Mesa, AZ Commercial Real Estate for Lease and Sale

Explore 502 listings of Mesa commercial real estate to find the best space for your business.

-

638 W Broadway Rd, Powell Estates, Mesa, AZProperty

638 W Broadway Rd, Powell Estates, Mesa, AZProperty- Industrial

- 157,153 SF

Availability- 1 Space

- 1,482 SF

Year Built- 1987

For Lease- $0.99/SF/MO

-

1610 N Rosemont, Falcon Field, Mesa, AZProperty

1610 N Rosemont, Falcon Field, Mesa, AZProperty- Industrial

- 24,988 SF

Availability- 1 Space

- 2,744 SF

Year Built- 2008

For Lease- $1.55/SF/MO

-

441 S Robson, Ste 108, Powell Estates, Mesa, AZProperty

441 S Robson, Ste 108, Powell Estates, Mesa, AZProperty- Industrial

- 9,000 SF

Availability- 1 Space

- 9,000 SF

Year Built- 1950

For Lease- $13.00/SF/YR

-

4425 East McKellips Road, Falcon Field, Mesa, AZProperty

4425 East McKellips Road, Falcon Field, Mesa, AZProperty- Retail

- 59,247 SF

Availability- 3 Spaces

- 3,396 SF

Year Built- 2004

For Lease Contact for pricing -

What type of listing property are you looking for?

