Advances in medical research and technology are catching up to the increasing demand for precision medicine and a patient-centric supply chain. Likewise, the growing potential for pathogens to spread calls for therapy and immunization discovery to work at an unprecedented pace. So, as life sciences industries are experiencing demand like never before, they also fuel the necessity for well-educated R&D talent, world-class facilities and a supportive economy. With this in mind, we set out to identify where in the U.S. these industry needs were best being met.

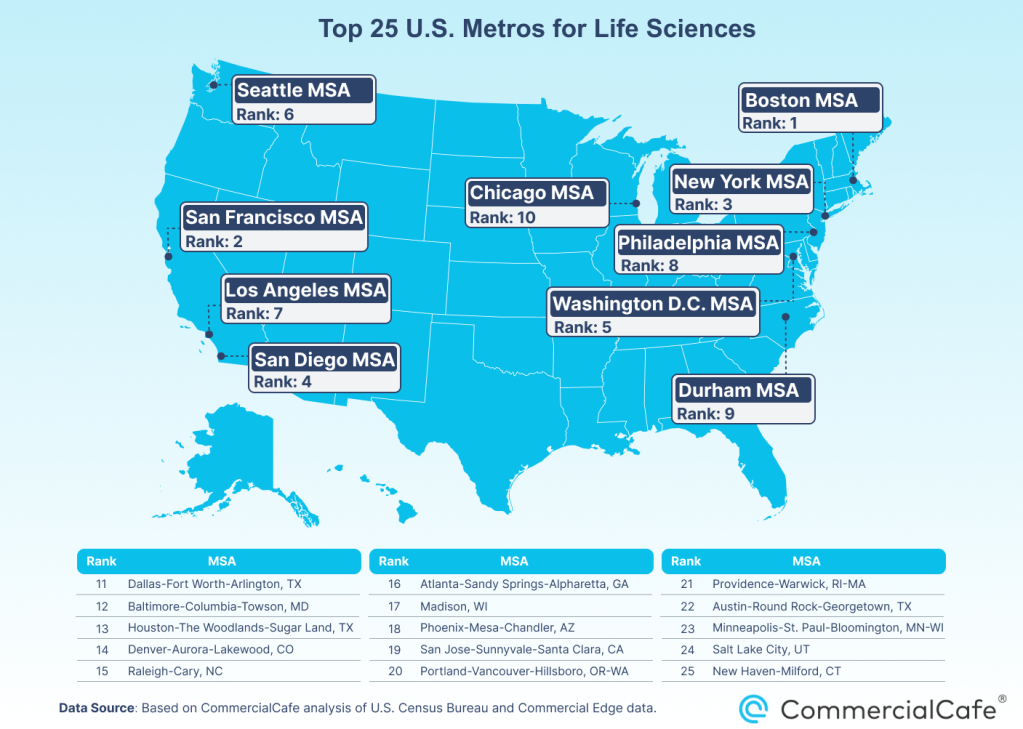

Using CommercialEdge market research data, as well as the most recent information available from various U.S. agencies, we analyzed more than 100 U.S. metros. Specifically, we assessed their strengths for life sciences success across several key indicators, such as innovation, the talent pool, and life sciences in the local office market. Below, we include a summary of the state of life sciences in the U.S. and rank the top 25 U.S. metros for life sciences that resulted from our comparative study.

National Highlights: A Look at Recent Life Sciences Growth Across the U.S.

Undoubtedly, life sciences activity in the U.S. makes for a thriving industry. In fact, half of the markets included in our comparative study saw double-digit percentage growth in the number of local life sciences establishments during the five years from 2018 through 2022. Then, by the start of 2023, the number of life sciences establishments had exceeded 1,000 in more than 30 of the metropolitan areas we compared.

Of course, the industry’s significant presence can also be seen in the real estate market: 20 of the locations we analyzed had a life sciences market segment that was larger than 1 million square feet by the start of 2024. Consequently, in terms of market share, our data showed that life sciences space accounted for more than 1% of the office market in 30 of the metropolitan areas we compared.

Meanwhile, from 2018 through 2023, 31 of the locations we analyzed had added new life sciences space to the local market. In eight of those markets, the expansion included more than 1 million square feet. Plus, growth in the sector looks poised to continue as ongoing market expansion plans show 28 of the metropolitan areas included in our study were home to life sciences developments that were in the planned or under-construction stages at the close of 2023.

What’s more, talent in the U.S. is not in short supply, either: In 17 of the metros we compared, the local talent pool encompassed more than 500,000 residents aged 25 and older who held at least a bachelor’s degree in science, engineering, and related fields. Of these, five locations boasted a talent pool larger than 1 million. Notably, 19 of the U.S. metros included in our study are home to more than 10 learning institutions that offer programs and/or majors in biological and biomedical sciences.

