Executive summary:

- Q2 overview: 85% of Q2 dollar volume amassed in L.A., San Francisco, Bay Area sales;

- Top Q2 deals: Blackstone unloads $1B worth of L.A. and Bay Area office assets;

- Los Angeles rising office sales stopped short of the $2B mark;

- Investment in Bay Area office assets dropped 37% year over year;

- San Francisco sales finally bounce back above the $1 billion threshold;

- San Diego rebounds from worst quarter in 5 years with 590% Y-o-Y boost in sales;

- Orange County investment dips below $300 million in Q2; prices drop 23% Y-o-Y;

- Sacramento office market adjusts with 73% Y-o-Y drop in sales;

- Q2 0ffice completions concentrated in San Francisco; 14MSF to come online in Q3.

Q2 Overview: LA, San Francisco, Bay Area Home to 85% of Total Sales Activity

The transactions that closed across the seven California office markets we analyzed totaled nearly $5 billion in sales. The quarter marked a 36% increase compared to Q1, however, the sales volume dropped 12% year-over-year.

Investment activity on the Los Angeles office market consisted of 21 transactions that raked in just under $2 billion—the equivalent of the sales volume recorded in San Francisco and the Bay Area, combined. Activity on the San Diego market picked up and marked a 71% increase in sales compared to Q1. In contrast, the Orange County and Sacramento markets hit the brakes, each seeing a year-over-year drop in sales of over 40%.

Apart from Sacramento and Orange County, which took a nose dive this past quarter, all California markets saw an uptick in prices. The sharpest increase was in the Bay Area, where average prices rose 41% year-over-year, followed by L.A.’s 29% increase. San Diego’s rebound boosted prices 22% above the values recorded in Q2 2017, which remains the market’s worst-performing quarter in five years. Average sale prices in San Francisco, the state’s most expensive market, held relatively steady, and wrapped up Q2 in the usual mid-$500s-per-square-foot range.

Blackstone Selling Spree Continues, Equity Firm Unloads $1B Worth of LA, Bay Area Assets

A total of 56 office deals closed between April and June 2018 in California, for close to $5 billion. Most of the deals involved properties located in the Bay Area, Los Angeles, and San Francisco. Four of the 10 largest transactions of the quarter were Los Angeles office properties that sold for a combined $1.2 billion. The highest price was commanded by Blackstone’s 21-building Santa Monica Business Park, which was purchased by Boston Properties for $616 million.

This was one of four California assets that Blackstone unloaded during Q2 for a combined total of just over $971 million. The selling spree also included McCaslin Park, Los Angeles, as well as the Bay Area properties at 2100 Powell Street in Emeryville, and the Stanford Research Park at 601 California Avenue in Palo Alto. These properties came into Blackstone’s possession in 2016, when it acquired Equity Office Properties Trust for a whopping $39 billion. Blackstone is down to selling the last remaining assets in that portfolio, while EOPT (now EQ Office) has rebranded and is currently partnering with coworking space providers to “address the evolving organizational needs in workplace culture and flexibility.”

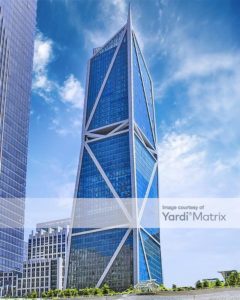

Three of the 10 priciest California office acquisitions of the quarter closed in San Francisco and raked in a combined $677 million. In what was the second-largest sale of the quarter, Northwood Investors took another property off HNA Group’s hands, and paid $300 million for the 346,000-square-foot, LEED Platinum-certified office tower at 123 Mission Street.

Of the few sales to close in Orange County during Q2, one made the top 10 list—Rockpoint Group paid $157 million for Phase One and Phase Two of the Summit Office Campus in Aliso Viejo, and is planning to reposition and rebrand the asset into an office property that is unique in the market.

Los Angeles Office Sales Stopped Short of the $2B Mark in Q2

Office sales picked up a little steam during Q2, gaining higher ground after a rather slow start to the year. The Los Angeles market closed the quarter with a sales volume of just under $2 billion, inching closer towards the numbers seen in previous quarters. Although the dollar volume amassed during Q2 was 53% higher compared to Q1, sales activity was still 16% lower year-over-year.

In terms of the average price per square foot, the L.A. office market stopped just short of the $400 threshold, and wrapped up Q1 at $397, marking a 28% year-over-year increase. Over 4.5 million square feet of inventory changed hands during the year’s second quarter, 33% more than in Q1.

The largest office acquisition in the market was completed at the start of the quarter. Boston Properties paid $616 million for the ground lease of the 1.2 million-square-foot Santa Monica Business Park, located in Sunset Park, in the West Side Los Angeles submarket.

The land is owned by the Transpacific Development Co., and the ground lease gives Boston Properties the right to purchase the fee in 2028, with subsequent purchase rights every 15 years. The seller (Blackstone) had acquired the 21-building campus in 2007, as part of its $39 billion buyout of Equity Office Properties Trust, and has been selling off the last remaining assets of that purchase. At the time of sale, the Santa Monica Business Park was reportedly 94% leased, with tenants including Snap Inc.—the parent company of messaging application Snapchat—Activision Blizzard, Pandora, Treyarch, and Cypress Creek Renewables.

