San Jose, CA Office Spaces for Rent

Find your best San Jose, CA office space among 788 for rent listings, which average an asking price of $47.46 per square foot.

-

3031 Tisch Way, San Jose, CAServices

3031 Tisch Way, San Jose, CAServices- Virtual Office

- Open Workspace

- Private Office

- Dedicated Desk

Amenities -

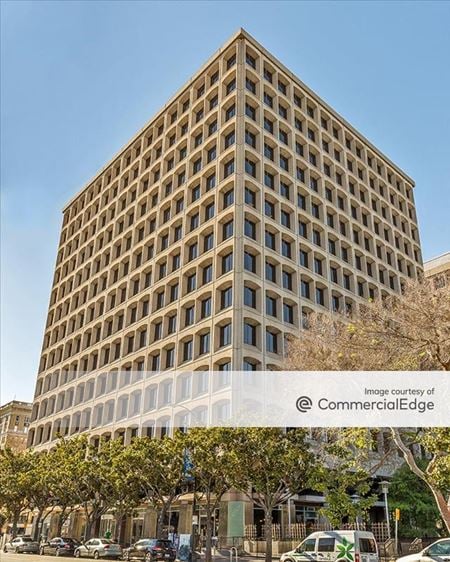

303 South Almaden Blvd, Downtown San Jose, San Jose, CAProperty

303 South Almaden Blvd, Downtown San Jose, San Jose, CAProperty- Office

- 166,361 SF

Availability- 1 Space

- 10,858 SF

Year Built- 1995

For Lease Contact for pricing -

25 Metro Drive, North San Jose, San Jose, CAProperty

25 Metro Drive, North San Jose, San Jose, CAProperty- Office

- 468,793 SF

Availability- 19 Spaces

- 213,583 SF

Year Built- 1987

For Lease Contact for pricing -

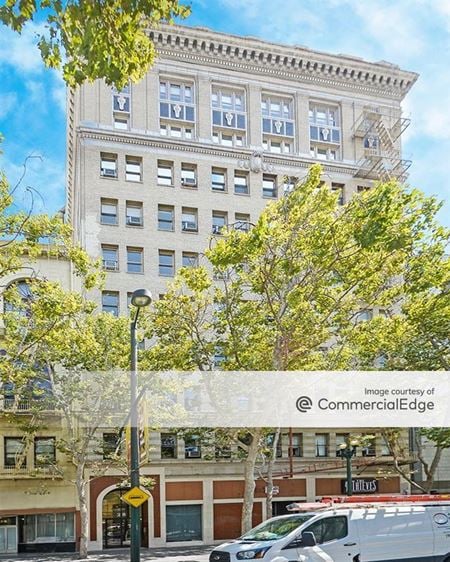

84 Santa Clara St, W., Downtown San Jose, San Jose, CAProperty

84 Santa Clara St, W., Downtown San Jose, San Jose, CAProperty- Office

- 110,000 SF

Availability- 7 Spaces

- 25,755 SF

Year Built- 1976

For Lease Contact for pricing -

58 Daggett Drive, North San Jose, San Jose, CAProperty

58 Daggett Drive, North San Jose, San Jose, CAProperty- Office

- 39,660 SF

Availability- 2 Spaces

- 23,660 SF

Year Built- 1981

For Lease- $1.75/SF/MO

-

2535 N 1st St 1, North San Jose, San Jose, CAProperty

2535 N 1st St 1, North San Jose, San Jose, CAProperty- Office

Availability- 1 Space

- 62,280 SF

Year Built- 2001

For Lease- $1.55/SF/MO

-

2880 Zanker Road, North San Jose, San Jose, CAProperty

- Office

- 302,000 SF

Availability- 5 Spaces

- 2,650 SF

Year Built- 1985

For Lease Contact for pricing -

1740 Technology Drive, North San Jose, San Jose, CA

1740 Technology Drive, North San Jose, San Jose, CA -

2885 Zanker Road, North San Jose, San Jose, CAProperty

2885 Zanker Road, North San Jose, San Jose, CAProperty- Office

- 30,260 SF

Availability- 1 Space

- 30,260 SF

Year Built- 1981

For Lease- $1.75/SF/MO

-

2077 Gateway Pl , North San Jose, San Jose, CAProperty

2077 Gateway Pl , North San Jose, San Jose, CAProperty- Office

Availability- 2 Spaces

- 16,869 SF

Year Built- 1985

For Lease- $3.85/SF/MO

-

5799 Fontanoso Way, Santa Teresa, San Jose, CAProperty

5799 Fontanoso Way, Santa Teresa, San Jose, CAProperty- Office

- 93,650 SF

Availability- 1 Space

- 93,650 SF

Year Built- 1999

For Lease- $0.89/SF/MO

-

1600 Technology Drive, North San Jose, San Jose, CA

1600 Technology Drive, North San Jose, San Jose, CA -

%20San%20Jose%20USA%20Large%20Office%20-%20The%20Almaden.jpg?width=450) 99 South Almaden Boulevard Suite 600, San Jose, CA