See our data in the table included directly below and the methodology section for details on metrics and scores. Then, read on for our deeper dive into the top 25 metros for life sciences in the U.S.

The 25 Best Metros for Life Sciences in the U.S.

While the top 10 positions are almost evenly filled by metros located along the West and East coasts, a look beyond #10 shows that life sciences are a notable presence in all regions and are also thriving outside of the usual top-ranking gateway office markets.

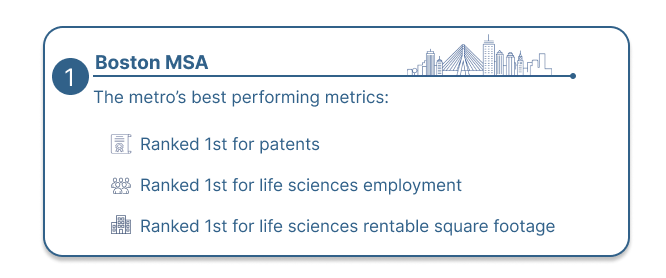

1Life Science Central: Boston Boasts Largest Life Sciences Real Estate Pipeline

Boston claimed the #1 spot with a total of 74 points out of 100. In fact, the Massachusetts metropolitan statistical area (MSA) earned top scores for several metrics, including dedicated real estate. For instance, with roughly 27 million square feet of office space in Boston dedicated to life sciences —.4 which adds up to about 10% of the local office market — the metro stood out as home to the largest life sciences real estate market among the entries in the ranking. And, with a little more than 18 million square feet of new projects in various stages of development, Boston also claimed a comfortable lead in terms of pipeline.

At the same time, Boston also took the lead in terms of innovation and employment in related industries. More precisely, life sciences innovators headquartered in this metro area had earned nearly 1,750 patents by 2023 — the highest number of grants out of all of the metros we compared. Moreover, according to BLS data, Boston metro was also home to the largest life sciences labor force (more than 26,000) among the entries in the ranking.

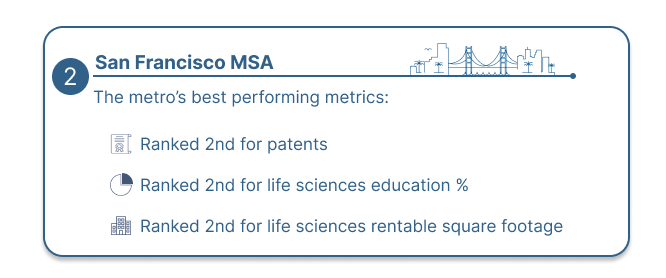

2Life Sciences Space Accounts for 8% of Sizeable San Francisco Office Market

San Francisco ranked as the second-best U.S. metro for life sciences with a total score of 55 points. It’s worth mentioning here that the Bay Area metro was the only other market in this ranking to encompass more than 20 million square feet of completed life sciences property: The roughly 20 million square feet dedicated to use in life sciences accounts for nearly 8% of office space in San Francisco, which is no small segment in one of the largest office markets in the country.

The city also stood out in terms of its pipeline as it was the only other ranking entry besides Boston to claim more than 10 million square feet of new life sciences space on the way. In particular, developers here have nearly 18 million square feet of projects in the works — more than double the 7.4 million square feet added to the market since 2018.

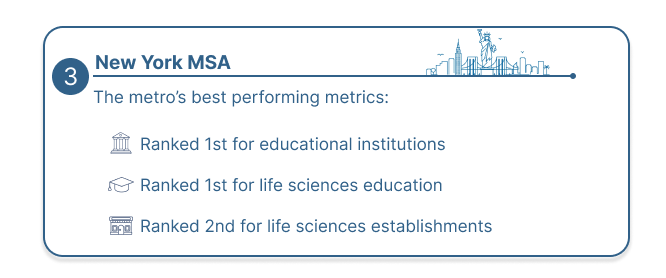

3New York Metro Area Offers Largest Life Sciences Talent Pool

In third place was the New York metropolitan area, which earned a total score of 53 points. In this case, the metro’s best performance in the ranking was in educational attainment. With the highest number of learning institutions offering biological and biomedical sciences programs or majors (70), the New York metro area is home to the largest number of residents aged 25 or older holding at least a bachelor’s degree in related fields (nearly 3 million).

Additionally, the New York metro is also home to the second-largest life sciences labor force among the entries in the ranking (more than 18,000), as well as one of the most innovative: With nearly 1,340 patents granted to local life sciences inventors by 2023, the MSA received the third-best score in the innovation index in our ranking.

