- Sales volume dips below the $1 billion mark

- Average price per square foot holds above $200, second-highest in 5 years

- Houston logs priciest deals; DFW most active Texas market

- 6 million square feet of office space delivered in Q2, more to come in Q3

Following up on the previous quarter, we turned to Yardi Matrix data and analyzed all sales of office buildings larger than 50,000 square feet to close at over $5 million, during 2017’s second quarter (see Methodology).

Overall, the Texas office market is performing well and developers have been particularly busy—6 million square feet of new office space was delivered to the market in Q2, matching the 6 million square feet that traded during the same quarter. While sales have taken a bit of a dive and the Q2 dollar volume slipped below $1 billion, the average price per square foot for Texas office space held above the $200 mark for the fifth consecutive quarter. The combined Texas office markets are still coming down from the heights reached during the second half of 2016. There were no major sales closed on the San Antonio office market during this past quarter, and sales activity in the top-tier markets of Austin, Houston and Dallas-Fort Worth wrapped up at 34% below Q1 dollar volume.

Q2 Sales Volume Slides Below $1 Billion

During 2017’s second quarter, office sales volume dipped below the $1 billion mark, and it was the first Q2 in five years to do so. The $886 million amassed in disclosed-price transactions marks a 22% slip year-over-year. However, the fact that Q2’s dollar volume is 43% lower than the five-year quarterly average of $1.5 billion is no real reason for concern. Texas’ combined office markets are generally stable, although the trailing five years averages are skewed by the record-high numbers seen in Q4 2015 and Q4 2016, as well as the record slump of Q1 2016.

The Dallas–Fort Worth Metroplex was the most active of the Texas markets, as 15 deals closed here during the second quarter, and carried almost half of the total Q2 sales. Houston followed closely behind, with $370 million in sales, while Austin concluded Q2 with just over $108 million in disclosed deals.

Average Price per Square Foot Still at Record High

Even though it dipped 8% below the Q1 record high of $294, the average price per square foot only slipped down to second-highest level of the past five years. Currently resting at $270, Q2 2017’s average price is 22% higher year-over-year and a good 37% above the past five-year quarterly average. Albeit with understandable fluctuations, this metric continues its steady ascension and concludes the fifth consecutive quarter in which the Texas’ average prices held well above the $200 mark.

Of the top-tier Texas office markets that we analyzed in Q2, Houston stands out as the priciest. While twice the deals closed and twice the inventory moved in the larger Dallas-Fort Worth market, the average price per square foot in Houston reached $354, 76% higher than prices in DFW.

Top Deals Go to Major US, International Investors

Major deals closed during Q2 2017 show strong investor interest in the combined Texas office markets—the top five asset buyers were Texas REITs, a California-based pension fund and a major foreign investor. Most deals closed in the Dallas office market, where the sub-market of Plano continues to attract significant attention. However, the top-priced Houston market was home to the quarter’s two biggest sales.

Local REIT Whitestone dished out $158 million for BLVD Place, in the biggest deal of the quarter. The Uptown Houston retail and office center came with 1.4 acres of land, on which Whitestone plans to develop a second building.

Dallas-based TIER REIT paid what is a near-record price for a suburban high rise, when it closed the third-biggest sale of the quarter and acquired Legacy District One in Plano for $123 million. TIER also owns 4 acres of adjoining vacant land and has already drawn plans to develop two office towers next to Legacy One.

Though not particularly active in terms of major deals or dollar volume, the Austin office market was the Texas destination of choice for Germany-based investment firm GLL.

The Class A Capital Ridge office property in Southwest Austin commanded $96 million, and, aside from its great location just off Highway 360, the asset comes with an impressive perk—it is fully leased to tech giant Apple, where the company operates its Lonestar Design Center.

The Fertile Texas Office Pipeline Keeps Flowing

While there are numerous new and soon-to-be-completed office projects throughout the top-tier markets, Houston and Dallas were home to the largest office developments.

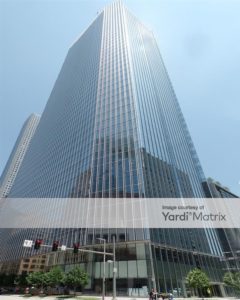

May 2017 marked the completion of downtown Houston’s newest landmark—609 Main at Texas is a 1 million-square-foot office tower designed by Pickard Chilton and developed by Hines. With full-height windows flooding the building with natural light, a sophisticated underfloor HVAC system, and private roof gardens among other Class A amenities, the property is expected to attain LEED-Platinum certification.

In terms of office development size, Plano takes the cake for both the second and the third quarters of 2017. Toyota celebrated the grand opening of its new headquarters at Legacy West. The 2.1 million-square-foot office campus has already welcomed the first wave of what is estimated to be roughly 4,000 total employees based here. According to the Dallas News, the massive North Texas development has further increased housing demand within the Dallas-Fort Worth real estate market.

With this in mind, Plano is about to welcome yet another sizeable office project—Regent Properties is expected to deliver the 900,000-square-foot Legacy Central in Q3. The developer is working on repositioning the 84-acre former Texas Instruments campus as a modern urban village, complete with Class A office space, an auditorium, a variety of indoor and outdoor conference rooms, a 30,000-square-foot fitness center with yoga rooms, a lap swimming pool, a tennis court, a 1-mile jogging and biking trail, coffee kiosks, 4-acre park and more.

Methodology

- Square footage parameters – over 50,000 sq. ft.

- Minimum amount per transaction $5,000,000

- Transactions recorded until July 20th, 2017

- Average per-square-foot price calculation: ‘ownership stake,’ ‘ground lease,’ ‘controlling interest,’ ‘portfolio’ and ‘undisclosed’ transactions were excluded

- Distressed sales were excluded

- Texas: Austin, Dallas – Fort Worth, San Antonio, Houston

- Data source: Yardi Matrix (download raw data)