99 South Almaden Boulevard Suite 600, San Jose, CADowntown San Jose

RegusServices- Virtual Office

- Open Workspace

- Private Office

- Dedicated Desk

Amenities -

1900 Camden Avenue, San Jose, CA

1900 Camden Avenue, San Jose, CASilicon Valley Business Center

Silicon Valley Business CenterServices- Meeting Room

- Private Office

Amenities -

178 East Tasman Drive, North San Jose, San Jose, CAProperty

178 East Tasman Drive, North San Jose, San Jose, CAProperty- Office

- 112,043 SF

Availability- 2 Spaces

- 106,401 SF

Year Built- 2001

For Lease- $2.05/SF/MO

-

2001 Gateway Place, North San Jose, San Jose, CAProperty

2001 Gateway Place, North San Jose, San Jose, CAProperty- Office

- 171,378 SF

Availability- 1 Space

- 1,633 SF

Year Built- 1981

For Lease Contact for pricing -

2125 O'Nel Drive, North San Jose, San Jose, CAProperty

2125 O'Nel Drive, North San Jose, San Jose, CAProperty- Office

- 110,669 SF

Availability- 2 Spaces

- 110,669 SF

Year Built- 1985

For Lease- $2.95/SF/MO

-

2210 O'Toole Avenue, North San Jose, San Jose, CAProperty

2210 O'Toole Avenue, North San Jose, San Jose, CAProperty- Office

- 53,594 SF

Availability- 3 Spaces

- 11,576 SF

Year Built- 1984

For Lease- $1.95/SF/MO

-

1745 Technology Dr , North San Jose, San Jose, CAProperty

1745 Technology Dr , North San Jose, San Jose, CAProperty- Office

Availability- 5 Spaces

- 145,248 SF

Year Built- 2000

For Lease- $4.25/SF/MO

-

2665 North 1st Street, North San Jose, San Jose, CAProperty

2665 North 1st Street, North San Jose, San Jose, CAProperty- Office

- 122,619 SF

Availability- 3 Spaces

- 32,313 SF

Year Built- 1984

For Lease- $3.25 - $3.75/SF/MO

-

2160 Lundy Ave, North Valley, San Jose, CA

2160 Lundy Ave, North Valley, San Jose, CA -

80 Rose Orchard Way, North San Jose, San Jose, CAProperty

80 Rose Orchard Way, North San Jose, San Jose, CAProperty- Industrial

- 63,950 SF

Availability- 1 Space

- 22,750 SF

Year Built- 1985

For Lease- $2.50/SF/MO

-

2099 Gateway Pl , North San Jose, San Jose, CAProperty

2099 Gateway Pl , North San Jose, San Jose, CAProperty- Office

Availability- 7 Spaces

- 26,298 SF

Year Built- 1985

For Lease- $3.85/SF/MO

-

2001 Gateway Pl , North San Jose, San Jose, CAProperty

2001 Gateway Pl , North San Jose, San Jose, CAProperty- Office

Availability- 18 Spaces

- 100,790 SF

Year Built- 1981

For Lease- $3.85/SF/MO

-

160 Santa Clara St, W., Downtown San Jose, San Jose, CAProperty

160 Santa Clara St, W., Downtown San Jose, San Jose, CAProperty- Office

- 228,588 SF

Availability- 12 Spaces

- 77,241 SF

Year Built- 1988

For Lease- $58.20/SF/YR

-

2590 North 1st Street, North San Jose, San Jose, CAProperty