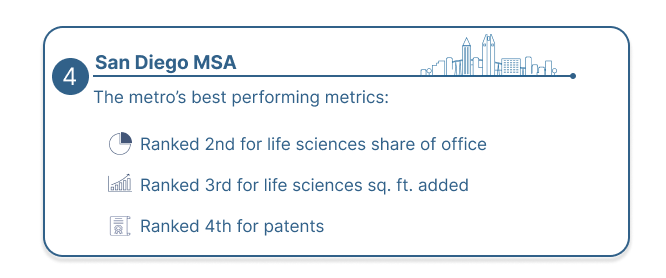

4San Diego Adds 3rd-Most New Life Sciences Square Footage Since 2018

The San Diego metro area earned more than 36 points and ranked as the fourth-best U.S. metro for life sciences. This entry’s strongest-performing metrics were for the life sciences segment of the local real estate market. Among the entries in our ranking, the 1.8 million square feet of new life sciences space delivered to the market since 2018 represented the third-largest growth by square footage added.

Furthermore, life sciences accounted for nearly 11% of office space in San Diego, which earned the metro the second-best score for the share of the market. And, with demand still on the rise, the metro area is already working on further growth: With more than 6 million square feet of new life sciences office projects in the works, San Diego is home to the third-largest life sciences real estate pipeline among the metros we compared.

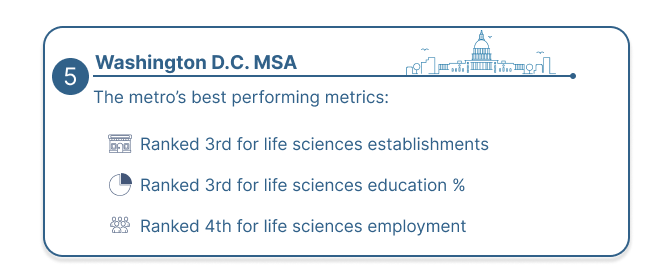

5Washington, D.C. Scores Podium Points for Educational Attainment & Life Sciences in Local Economy

Ranking fifth overall with a total score of nearly 36 points, Washington, D.C. shined in terms of its talent pool, as well as for life sciences in the local economy. Among the ranking entries we compared, the capital metro area was home to the third-largest number of life sciences establishments (5,645), as well as the fourth-largest labor pool (15,160 metro residents employed in life sciences occupations).

Notably, D.C. also scored third-best for the two educational attainment metrics we considered in the talent pool category. Namely, the 1.2 million residents holding at least a bachelor’s degree in related fields represented 28% of the total metro population aged 25 or older.

What’s more, D.C. also placed among the top 10 for several indicators in the real estate market category: Here, more than 5 million square feet of Washington, D.C. office space is dedicated to use in life sciences, which gave the Capital the seventh-largest market for the industry. And, with 2.8 million square feet of new projects in various stages of development, the metro also claimed the seventh-largest life sciences pipeline in the ranking.

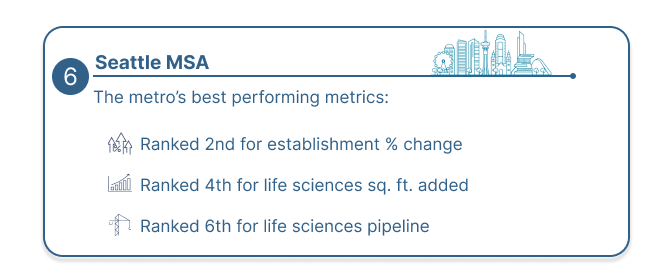

6Seattle Sees 2nd-Largest 5-Year Growth of Local Life Sciences Scene

In sixth place was the Seattle metropolitan area. Its strongest suit was the growth of life sciences in the local economy. Specifically, Emerald City saw a 54% increase in the number of life sciences establishments during the five years following 2018, which was second only to the MSA in Charleston, S.C., where data showed 67% growth during the same time period. It’s worth noting that Seattle was also home to the sixth-largest number of life sciences establishments (nearly 3,600) and the seventh-largest life sciences labor force (9,320) among the locations we compared.

Our analysis also found that Seattle was home to the sixth-largest life sciences real estate pipeline with nearly 3 million square feet of new space in development. This marks a significant expansion of the market and adds to the nearly 4.5 million square feet of existing stock (the eighth-largest life sciences market in our ranking), which represented nearly 3% of office space in Seattle.

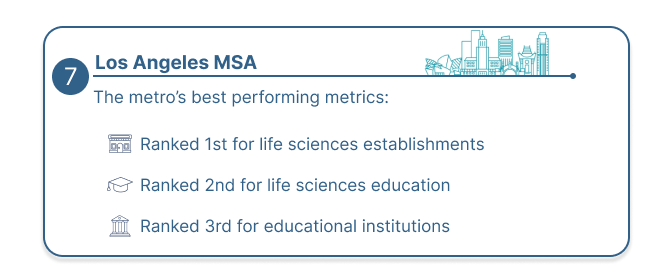

7Los Angeles Metro Harbors Largest Number of Life Sciences Establishments

Los Angeles came in seventh among the top U.S. metros for life sciences. Here, LA’s best scores reflected strengths in the life sciences sector of the local economy, as well as in educational attainment in industry related fields: By 2023, the Los Angeles metropolitan area was home to nearly 8,300 life sciences establishments, which was the largest number among the locations we compared. Plus, this was the case even after data showed a 6% decrease during the previous five years. What’s more, with 11,300 people working in life sciences occupations across the metro area, Los Angeles claimed the fifth-largest labor force in the ranking.