Bay Area Sales Continue Downward Trend, Drop 37% Y-o-Y

The downward trend seen in Bay Area office sales at the start of the year continued, as the market closed Q2 with a 37% year-over-year drop—11 office assets traded during Q2, for a total of $826 million.

Average prices rested at $482 at the close of the second quarter, climbing 3% compared to Q1, and a sharp 41% year-over-year. Nearly 1.7 million square feet of Bay Area office space changed hands during this past quarter, 34% less than in Q1.

In the largest deal to close during Q2 in the Bay Area, CBRE Global Investors paid $171 million for the Class A office tower at 2100 Powell Street in Emeryville. The acquisition of the 344,433-square-foot, LEED Gold-certified property at nearly $500 per square foot further cements CBRE’s focus on the high potential of this East Bay submarket as one of the region’s premier addresses for healthcare, life science, technology, and professional service tenants.

San Francisco Office Sales Finally Bounce Back, Surpass $1B

Sales activity had been notably sluggish on the San Francisco office market since Q3 2017 but kicked into high gear starting this April. The quarterly sales volume reached $1.2 billion, marking a 52% growth year-over-year, and a four-fold increase compared to Q1.

Roughly 2.2 million square feet of office inventory changed hands in San Francisco from April through June. Although prices dipped 2% compared to the previous year, San Francisco remains undisputed as California’s most expensive office market, wrapping up Q2 with an average of $546 per square foot.

The biggest deal to close in Q2 was the $300 million acquisition of the 123 Mission Street tower by Northwood, an investment firm led by former Blackstone executive John Kukral. The 29-story, LEED Platinum-certified, Class A office property was reportedly 100% leased at the time of sale, with tenants including startup incubator RocketSpace, analytics software company New Relic, and Salesforce. This office asset was HNA Group’s first West Coast investment, acquired in August 2016 for $255 million, and is among the latest to go in the company’s recent selling spree—the Chinese conglomerate seeks to quickly reduce the significant debt it has accumulated while building its global portfolio.

San Diego Rebounds from Worst Quarter in 5 Years

Showing signs of recovery from recent sales slumps, the San Diego market wrapped up Q2 with a total of $318 million in sales in seven transactions. This marks a 72% increase compared to Q1, and a 590% growth year-over-year. Granted, this nearly six-fold increase is over Q2 2017, the market’s worst quarter in the past five years, when only two assets larger than 50,000 square feet traded, for a combined total of $46 million.

Just over 1 million square feet of office space changed hands in San Diego during Q2, more than double the inventory traded in the first three months of the year. Average prices rested at $307 per square foot, marking a 21% increase year-over-year, and an 86% boost compared to the previous quarter.

In the largest deal to close in Q2, Pendulum Property Partners paid $100 million for the 336,000-square-foot Stonecrest office campus located in the Serra Mesa submarket. This marked the Irvine-based company’s fifth Southern California acquisition, and its first investment in the San Diego office market. At the time of sale, the campus was 93% occupied, home to both local and national tenants, including Blue Cross Blue Shield, Mercury Insurance, ACE Insurance, and Vitas Healthcare. According to Pendulum founding partner Kevin Hayes, the region boasts a strong economic base, which includes technology, life science, and a significant military presence, and with better in-place yields than Orange and Los Angeles counties, it is poised for significant long-term growth.

Orange County Sales Fall Below $300M; Prices Drop 23% Y-o-Y

It was a slower-than-usual quarter for the Orange County office market. The $278 million sales volume marks a 24% decrease from Q1, and a 48% drop year-over-year, as well as the third quarter in five years when office investment in Orange County falls below the $300 million mark.

Just over 1.1 million square feet of office space changed hands from April through June this year, 54% less than during Q1, and 41% less year over year. In terms of the price per square foot, the Orange County office market wrapped up the quarter with an average of $180—a 23% decrease compared to Q2 2017.

Deutsche Asset & Wealth Management real estate investment trust RREEF Property Trust sold the Summit Office Campus Phase One and Summit Office Campus Phase Two buildings in Aliso Viejo to Boston-based Rockpoint Group, for $157 million. According to NKF Capital Markets (representing the seller in the deal), this was the largest Orange County office sale in six months. The multi-tenant office buildings were 79% occupied at the time of purchase, with notable tenants including Microsoft Corp., Tech Space, NuVasive, Inc., and Pacific World Corp.

Paul Jones, executive managing director with NKF, stated that “Rockpoint intends to undergo a heavy reposition and re-branding on this asset in order to push market rents, drive leasing velocity and create a very unique office campus like nothing else in the submarket.”

Sacramento Office Market Adjusts with 73% Y-o-Y Drop in Sales

Sales data trailing five years shows that Q2 often tends to be the slowest quarter of the year. Moreover, as the market’s investment potential has grown over the past few years, sales have shown wilder fluctuations from quarter to quarter. Therefore, the 73% year-over-year drop in sales is not a drastic plunge, but more likely part of a market adjustment process.