2590 North 1st Street, North San Jose, San Jose, CAProperty- Office

- 73,242 SF

Availability- 3 Spaces

- 21,871 SF

Year Built- 1985

For Lease- $3.75/SF/MO

-

28 North 1st Street, Downtown San Jose, San Jose, CAProperty

28 North 1st Street, Downtown San Jose, San Jose, CAProperty- Office

- 30,000 SF

Availability- 2 Spaces

- 3,431 SF

Year Built- 1936

For Lease- $3.25/SF/MO

-

2833 Junction Avenue, North San Jose, San Jose, CAProperty

2833 Junction Avenue, North San Jose, San Jose, CAProperty- Office

- 302,000 SF

Availability- 12 Spaces

- 68,568 SF

Year Built- 1985

For Lease- $36.00 - $43.80/SF/YR

-

1871 The Alameda, Downtown San Jose, San Jose, CAProperty

1871 The Alameda, Downtown San Jose, San Jose, CAProperty- Office

- 52,198 SF

Availability- 2 Spaces

- 4,742 SF

Year Built- 1972

For Lease- $35.40/SF/YR

-

841 Blossom Hill Road, Blossom Valley, San Jose, CAProperty

841 Blossom Hill Road, Blossom Valley, San Jose, CAProperty- Office

- 32,337 SF

Availability- 3 Spaces

- 7,249 SF

Year Built- 1974

For Lease- $3.00/SF/MO

-

226 Airport Pkwy , North San Jose, San Jose, CAProperty

226 Airport Pkwy , North San Jose, San Jose, CAProperty- Office

Availability- 11 Spaces

- 57,090 SF

Year Built- 1980

For Lease- $3.85/SF/MO

-

152 North 3rd Street, Downtown San Jose, San Jose, CAProperty

152 North 3rd Street, Downtown San Jose, San Jose, CAProperty- Office

- 130,714 SF

Availability- 9 Spaces

- 130,614 SF

Year Built- 1986

For Lease- $3.95/SF/MO

-

-

75 Santa Clara St., E., Downtown San Jose, San Jose, CAProperty

75 Santa Clara St., E., Downtown San Jose, San Jose, CAProperty- Office

- 200,674 SF

Availability- 16 Spaces

- 128,425 SF

Year Built- 1974

For Lease- $46.20/SF/YR

-

1732 North 1st Street, North San Jose, San Jose, CAProperty

1732 North 1st Street, North San Jose, San Jose, CAProperty- Office

- 171,574 SF

Availability- 3 Spaces

- 46,758 SF

Year Built- 1998

For Lease- $4.25/SF/MO

-

3030 Orchard Pkwy, North San Jose, San Jose, CAProperty

3030 Orchard Pkwy, North San Jose, San Jose, CAProperty- Office

Availability- 1 Space

- 77,822 SF

Year Built- 2001

For Lease- $2.35/SF/MO

-

2460 N 1st St, North San Jose, San Jose, CA

2460 N 1st St, North San Jose, San Jose, CA -

111 Market St, N., Downtown San Jose, San Jose, CAProperty

111 Market St, N., Downtown San Jose, San Jose, CAProperty- Office

- 156,784 SF

Availability- 19 Spaces

- 79,153 SF

Year Built- 1967

For Lease Contact for pricing -

2150 North 1st Street, San Jose, CA

2150 North 1st Street, San Jose, CAExpansive North First

ExpansiveServices- Meeting Room

- Private Office

- Dedicated Desk

Amenities -

1960 The Alameda, Downtown San Jose, San Jose, CAProperty