The talent pool potential across the LA metro area also shined among its top scores. With nearly 1.6 million residents aged 25 years or older holding at least a bachelor’s degree in industry related fields, LA was second only to New York in terms of educational attainment.

As for real estate, it’s worth noting that although the life sciences segment accounted for less than 1% of office space in Los Angeles, it nevertheless encompassed roughly 3.9 million square feet of space and represented the 10th-largest life sciences real estate market among ranking entries.

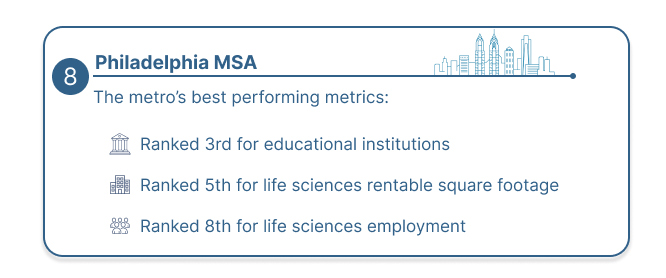

8Philadelphia Pipeline Marks Notable Future Market Expansion

Philadelphia earned eighth place among the top U.S. metros for life sciences with its highest scores reflecting strengths in the core office market. Life sciences developments currently underway here totaled nearly 2.2 million square feet, which represented the eighth-largest life sciences real estate pipeline among the metros in this ranking. It also marks a significant future market expansion as existing stock adds up to roughly 6.3 million square feet (the fifth-largest life sciences real estate segment in our ranking) and represents roughly 3% of Philadelphia office space.

The growth potential in this Pennsylvania metro was also apparent in the metrics pertaining to the local talent pool: With 35 learning institutions offering industry related programs or majors, Philadelphia was on par with Los Angeles and landed third behind only Chicago and New York for this metric. Accordingly, the 850,000 residents holding at least a bachelor’s degree in life sciences-related fields represent about 20% of the total number of residents aged 25 and older and make Philly home to one of the 10 largest highly educated talent pools among the metros in our ranking.

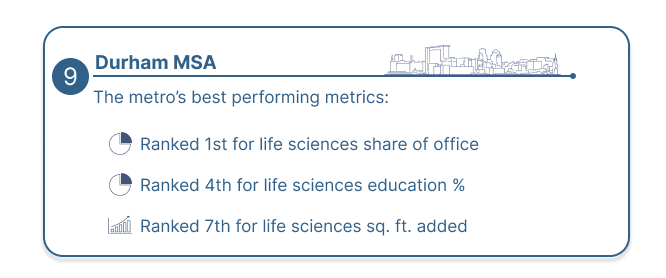

9Durham Home to Largest Share of Life Sciences Space in Local Office Market

The Durham metro area landed a close ninth behind Philadelphia in our ranking. Here, the life sciences sector accounted for nearly 14% of office space in Durham, which was the largest share of the market among the locations we compared. With existing stock totaling nearly 5.8 million square feet, the metro claimed the sixth-largest life sciences real estate market in the ranking.

Plus, with demand poised to remain strong at least into the near future, almost all of the major markets we analyzed had new projects in some stage of planning or construction. Developments currently underway in Durham amount to roughly 1.8 million square feet of new space, which marked the ninth-largest pipeline among all entries in the ranking. It also surpassed the nearly 1.2 million square feet of projects delivered from 2018 through 2023, which was the seventh-most life sciences space added during that time of the metros we compared.

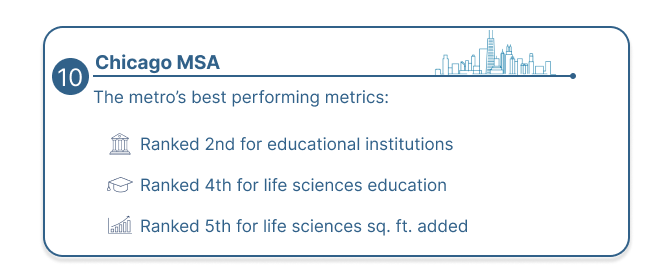

10Chicago Shines as 2nd-Strongest Talent Educating Powerhouse

Chicagoland rounded out the top 10 U.S. metros for life sciences. The strongest suit of the Windy City in this ranking was its potential to produce highly educated talent. In fact, the Chicago-Naperville-Elgin metropolitan area is home to 37 institutions offering industry related programs or majors, which ranked second only to New York. It comes as no surprise, then, that roughly 18% of metro residents aged 25 or older hold at least a bachelor’s degree in an industry related field, which equates to nearly 1.2 million highly educated individuals — the fourth-largest talent pool among the metros in our ranking.

