San Francisco, CA Office Spaces for Rent

Find your best San Francisco, CA office space among 2,313 for rent listings, which average an asking price of $66.06 per square foot.

-

.jpg?width=450) 1160 Battery Street East #100, San Francisco, CAServices

1160 Battery Street East #100, San Francisco, CAServices- Virtual Office

- Open Workspace

- Private Office

- Dedicated Desk

Amenities -

2 Embarcadero Center 8th Floor, San Francisco, CAServices

2 Embarcadero Center 8th Floor, San Francisco, CAServices- Virtual Office

- Event Space

- Meeting Room

- Private Office

- Dedicated Desk

Amenities -

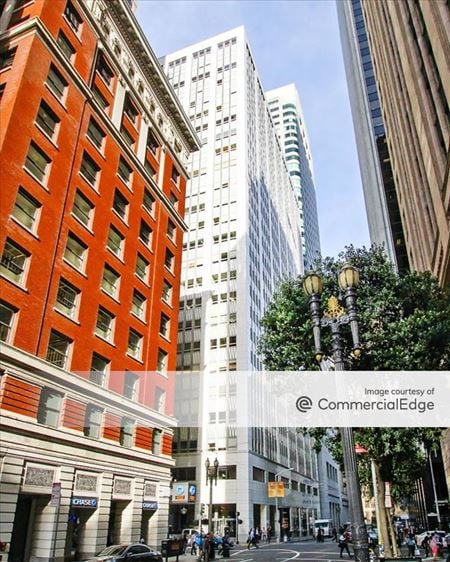

44 Montgomery St, San Francisco, CAServices

44 Montgomery St, San Francisco, CAServices- Event Space

- Meeting Room

- Private Office

- Dedicated Desk

Amenities -

650 California St. Floor 7, San Francisco, CAServices

650 California St. Floor 7, San Francisco, CAServices- Virtual Office

- Event Space

- Meeting Room

- Private Office

- Dedicated Desk

Amenities -

201 Spear St, San Francisco, CAServices

201 Spear St, San Francisco, CAServices- Event Space

- Meeting Room

- Private Office

Amenities -

535 Mission St 14th floor, San Francisco, CAServices

535 Mission St 14th floor, San Francisco, CAServices- Virtual Office

- Event Space

- Meeting Room

- Private Office

- Dedicated Desk

Amenities -

95 Third Street 2nd Floor, San Francisco, CAServices

95 Third Street 2nd Floor, San Francisco, CAServices- Virtual Office

- Open Workspace

- Private Office

- Dedicated Desk

Amenities -

188 Spear Street, South Beach, San Francisco, CAProperty

188 Spear Street, South Beach, San Francisco, CAProperty- Office

- 216,107 SF

Availability- 1 Space

- 3,266 SF

Year Built- 1973

For Lease Contact for pricing -

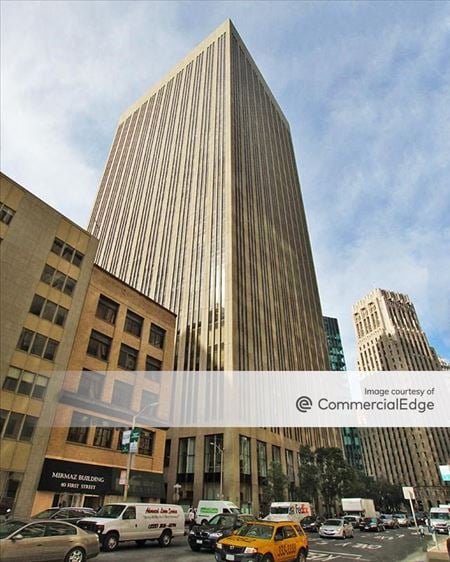

525 Market St, Yerba Buena, San Francisco, CA

525 Market St, Yerba Buena, San Francisco, CA -

301 Howard Street, Yerba Buena, San Francisco, CAProperty

301 Howard Street, Yerba Buena, San Francisco, CAProperty- Office

- 307,396 SF

Availability- 14 Spaces

- 168,192 SF

Year Built- 1987

For Lease Contact for pricing -

44 Page Street, Hayes Valley, San Francisco, CAProperty

44 Page Street, Hayes Valley, San Francisco, CAProperty- Office

- 31,000 SF

Availability- 1 Space

- 1,800 SF

Year Built- 1912

For Lease- $48.00/SF/YR

-

71 Stevenson Street, San Francisco, CAServices

71 Stevenson Street, San Francisco, CAServices- Virtual Office

- Open Workspace

- Private Office

- Dedicated Desk

Amenities -

38 Keyes Avenue, Presidio, San Francisco, CAProperty

38 Keyes Avenue, Presidio, San Francisco, CAProperty- Office

- 57,856 SF

Availability- 1 Space

- 3,288 SF

Year Built- 1941

For Lease Contact for pricing -

121 Spear Street, South Beach, San Francisco, CA

121 Spear Street, South Beach, San Francisco, CA -

235 2nd Street, Yerba Buena, San Francisco, CAProperty