-

1955 West Baseline Road, Dobson Ranch, Mesa, AZProperty

1955 West Baseline Road, Dobson Ranch, Mesa, AZProperty- Retail

- 51,883 SF

Availability- 2 Spaces

- 4,283 SF

Year Built- 1997

For Lease Contact for pricing -

7256 S 89th Pl, Ste 103, Gateway Airport, Mesa, AZProperty

7256 S 89th Pl, Ste 103, Gateway Airport, Mesa, AZProperty- Industrial

- 2,364 SF

For Sale- $795,000

-

2630 N Ogden Rd, Falcon Field, Mesa, AZProperty

2630 N Ogden Rd, Falcon Field, Mesa, AZProperty- Industrial

- 152,909 SF

Availability- 1 Space

- 2,698 SF

Year Built- 2007

For Lease- $1.40/SF/MO

-

Signal Butte Rd & Elliot Rd, Eastmark, Mesa, AZ

Signal Butte Rd & Elliot Rd, Eastmark, Mesa, AZ -

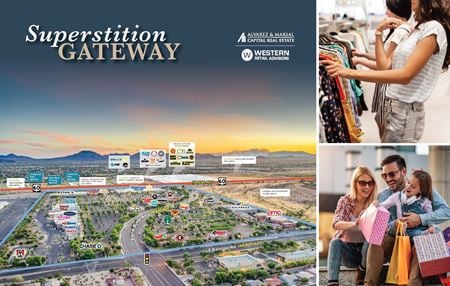

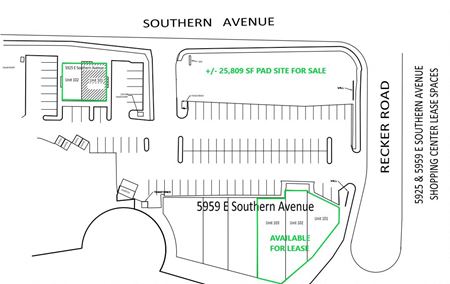

Recker Rd & Loop 202, Alta Mesa, Mesa, AZ

Recker Rd & Loop 202, Alta Mesa, Mesa, AZ -

112 S Country Club Dr, Powell Estates, Mesa, AZProperty

112 S Country Club Dr, Powell Estates, Mesa, AZProperty- Industrial

- 3,640 SF

Availability- 1 Space

- 3,640 SF

Year Built- 1935

For Lease- $4,300.00/MO

-

Arizona College 163 N Dobson Rd, Mesa Grande, Mesa, AZProperty

Arizona College 163 N Dobson Rd, Mesa Grande, Mesa, AZProperty- Other

- 24,000 SF

Year Built- 2002

For Sale- $7,769,000

-

4422 East University Drive, Leisure World, Mesa, AZProperty

4422 East University Drive, Leisure World, Mesa, AZProperty- Retail

- 111,153 SF

Availability- 3 Spaces

- 26,928 SF

Year Built- 1987

For Lease Contact for pricing -

1635 N Greenfield Rd, Bldg 2, Ste 106, 108, Falcon Field, Mesa, AZProperty

1635 N Greenfield Rd, Bldg 2, Ste 106, 108, Falcon Field, Mesa, AZProperty- Office

- 4,052 SF

Year Built- 2004

For Sale- $1,525,000

-

3707 E Southern Ave Floors 1 & 2, Mesa, AZ

3707 E Southern Ave Floors 1 & 2, Mesa, AZVal Vista

RegusServices- Virtual Office

- Open Workspace

- Private Office

- Dedicated Desk

Amenities -

NE of Gilbert Road & Southern Ave, Meadowgreen, Mesa, AZ

NE of Gilbert Road & Southern Ave, Meadowgreen, Mesa, AZ -

1411 E University Dr, Sherwood, Mesa, AZProperty

1411 E University Dr, Sherwood, Mesa, AZProperty- Office

- 2,500 SF

Year Built- 1965

For Sale- $587,748

-

Superstition Springs Corporate Center 1234 S Power Rd, Superstition Springs, Mesa, AZ

Superstition Springs Corporate Center 1234 S Power Rd, Superstition Springs, Mesa, AZ -

