Washington, DC Commercial Real Estate for Lease and Sale

Explore 702 listings of Washington commercial real estate to find the best space for your business.

-

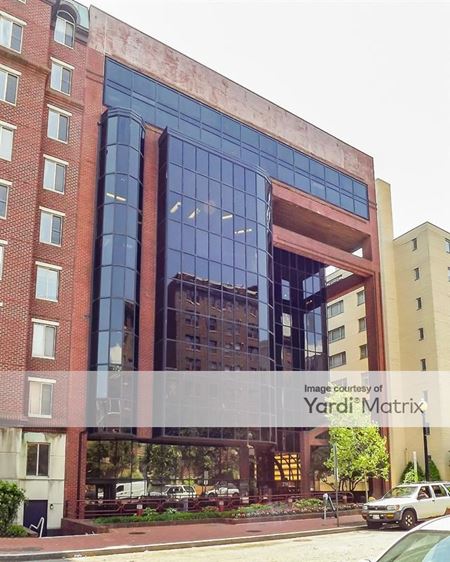

1255 23rd Street NW, West End Washington, Washington, DCProperty

1255 23rd Street NW, West End Washington, Washington, DCProperty- Office

- 342,243 SF

Availability- 7 Spaces

- 100,728 SF

Year Built- 1983

For Lease- $53.00/SF/YR

-

1725 I St NW, Suite 300, , Washington, DC

1725 I St NW, Suite 300, , Washington, DCMetro Offices - Midtown

METRO OFFICESServices- Meeting Room

- Private Office

Amenities -

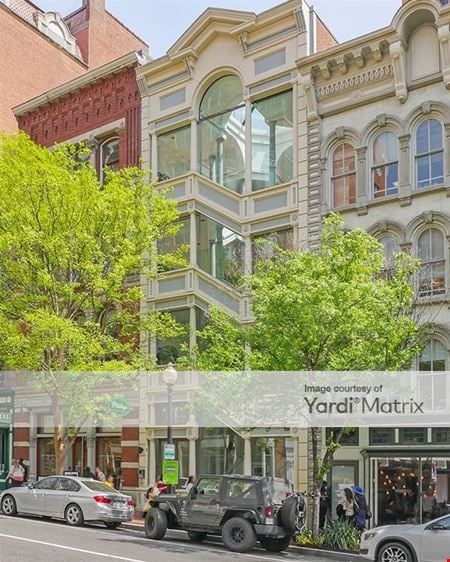

1424 K St NW, Downtown Washington, Washington, DCProperty

1424 K St NW, Downtown Washington, Washington, DCProperty- Office

- 57,789 SF

Availability- 1 Space

- 5,799 SF

Year Built- 1910

For Lease- $39.50/SF/YR

-

750 17th Street NW, Downtown Washington, Washington, DCProperty

750 17th Street NW, Downtown Washington, Washington, DCProperty- Office

- 126,932 SF

Availability- 6 Spaces

- 32,913 SF

Year Built- 1989

For Lease Contact for pricing -

What type of listing property are you looking for?