235 2nd Street, Yerba Buena, San Francisco, CAProperty- Office

- 283,000 SF

Availability- 4 Spaces

- 33,170 SF

Year Built- 2001

For Lease Contact for pricing -

2720 Taylor Street, North Waterfront, San Francisco, CAProperty

2720 Taylor Street, North Waterfront, San Francisco, CAProperty- Office

- 64,068 SF

Availability- 15 Spaces

- 47,001 SF

Year Built- 1974

For Lease Contact for pricing -

45 Fremont Street, Yerba Buena, San Francisco, CAProperty

45 Fremont Street, Yerba Buena, San Francisco, CAProperty- Office

- 596,059 SF

Availability- 12 Spaces

- 190,494 SF

Year Built- 1978

For Lease Contact for pricing -

340 Bryant Street, South Beach, San Francisco, CAProperty

340 Bryant Street, South Beach, San Francisco, CAProperty- Office

- 57,888 SF

Availability- 1 Space

- 14,597 SF

Year Built- 1932

For Lease Contact for pricing -

500 Treat Avenue, Inner Mission, San Francisco, CAProperty

500 Treat Avenue, Inner Mission, San Francisco, CAProperty- Office

- 32,507 SF

Availability- 2 Spaces

- 17,996 SF

Year Built- 1947

For Lease Contact for pricing -

153 Townsend Street, South Beach, San Francisco, CAProperty

153 Townsend Street, South Beach, San Francisco, CAProperty- Office

- 167,985 SF

Availability- 1 Space

- 35,578 SF

Year Built- 2002

For Lease Contact for pricing -

.jpg?width=450) 220 Halleck Street, Presidio, San Francisco, CA

220 Halleck Street, Presidio, San Francisco, CA -

1390 Market Street, Van Ness - Civic Center, San Francisco, CAProperty

1390 Market Street, Van Ness - Civic Center, San Francisco, CAProperty- Office

- 237,153 SF

Availability- 14 Spaces

- 80,453 SF

Year Built- 1967

For Lease Contact for pricing -

57 Post Street, Financial District - Barbary Coast, San Francisco, CAProperty

57 Post Street, Financial District - Barbary Coast, San Francisco, CAProperty- Office

- 59,751 SF

Availability- 13 Spaces

- 6,041 SF

Year Built- 1909

For Lease- $36.00 - $43.04/SF/YR

-

340 Brannan Street, South Beach, San Francisco, CAProperty

340 Brannan Street, South Beach, San Francisco, CAProperty- Office

- 39,776 SF

Availability- 6 Spaces

- 32,203 SF

Year Built- 1911

For Lease Contact for pricing -

1 Ferry Building, Financial District - Barbary Coast, San Francisco, CAProperty

1 Ferry Building, Financial District - Barbary Coast, San Francisco, CAProperty- Office

- 266,335 SF

Availability- 3 Spaces

- 3,554 SF

Year Built- 1952

For Lease Contact for pricing -

28 2nd Street, Yerba Buena, San Francisco, CAProperty

28 2nd Street, Yerba Buena, San Francisco, CAProperty- Office

- 28,383 SF

Availability- 1 Space

- 3,984 SF

Year Built- 1914

For Lease- $70.00/SF/YR

-

845 Market Street, Yerba Buena, San Francisco, CAProperty

845 Market Street, Yerba Buena, San Francisco, CAProperty- Retail

- 1,564,533 SF

Availability- 4 Spaces

- 241,423 SF

Year Built- 1908

For Lease Contact for pricing -

275 Ellis St, Tenderloin, San Francisco, CAProperty