Recent development activity in the real estate market showed that there’s also an innovation hub developing here to meet that talent where it grows. Although life sciences account for less than 1% of office space in Chicago, this real estate segment adds up to almost 2.9 million square feet — almost half of which was added to the market starting in 2018.

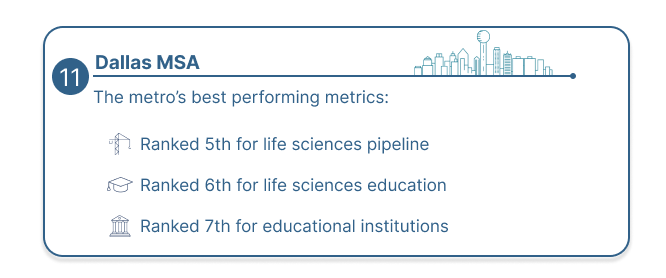

11Dallas-Fort Worth Offers 6th-Largest Life Sciences Talent Pool

This Texas metro landed 11th among the top U.S. metros for life sciences, and the Dallas-Fort Worth metropolitan area’s strongest metrics reflected significant talent pool potential and a relatively accessible office market.

As an example, the roughly 904,000 metroplex residents who hold at least a bachelor’s degree in a life sciences-related field made up 17% of total residents aged 25 or older and represented the sixth-largest talent pool of the locations we compared for this ranking.

On the real estate front, the average asking rate for metro Dallas office space stood at a little more than $27 per square foot, which was also roughly the average rate across the markets we analyzed.

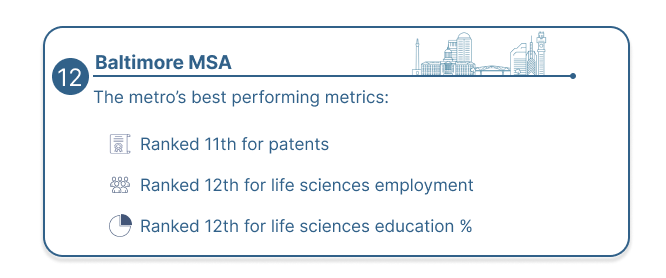

12Baltimore Sees 41% Growth of Life Sciences Scene in 5 Years

The Baltimore metropolitan area placed 12th in our ranking of the top U.S. metros for life sciences. Clearly, the metro’s potential is well-represented in the recent growth of the life sciences sector in the local economy: From 2018 through 2022, the number of life sciences establishments here increased 41%. In the local real estate market, life sciences properties added up to nearly 1.6 million square feet, which was a little less than 2% of office space in Baltimore.

Furthermore, the metro also scored among the top 20 for educational attainment. Drawing on support from regional institutions such as Johns Hopkins University and the University of Maryland, the Baltimore metro is home to an educated talent pool of nearly 430,000 residents who hold at least a bachelor’s degree in a life sciences-related field. That number makes up about 22% of metro residents aged 25 and older.

13Houston Home to 10th-Largest Life Sciences Labor Force

The resilient Texas powerhouse ranked 13th-best among the top U.S. metros for life sciences. Its best scores were for metrics pertaining to the presence of the industry in the local economy and the real estate market. To that end, the number of life sciences establishments here increased 23% since 2018 to a total of nearly 3,300, which represented the ninth-largest scene among the metros we compared. And, with 5,100 workers employed in industry related occupations, Houston claimed the 10th-largest life sciences labor force in the ranking.

Moreover, talent here is not in short supply, either. In fact, life sciences educational attainment levels placed the Texas MSA among the 10 most educated talent pools in our ranking: More than 860,000 area residents aged 25 years or older hold a bachelor’s degree in an industry related field.

Houston also scored 11th-best for market expansion: The roughly 840,000 square feet of new life sciences projects currently in development represented the 11th-largest pipeline among the metros in our ranking. And, although existing local life sciences stock made up less than 1% of office space in Houston, it nevertheless added up to nearly 2.6 million square feet of space, which represented the 13th-largest life sciences market by square footage among the metros we compared.

14Denver MSA Presents Broad Talent Pool & Comparatively Accessible Office Market

By now, the Denver metropolitan area has certainly established itself as an important hub for innovation in a variety of industries. In our current ranking of top U.S. metros for life sciences, Denver landed in 14th place and demonstrated several advantages over higher-ranking entries.

Specifically, the real estate market here placed toward the more accessible end of the ranking. That’s because the average asking rate for office space in Denver rested at about $30 per square foot, which was less than half of what data showed for New York City and San Francisco.