1960 The Alameda, Downtown San Jose, San Jose, CAProperty- Office

- 38,800 SF

Availability- 1 Space

- 2,176 SF

Year Built- 1985

For Lease- $43.80/SF/YR

-

2218 First St, N., North San Jose, San Jose, CAProperty

2218 First St, N., North San Jose, San Jose, CAProperty- Office

- 6,499 SF

Availability- 1 Space

- 6,499 SF

Year Built- 1982

For Lease Contact for pricing -

150 Charcot Avenue, North San Jose, San Jose, CAProperty

150 Charcot Avenue, North San Jose, San Jose, CAProperty- Industrial

- 165,601 SF

Availability- 2 Spaces

- 18,006 SF

Year Built- 1979

For Lease- $23.40/SF/YR

-

2580 North 1st Street, North San Jose, San Jose, CAProperty

2580 North 1st Street, North San Jose, San Jose, CAProperty- Office

- 70,981 SF

Availability- 2 Spaces

- 5,058 SF

Year Built- 1985

For Lease- $3.75/SF/MO

-

1731 Technology Dr, North San Jose, San Jose, CAProperty

1731 Technology Dr, North San Jose, San Jose, CAProperty- Office

- 153,665 SF

Availability- 1 Space

- 10,940 SF

Year Built- 1984

For Lease- $30.00/SF/YR

-

1777 Hamilton Avenue, Willow Glen, San Jose, CAProperty

1777 Hamilton Avenue, Willow Glen, San Jose, CAProperty- Office

- 28,181 SF

Availability- 8 Spaces

- 5,779 SF

Year Built- 1965

For Lease- $2.00/SF/MO

-

1180 Coleman Ave, North San Jose, San Jose, CAProperty

1180 Coleman Ave, North San Jose, San Jose, CAProperty- Office

Availability- 1 Space

- 10,033 SF

Year Built- 1962

For Lease- $1.75/SF/MO

-

2515 N 1st St 4, North San Jose, San Jose, CAProperty

2515 N 1st St 4, North San Jose, San Jose, CAProperty- Office

Availability- 1 Space

- 49,560 SF

Year Built- 2001

For Lease- $1.55/SF/MO

-

1610 East Capitol Expwy, Evergreen, San Jose, CAProperty

1610 East Capitol Expwy, Evergreen, San Jose, CAProperty- Retail

- 61,936 SF

Availability- 1 Space

- 3,157 SF

Year Built- 1990

For Lease- $3.75/SF/MO

-

300 Park Ave, Downtown San Jose, San Jose, CAProperty

300 Park Ave, Downtown San Jose, San Jose, CAProperty- Office

- 321,618 SF

Availability- 1 Space

- 59,205 SF

Year Built- 2008

For Lease- $24.00/SF/YR

-

3200 North 1st Street, North San Jose, San Jose, CAProperty

3200 North 1st Street, North San Jose, San Jose, CAProperty- Office

- 85,017 SF

Availability- 1 Space

- 85,017 SF

Year Built- 1997

For Lease Contact for pricing -

41 Daggett Drive, North San Jose, San Jose, CAProperty

41 Daggett Drive, North San Jose, San Jose, CAProperty- Office

- 248,835 SF

Availability- 1 Space

- 10,983 SF

Year Built- 1983

For Lease- $2.75/SF/MO

-

1096 Blossom Hill Road, Blossom Valley, San Jose, CAProperty

1096 Blossom Hill Road, Blossom Valley, San Jose, CAProperty- Office

- 13,527 SF

Availability- 2 Spaces

- 9,890 SF

Year Built- 1991

For Lease- $3.00/SF/MO