Roughly 470,000 square feet of office inventory changed hands in Sacramento from April through June, considerably less than the 1 million square feet traded during Q2 2017, or the 1.7 million square feet transacted in Q1. Because only three office assets equal to or larger than 50,000 square feet were sold during Q2, no reliable average sale price per square foot could be calculated.

The largest of the three transactions to close in Sacramento in Q2 was the $43 million purchase of a two-building, 219,402-square-foot office park in Rocklin, which accounted for nearly half of the total sales volume. The Rocklin Corporate Plaza buildings at 6020 West Oaks Blvd., and 6030 West Oaks Blvd., were acquired by Pappas Investments from KBS Realty Advisors, at nearly 100% occupancy. The tenant roster is diverse and includes names like Liberty Mutual Insurance, SMA Solar Technology, PG&E, and Oracle.

San Francisco Hogs the Pipeline in Q2; Half of New Projects are Biomed/MOB

San Francisco is home to 8 of the 12 new office projects that were completed during Q2 2018, accounting for 88% of the 3.6 million square feet delivered in California during the past quarter.

Front-and-center was the long-awaited nominal completion of the innovative and ultra-green 1.4 million-square-foot Salesforce Tower.

Steps away from San Francisco’s tallest edifice is 181 Fremont, the second-largest office project to be completed during the past quarter. The mixed-use Jay Paul Co. development encompasses just over 3,000 square feet of retail on the lower floors, and about 435,000 square feet of Class A office space through floor 44 (almost entirely leased to Facebook’s Instagram division), while the top 17 floors house 67 luxury residential units that have been selling like hot cakes.

Half of the 12 new properties brought to market were pharmaceutical and bioscience R&D facilities, and medical office buildings. San Diego-based life sciences company Illumina’s new Foster City headquarters was developed by BioMed Realty, and is meant to boast a collegiate feel, as part of the company’s strategy to attract recent Ph.Ds. in the field. The 360,000-square-foot Illumina at Lincoln Center is home to the company’s Bay Area and San Francisco employees, and can accommodate up to 1,200 people. Incorporating a 40,000-square-foot amenity building, and two 151,000-square-foot office and R&D buildings, the campus blends a mix of open collaborative workspace and natural light-filled labs, as well as an 8,000-square-foot accelerator space that Illumina offers to startups in the genomics field for six months to use its space and equipment.

The 170,523-square-foot Vertex Pharmaceuticals Research Facility in University City, San Diego, was recently completed by BNBuilders, a development company focused on creating cutting-edge facilities for companies operating in the biotech, health, and life science industries. Roughly 70% dedicated to laboratory/research activities, the site encompasses a 1,500-square-foot Learning Lab for STEM education programs, and a 4,000-square-foot Incubator Suite for external collaboration. Moreover, the LEED Gold-certified facility incorporates an innovative air circulation system designed to bring in 100% outside air.

The Orange County market welcomed the Hoag Health Center medical offices at Tustin Legacy, the Downtown West Medical Offices in Central L.A. were completed in April, and the Skyport Medical Offices were brought to the North San Jose submarket in May.

Roughly 13.4 million square feet of new office space is expected to be completed in California during Q3 2018. The main delivery arena, with about 6.7 million square feet of new developments set to come online, will be the Bay Area, home to notable projects such as the Apple Park in Cupertino, the Moffett Towers II Building 1 and Building 2, and the Moffett Place – 1190 Bordeaux in Sunnyvale, as well as phase one of the Assembly at North First in San Jose, and the newest Stanford Research Park facility in Palo Alto. The historic Spruce Goose hangar rehabilitation is also set to come online in Q3, and is one of the best adaptive reuse projects of the past decade in L.A.

Methodology

For this report, we relied on Yardi Matrix data to analyze all office transactions to close in the Bay Area, Inland Empire, Los Angeles, Orange County, Sacramento, San Diego and San Francisco markets during the second quarter of 2018 (April through June), and we selected only those carrying price tags equal to or larger than $5 million each. Our research, based on sales data recorded up until July 5th, 2018, includes completed office buildings that are equal to or larger than 50,000 square feet. Regarding mixed-use assets, only properties including over 50% office space were considered. Portfolio deals were counted as single transactions, while distressed sales were excluded altogether. To ensure that the trends and comparisons presented in our report are valid, we also excluded ‘ownership stake,’ ‘ground lease,’ ‘controlling interest,’ ‘portfolio’ and ‘undisclosed’ deals from our calculation of the average price per square foot. No sales of office properties equal to or larger than 50,000 square feet were recorded in the Inland Empire in Q2 2018.

Although we have made every effort to ensure the accuracy, timeliness and completeness of the information included in this report, the data is provided “as is” and neither CommercialCafe nor Yardi Matrix can guarantee that the information provided herein is exhaustive.

Property images courtesy of Yardi Matrix.