At the same time, metro residents with an advanced education in a life sciences-related field accounted for 24% of the metro population aged 25 and older (the 10th-best life sciences talent pool representation). These individuals also added up to roughly 513,000 (the 15th-largest talent pool in the ranking).

15Raleigh Nurtures 4th Highest Rate of Growth for Life Sciences Establishments

Raleigh followed Denver very closely in 15th place. The second North Carolina location to rank among the top 25 metros for life sciences earned its best scores for growth of the representation of the industry in the local economy, as well as its highly educated talent pool and sizeable life sciences pipeline.

Accordingly, by 2023, there were more than 1,300 life sciences establishments across the Raleigh-Cary, N.C., metropolitan area. This followed a 53% increase since 2018, which was roughly on par with Providence, R.I., and represented the fourth-largest rate of growth among the metros we compared.

Meanwhile, Raleigh earned its highest talent pool score for the share of life sciences degree-holders out of the population considered in the data. To be precise, the roughly 263,000 residents with at least a bachelor’s degree in an industry related field made up more than one-quarter of the metro’s population aged 25 and older. At about 26%, this marked the sixth-best talent pool distribution and scored very closely to Madison, Wis.; Boston; and Seattle.

The data we analyzed also showed that the real estate market was gearing up to accommodate growth in the sector. To that end, projects currently in development include nearly 1.7 million square feet of new Raleigh office space dedicated to life sciences activities — the 10th-largest pipeline in the ranking.

16Atlanta Earns Its Best Scores for Academic Education Potential

Atlanta ranked 16th-best among the more than 100 metropolitan areas we compared. The birthplace of the CDC and home to highly respected world-class universities — such as Georgia Tech, Emory University and the University of Georgia — the Atlanta metropolitan area is well-deserving of a place in this ranking.

In fact, the metro’s potential for producing life sciences talent also earned its highest score: The Atlanta-Sandy Springs-Alpharetta MSA is home to 17 institutions that offer programs or majors in life sciences-related fields, which was on par with St. Louis and represented the academic potential of the locations we compared.

And, with 777,000 residents aged 25 or older who hold at least a bachelor’s degree in an industry related field, Atlanta is also home to the 10th-largest life sciences talent pool among ranking entries.

17Madison, Wis., Makes Way: Life Sciences Occupy Nearly 10% of Local Office Market

The Madison metro area has a long history of leading discoveries in biotechnology. From the discovery of vitamins to the first lab-grown stem cells, Madison innovation has been at the forefront of breakthroughs in life sciences.

Accordingly, nearly 10% of office space in Madison serves groundbreaking research, which was the fourth-best representation of life sciences in the local real estate market among the locations we compared. It was also Madison’s best-performing metric.

However, the metro’s second strongest suit was the concentration of talent, for which Madison earned the fifth-highest score. The nearly 122,000 residents holding at least a bachelor’s degree in related fields represented a little more than 26% of the total metro population aged 25 or older.

18Phoenix Sees 5th-Best Rate of Life Sciences Cluster Growth

The prestigious academic and research institutions in the Valley of the Sun have been producing top-tier talent and attracting significant funding for innovation, resulting in one of the hottest emerging life sciences research clusters in the country, as well as a global destination for innovators in health care and bioscience. Thus, among the U.S. metros we compared for this ranking, the Phoenix-Mesa-Chandler MSA earned the 18th-highest score.

By 2023, the metro was home to more than 2,000 life sciences establishments. This followed an increase of roughly 48% in just five years and marked the fifth-highest rate of growth since 2018 among the locations we surveyed.

Growth was also notable in the Phoenix office market, where developers delivered life sciences projects totaling more than 500,000 square feet during that same period to earn Phoenix the 14th-best score for most life sciences square footage added.

19San Jose, Calif., Boasts Highest Concentration of Talent in Ranking

Driven largely by pharmaceutical R&D and medical devices and equipment research and manufacturing, the life sciences ecosystem across the San Jose-Sunnyvale-Santa Clara MSA has grown to be one of the most innovative concentrations of talent in a region where technological competition is fierce.

As such, San Jose earned its top score for the notable concentration of highly educated talent. In a metropolitan area that has a total population of about 2 million residents, nearly 504,000 people held at least a bachelor’s degree in an industry related field. This accounted for 37% of the population segment aged 25 or older, which was the highest representation among the locations we compared for this ranking.

Furthermore, inventors headquartered here earned nearly 700 patents by 2023 — the fifth-highest number of grants out of the locations included in our ranking, as well as the second-best-performing metric for this northern California metro.

And, with 3.9 million square feet of San Jose office space dedicated to this sector of local innovation, the metro is also home to the ninth-largest life sciences real estate market on our list.