275 Ellis St, Tenderloin, San Francisco, CAProperty- Office

- 8,000 SF

Availability Contact for availabilityYear Built- 1963

For Lease Contact for pricing -

1160 Battery Street, North Waterfront, San Francisco, CAProperty

1160 Battery Street, North Waterfront, San Francisco, CAProperty- Office

- 215,359 SF

Availability- 5 Spaces

- 2,650 SF

Year Built- 1982

For Lease Contact for pricing -

388 Market Street, Financial District - Barbary Coast, San Francisco, CAProperty

388 Market Street, Financial District - Barbary Coast, San Francisco, CAProperty- Office

- 252,756 SF

Availability- 10 Spaces

- 55,829 SF

Year Built- 1986

For Lease Contact for pricing -

475 Sansome Street, Financial District - Barbary Coast, San Francisco, CAProperty

475 Sansome Street, Financial District - Barbary Coast, San Francisco, CAProperty- Office

- 353,686 SF

Availability- 12 Spaces

- 155,576 SF

Year Built- 1969

For Lease Contact for pricing -

2121 Mission Street, Inner Mission, San Francisco, CAProperty

2121 Mission Street, Inner Mission, San Francisco, CAProperty- Office

- 109,842 SF

Availability- 7 Spaces

- 50,380 SF

Year Built- 1916

For Lease Contact for pricing -

149 New Montgomery Street, San Francisco, CA

149 New Montgomery Street, San Francisco, CA149 New Montgomery Street

WerqwiseServices- Open Workspace

- Meeting Room

- Private Office

Amenities -

180 Sansome Street, Financial District - Barbary Coast, San Francisco, CAProperty

180 Sansome Street, Financial District - Barbary Coast, San Francisco, CAProperty- Office

- 151,326 SF

Availability- 1 Space

- 6,100 SF

Year Built- 1965

For Lease Contact for pricing -

50 Green Street, North Waterfront, San Francisco, CAProperty

50 Green Street, North Waterfront, San Francisco, CAProperty- Office

- 101,160 SF

Availability- 8 Spaces

- 85,505 SF

Year Built- 1907

For Lease Contact for pricing -

55 4th Street 2nd level, San Francisco, CA

55 4th Street 2nd level, San Francisco, CASan Franciso

AMA New York Executive Conference CenterServices- Event Space

- Meeting Room

- Private Office

Amenities -

550 California Street, Financial District - Barbary Coast, San Francisco, CAProperty

550 California Street, Financial District - Barbary Coast, San Francisco, CAProperty- Office

- 338,943 SF

Availability- 22 Spaces

- 108,724 SF

Year Built- 1960

For Lease- $36.00 - $40.00/SF/YR

-

303 Second Street, Yerba Buena, San Francisco, CAProperty

303 Second Street, Yerba Buena, San Francisco, CAProperty- Office

- 723,496 SF

Availability- 1 Space

- 44,961 SF

Year Built- 1988

For Lease Contact for pricing -

2601 Mission Street, Inner Mission, San Francisco, CAProperty

2601 Mission Street, Inner Mission, San Francisco, CAProperty- Office

- 90,669 SF

Availability- 4 Spaces

- 14,270 SF

Year Built- 1962

For Lease- $2.50/SF/MO

-

525 Market Street, Yerba Buena, San Francisco, CAProperty