7000 E Main St, Fountain of the Sun, Mesa, AZProperty

7000 E Main St, Fountain of the Sun, Mesa, AZProperty- Retail

- 6,598 SF

Year Built- 1977

For Sale- $2,709,733

-

1450 South Dobson Road, Powell Estates, Mesa, AZProperty

1450 South Dobson Road, Powell Estates, Mesa, AZProperty- Office

- 66,214 SF

Availability- 1 Space

- 3,895 SF

Year Built- 1975

For Lease Contact for pricing -

11224 E Pecos Rd, Rancho Apache, Mesa, AZ

11224 E Pecos Rd, Rancho Apache, Mesa, AZ -

1930 N Arboleda Dr, Arboleda, Mesa, AZProperty

1930 N Arboleda Dr, Arboleda, Mesa, AZProperty- Office

- 19,477 SF

Availability- 2 Spaces

- 3,229 SF

Year Built- 2005

For Lease- $23.95/SF/YR

-

NEC 80th St & Elliot Rd, Gateway Airport, Mesa, AZProperty

NEC 80th St & Elliot Rd, Gateway Airport, Mesa, AZProperty- VacantLand

For Sale- $8,205,408

-

1764 South Signal Butte Road, Augusta Ranch, Mesa, AZ

1764 South Signal Butte Road, Augusta Ranch, Mesa, AZ -

1836 N Country Club Dr, Mesa Grande, Mesa, AZProperty

1836 N Country Club Dr, Mesa Grande, Mesa, AZProperty- Industrial

- 2,372 SF

Year Built- 1940

For Sale- $624,999

-

925 N Stapley Drive, Sherwood, Mesa, AZProperty

925 N Stapley Drive, Sherwood, Mesa, AZProperty- Office

- 9,216 SF

Availability- 1 Space

- 546 SF

Year Built- 1978

For Lease- $859.00/MO

-

136 W Main St, Mesa Grande, Mesa, AZProperty

136 W Main St, Mesa Grande, Mesa, AZProperty- Retail

- 10,263 SF

Year Built- 1891

For Sale- $1,950,000

-

1826 W Broadway Rd, Mesa Grande, Mesa, AZProperty

1826 W Broadway Rd, Mesa Grande, Mesa, AZProperty- Industrial

- 100,800 SF

Availability- 2 Spaces

- 3,600 SF

Year Built- 1981

For Lease- $1.35/SF/MO

-

1550 E University Dr #O-2, Sherwood, Mesa, AZProperty

1550 E University Dr #O-2, Sherwood, Mesa, AZProperty- Office

- 1,222 SF

Year Built- 1976

For Sale- $190,000

-

320 South El Dorado, Mesa Grande, Mesa, AZProperty

320 South El Dorado, Mesa Grande, Mesa, AZProperty- Industrial

- 12,500 SF

Availability- 1 Space

- 3,125 SF

Year Built- 1986

For Lease- $1.30/SF/MO

-

5959 E Southern Ave, Superstition Springs, Mesa, AZProperty

5959 E Southern Ave, Superstition Springs, Mesa, AZProperty- Retail

- 19,363 SF

Availability- 3 Spaces

- 9,480 SF

Year Built- 2000

For Lease- $15.00/SF/YR

-

1910 S Stapley Drive, Powell Estates, Mesa, AZ

1910 S Stapley Drive, Powell Estates, Mesa, AZ -

4827 E Southern Ave, Leisure World, Mesa, AZProperty

4827 E Southern Ave, Leisure World, Mesa, AZProperty- Office

- 5,122 SF

Year Built- 2000

For Sale- $2,200,301.71

-

4111 E Valley Auto Dr, Meadowgreen, Mesa, AZProperty

4111 E Valley Auto Dr, Meadowgreen, Mesa, AZProperty- Office

- 26,079 SF

Availability- 2 Spaces

- 215 SF

Year Built- 1999

For Lease Contact for pricing -

4215 E McDowell Rd, Falcon Field, Mesa, AZProperty

4215 E McDowell Rd, Falcon Field, Mesa, AZProperty- Industrial

- 152,909 SF

Availability- 1 Space

- 2,896 SF

Year Built- 2007

For Lease- $24.50/SF/YR

-

555 W University Dr, Mesa Grande, Mesa, AZProperty

555 W University Dr, Mesa Grande, Mesa, AZProperty- Office

- 6,402 SF

Availability- 2 Spaces

- 4,602 SF

Year Built- 1985

For Lease- $18.00/SF/YR

-

856 S Alma School Rd, Powell Estates, Mesa, AZProperty

856 S Alma School Rd, Powell Estates, Mesa, AZProperty- Retail

- 11,801 SF

Year Built- 1985

For Sale- $1,800,000

-

61 N Hibbert, Mesa Grande, Mesa, AZProperty

61 N Hibbert, Mesa Grande, Mesa, AZProperty- Office

- 4,022 SF

Year Built- 1956

For Sale- $899,000

-

156 S Mesa Drive Ste. 101 , Powell Estates, Mesa, AZProperty

156 S Mesa Drive Ste. 101 , Powell Estates, Mesa, AZProperty- Retail

- 5,600 SF

Availability- 1 Space

- 2,200 SF

For Lease- $15.00/SF/YR

-

1535 E University Dr, Sherwood, Mesa, AZ

1535 E University Dr, Sherwood, Mesa, AZ -

1255 West Guadalupe Road, Dobson Ranch, Mesa, AZ

1255 West Guadalupe Road, Dobson Ranch, Mesa, AZ -

2651 West Guadalupe Road, Dobson Ranch, Mesa, AZProperty

2651 West Guadalupe Road, Dobson Ranch, Mesa, AZProperty- Office

- 7,777 SF

Availability- 1 Space

- 1,147 SF

Year Built- 1984

For Lease- $18.00/SF/YR

-

7303 S Hawes Rd, Gateway Airport, Mesa, AZProperty

7303 S Hawes Rd, Gateway Airport, Mesa, AZProperty- Industrial

- 154,282 SF

Availability- 5 Spaces

- 56,685 SF

Year Built- 2024

For Lease- $1.85 - $1.90/SF/MO

-

2725 E McKellips Rd, Arboleda, Mesa, AZ

2725 E McKellips Rd, Arboleda, Mesa, AZ -

36 W Mckellips Rd, Sherwood, Mesa, AZProperty

36 W Mckellips Rd, Sherwood, Mesa, AZProperty- VacantLand

For Sale- $3,100,000

-

1955 S Stapley Dr, Powell Estates, Mesa, AZProperty

1955 S Stapley Dr, Powell Estates, Mesa, AZProperty- Retail

- 564,374 SF

Availability- 5 Spaces

- 44,646 SF

Year Built- 1999

For Lease Contact for pricing -

445 W 5th Pl, Mesa Grande, Mesa, AZProperty

445 W 5th Pl, Mesa Grande, Mesa, AZProperty- Office

- 18,206 SF

Year Built- 1966

For Sale- $1,749,900

-

5222 East Baseline Road, Leisure World, Gilbert, AZProperty

5222 East Baseline Road, Leisure World, Gilbert, AZProperty- Office

- 62,480 SF

Availability Contact for availabilityYear Built- 2000

For Lease Contact for pricing -

557 East Juanita Avenue, Powell Estates, Mesa, AZProperty

557 East Juanita Avenue, Powell Estates, Mesa, AZProperty- Industrial

- 13,440 SF

Availability- 2 Spaces

- 3,360 SF

Year Built- 1984

For Lease- $1.15/SF/MO

-

8200 Block of East German Rd, Gateway Airport, Mesa, AZ

8200 Block of East German Rd, Gateway Airport, Mesa, AZ -

.jpg?width=450) 2165 N Power Rd, Fountain of the Sun, Mesa, AZ

2165 N Power Rd, Fountain of the Sun, Mesa, AZ -

6455 East Southern Avenue, Superstition Springs, Mesa, AZProperty

6455 East Southern Avenue, Superstition Springs, Mesa, AZProperty- Retail

- 5,780 SF

Availability- 1 Space

- 5,780 SF

Year Built- 1996

For Lease Contact for pricing -

1930 N Arboleda Dr, Arboleda, Mesa, AZProperty

1930 N Arboleda Dr, Arboleda, Mesa, AZProperty- Office

- 19,477 SF

Year Built- 2005

For Sale- $4,254,850