20Portland, Ore., Nurtures Thriving Emerging Cluster & Sizeable Share of Highly Educated Professionals

This Pacific Northwest powerhouse continues to solidify its status among top destinations for innovative industries. Thus, Portland rounded out the top 20 in our ranking with notable performances for metrics pertaining to educational attainment and life sciences in the local economy.

Here, nearly 370,000 residents have earned at least a bachelor’s degree in an industry related field. With that, they make up 20% of the population aged 25 or older, which marked the 15th-highest density of educated talent of the metros included in our ranking.

The Portland-Vancouver-Hillsboro MSA also scored among the 15 largest life sciences scenes in the ranking. Following a cluster growth spurt of nearly 31% from 2018 through 2022, Portland was home to more than 3,000 life sciences establishments (the 12th-largest hub in the ranking) and nearly 3,400 workers in industry related occupations (the 13th-largest life sciences labor force).

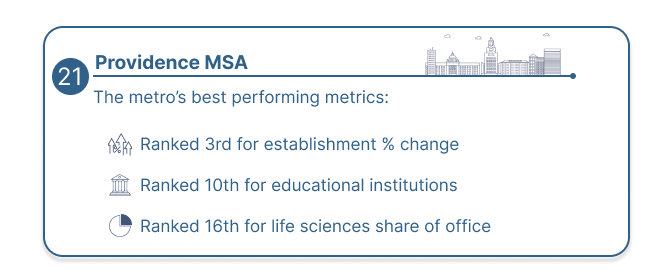

21Providence, R.I., Life Sciences Hub Boasts 3rd-Fastest Growth in 5 Years

Adding to the list of thriving new clusters emerging on the East Coast, the Providence-Warwick metropolitan area earned 21st place on our list of top U.S. metros for life sciences. In this region, efforts spearheaded by the local administration to capture some of the increasing demand have paid off: The campaign attracted notable interest from partners such as Brown University, which, in 2022, announced plans to build an integrated life sciences building that would provide top-tier laboratory space for research in various fields, including biology, medicine, brain science, bioengineering, and public health.

Last year, the metro was already home to more than 1,000 life sciences establishments, following a growth spurt of 53% since 2018 — the third-highest such increase among the metros we compared. Additionally, real estate research data for 2023 showed that life sciences were represented in nearly 2% of Providence office space and occupied roughly 563,000 square feet in the market.

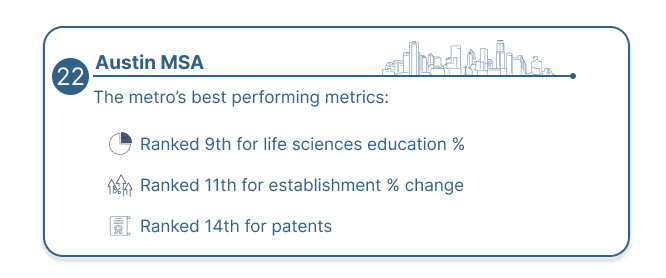

22Regional Advantages in Austin, Texas, Encourage Growing Success in Life Sciences

Aided by the region’s technology infrastructure; academic pipeline; and renowned dynamic, creative, and entrepreneurial environment, the Austin metropolitan area has been successful in attracting companies operating in a variety of pursuits. These include medical devices; biologics and biotech; diagnostics; and pharmaceuticals.

Among the locations included in our comparative study, Austin received its best scores for the concentration of talent in the metro area, as well as the growth of the local life sciences scene. Specifically, the nearly 412,000 residents holding at least a bachelor’s degree in an industry related field made up about one-quarter of the metro’s population aged 25 and older. Consequently, this marked the ninth-best talent pool distribution, for which it scored very closely to Denver; Seattle; Boston; Raleigh, N.C.; and Madison, Wis.

Next, Austin’s potential is also apparent in the recent growth of the life sciences sector: From 2018 through 2022, the number of life sciences establishments here increased 42%, which was the 11th-highest rate of growth in the ranking.

And, the roughly 304,000 square feet of new life sciences space delivered since 2018 landed Austin among the top 20 markets for growth by square footage added.

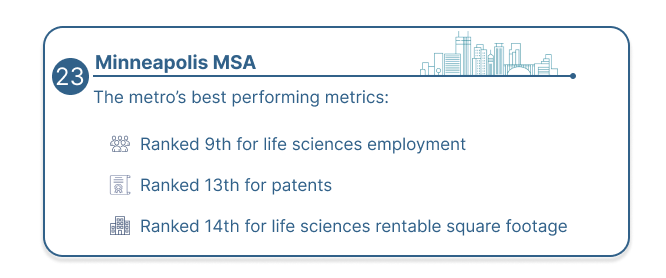

23Minnesota’s Twin Cities Place Among 15 Most Innovative Metros in Ranking

The Minneapolis-St. Paul metro landed 23rd among the MSAs we compared in our analysis. Of course, Minnesota’s top life sciences ecosystem has long been the preferred home to some of the largest U.S. companies operating in health insurance, digital health, and medical device innovation.

