Lease- $26.75/SF/YR