525 Market Street, Yerba Buena, San Francisco, CAProperty- Office

- 1,058,200 SF

Availability- 12 Spaces

- 322,402 SF

Year Built- 1973

For Lease Contact for pricing -

425 Market Street, Yerba Buena, San Francisco, CAProperty

425 Market Street, Yerba Buena, San Francisco, CAProperty- Office

- 908,500 SF

Availability- 12 Spaces

- 294,816 SF

Year Built- 1973

For Lease Contact for pricing -

150 Hooper Street, Potrero Hill, San Francisco, CAProperty

150 Hooper Street, Potrero Hill, San Francisco, CAProperty- Industrial

- 56,000 SF

Availability- 4 Spaces

- 13,594 SF

Year Built- 2018

For Lease- $27.00 - $30.00/SF/YR

-

26 O'Farrell Street, Downtown District 8 - North East, San Francisco, CAProperty

26 O'Farrell Street, Downtown District 8 - North East, San Francisco, CAProperty- Office

- 37,000 SF

Availability- 4 Spaces

- 12,433 SF

Year Built- 1909

For Lease Contact for pricing -

1160 Battery Street, North Waterfront, San Francisco, CAProperty

1160 Battery Street, North Waterfront, San Francisco, CAProperty- Office

- 215,359 SF

Availability- 5 Spaces

- 2,650 SF

Year Built- 1982

For Lease Contact for pricing -

40 Mesa Street, Presidio, San Francisco, CA

40 Mesa Street, Presidio, San Francisco, CA -

139 Townsend Street, South Beach, San Francisco, CAProperty

139 Townsend Street, South Beach, San Francisco, CAProperty- Office

- 57,000 SF

Availability- 3 Spaces

- 19,790 SF

Year Built- 1909

For Lease Contact for pricing -

185 Berry Street, Mission Bay, San Francisco, CAProperty

185 Berry Street, Mission Bay, San Francisco, CAProperty- Office

- 502,579 SF

Availability- 8 Spaces

- 175,802 SF

Year Built- 1920

For Lease Contact for pricing -

_CA,%20San%20Francisco_USA_BusinessLounge.jpg?width=450) 1390 Market Street Suite 200, San Francisco,, CA

1390 Market Street Suite 200, San Francisco,, CAMid Market

RegusServices- Virtual Office

- Open Workspace

- Private Office

- Dedicated Desk

Amenities -

333 Bush Street, Financial District - Barbary Coast, San Francisco, CAProperty

333 Bush Street, Financial District - Barbary Coast, San Francisco, CAProperty- Office

- 769,197 SF

Availability- 1 Space

- 4,871 SF

Year Built- 1986

For Lease- $62.00/SF/YR

-

703 Market Street, Yerba Buena, San Francisco, CAProperty

703 Market Street, Yerba Buena, San Francisco, CAProperty- Office

- 108,225 SF

Availability- 7 Spaces

- 51,535 SF

Year Built- 1898

For Lease Contact for pricing -

100 Montgomery Street, Financial District - Barbary Coast, San Francisco, CAProperty

100 Montgomery Street, Financial District - Barbary Coast, San Francisco, CAProperty- Office

- 435,290 SF

Availability- 20 Spaces

- 194,467 SF

Year Built- 1955

For Lease Contact for pricing -

650 7th Street, South of Market, San Francisco, CAProperty

650 7th Street, South of Market, San Francisco, CAProperty- Office

- 82,862 SF

Availability- 5 Spaces

- 87,405 SF

Year Built- 1908

For Lease Contact for pricing