In fact, inventors headquartered here had earned more than 210 patents by 2023, which placed the Twin Cities metro among the 15 most innovative locations included in the ranking.

Talent is not in short supply, here, either: Nearly 513,500 area residents aged 25 years or older hold a bachelor’s degree in an industry related field, which ranked 14th among the largest talent pools represented in the ranking. And, the more than 7,500 residents employed in select industry related occupations made up what our data showed to be the ninth-largest life sciences workforce among the metros we compared.

As for real estate, the life sciences sector accounted for a little more than 1% of the local office stock and occupied a bit more than 2 million square feet of Minneapolis office space (the 14th-largest life sciences market in the ranking).

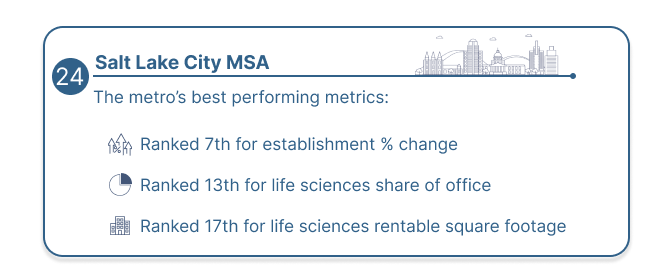

24Salt Lake City Metro Posts Nearly 50% Growth of Life Sciences Scene

The Salt Lake City metropolitan area proved to be another strong contender among emerging clusters in the U.S. and earned a place among the top 25 metros for life sciences. In particular, the Utah MSA’s best-performing metrics were related to the growth of the innovation hub in recent years, as well as the sector’s share of the local real estate market.

Specifically, Salt Lake City saw a 47% increase in the number of life sciences establishments during the five years following 2018 — the seventh-highest rate of growth among ranking entries and the best-scoring metric for the Utah MSA.

In the real estate metric, the life sciences sector accounted for a little more than 2% of the local office stock (the 13th-best representation in the market). The sector occupied roughly 1.2 million square feet of office space in Salt Lake City (the 17th-largest life sciences market in the ranking).

25New Haven, Conn., Home to 8th-Highest Density of Life Sciences Space in Office Market

Along with Stamford and Hartford, New Haven is a significant component of the Connecticut Innovation Corridor, which nurtures a diverse community of life and health care sciences companies that make up the growing life sciences cluster in Connecticut.

The importance of these industries in the local economy is also apparent when looking at the real estate market: Nearly 5% of office space in New Haven is dedicated to life sciences uses, which marked the eighth-highest representation of this sector.

Being one of the smaller urban centers to make the top 25 in our ranking, variation in the local scene is likely to have a significant influence in a short period of time. For instance, the number of life sciences establishments in the metro increased roughly 41% from 2018 through 2022 to reach a total of nearly 560 by 2023. That equated to the 10th-largest rate of growth among the life sciences scenes we compared for this ranking, but the 43rd life sciences scene by number of establishments.

Methodology

For this ranking, we compared 102 metropolitan statistical areas for 12 metrics (indicators) across three categories — the local talent pool, the life sciences ecosystem, and the life sciences segment of the office market. The ranking did not include metropolitan areas for which existing life sciences real estate data was unavailable. Consequently, the final reference list consisted of 67 MSAs.

We considered local life sciences educational attainment and educational institutions as the most relevant talent pool indicators.

To gauge and compare the local life sciences sector in each of the metropolitan areas analyzed, we looked at data on employment in select occupations, the number of life sciences establishments, the growth of the local sector in five years, and local innovation as reflected in the number of patents earned by local inventors.

In the life sciences office market category, we scored data on the amount of existing life sciences square footage in the market; the share that this accounted for within the overall local office market; how much life sciences square footage was added since 2018; how much new life sciences property was currently in the pipeline in each MSA; and the most recent local average office asking rates.

For each metric, the number of maximum points was evenly distributed between the lowest and the highest metric values. On this scale, a score was calculated for each MSA based on its metric values. The factors (metrics or indicators) on which we based the composite scores are explained in the table below. For average office asking rates, the number of points awarded was inversely proportional to the metric values. For all other indicators, the number of points awarded was directly proportional to the metric values.

Disclaimer

While every effort was made to ensure the timeliness and accuracy of the information presented herein, the information is provided “as is” and neither CommercialCafe nor CommercialEdge can guarantee that the information provided is complete. This ranking is for general informational purposes only. It does not constitute and should not be relied upon as a basis for any investment decision. The information presented is subject to change without notice and may or may not apply depending on the circumstances. Always contact a qualified investment consultant if you need advice regarding buying, selling or otherwise transacting in any investment.