-

131 M Street NE, Near Northeast, Washington, DCProperty

131 M Street NE, Near Northeast, Washington, DCProperty- Office

- 408,400 SF

Availability- 3 Spaces

- 132,811 SF

Year Built- 2001

For Lease Contact for pricing -

1455 Pennsylvania Avenue NW, Suite 400, Washington, DC

1455 Pennsylvania Avenue NW, Suite 400, Washington, DCCarr Workplaces - The Willard

Carr WorkplacesServices- Meeting Room

Amenities -

1211 Connecticut Avenue NW, Dupont Circle, Washington, DCProperty

1211 Connecticut Avenue NW, Dupont Circle, Washington, DCProperty- Office

- 129,298 SF

Availability- 1 Space

- 1,702 SF

Year Built- 1967

For Lease Contact for pricing -

1200 K Street NW, Downtown Washington, Washington, DCProperty

1200 K Street NW, Downtown Washington, Washington, DCProperty- Office

- 402,176 SF

Availability- 15 Spaces

- 402,176 SF

Year Built- 1992

For Lease Contact for pricing -

1328 Florida Avenue NW, U Street Washington, Washington, DCProperty

1328 Florida Avenue NW, U Street Washington, Washington, DCProperty- Office

- 77,851 SF

Availability- 3 Spaces

- 18,050 SF

Year Built- 1887

For Lease Contact for pricing -

1030 15th Street NW, Downtown Washington, Washington, DCProperty

1030 15th Street NW, Downtown Washington, Washington, DCProperty- Office

- 328,978 SF

Availability- 2 Spaces

- 183,437 SF

Year Built- 2008

For Lease Contact for pricing -

926 Pennsylvania Avenue Southeast, Capitol Hill, Washington, DC

926 Pennsylvania Avenue Southeast, Capitol Hill, Washington, DC -

409 3rd Street SW, Southwest Waterfront, Washington, DCProperty

409 3rd Street SW, Southwest Waterfront, Washington, DCProperty- Office

- 420,125 SF

Availability- 3 Spaces

- 3,879 SF

Year Built- 1990

For Lease- $35.00 - $45.00/SF/YR

-

-

701 Pennsylvania Avenue NW, Penn Quarter, Washington, DCProperty

701 Pennsylvania Avenue NW, Penn Quarter, Washington, DCProperty- Office

- 374,499 SF

Availability- 9 Spaces

- 43,188 SF

Year Built- 1990

For Lease Contact for pricing -

1720 I Street, NW, Downtown Washington, Washington, DCProperty

1720 I Street, NW, Downtown Washington, Washington, DCProperty- Office

- 70,547 SF

Availability- 5 Spaces

- 33,183 SF

Year Built- 1968

For Lease- $49.00/SF/YR

-

1152 15th Street NW, Downtown Washington, Washington, DCProperty

1152 15th Street NW, Downtown Washington, Washington, DCProperty- Office

- 385,500 SF

Availability- 12 Spaces

- 278,337 SF

Year Built- 2007

For Lease Contact for pricing -

2112 F Street NW, Foggy Bottom, Washington, DCProperty

2112 F Street NW, Foggy Bottom, Washington, DCProperty- Office

- 40,842 SF

Availability- 1 Space

- 6,161 SF

Year Built- 1984

For Lease- $45.00/SF/YR

-

1808 I Street NW, Downtown Washington, Washington, DCProperty

1808 I Street NW, Downtown Washington, Washington, DCProperty- Office

- 32,529 SF

Availability- 2 Spaces

- 1,915 SF

Year Built- 2000

For Lease Contact for pricing -

1575 I Street NW, Downtown Washington, Washington, DCProperty

1575 I Street NW, Downtown Washington, Washington, DCProperty- Office

- 210,655 SF

Availability- 3 Spaces

- 56,616 SF

Year Built- 1979

For Lease Contact for pricing -

1275 New Jersey Ave SE, Navy Yard, Washington, DCProperty

1275 New Jersey Ave SE, Navy Yard, Washington, DCProperty- Office

- 315,000 SF

Availability- 2 Spaces

- 214,978 SF

Year Built- 2021

For Lease Contact for pricing -

400 Virginia Avenue SW, Southwest Waterfront, Washington, DCProperty

400 Virginia Avenue SW, Southwest Waterfront, Washington, DCProperty- Office

- 219,218 SF

Availability- 12 Spaces

- 90,840 SF

Year Built- 1985

For Lease- $35.00 - $38.00/SF/YR

-

1515 14th Street Northwest, Logan Circle, Washington, DCProperty

1515 14th Street Northwest, Logan Circle, Washington, DCProperty- Office

- 8,264 SF

Availability- 1 Space

- 4,364 SF

Year Built- 1920

For Lease- $45.00/SF/YR

-

555 13th Street NW, Penn Quarter, Washington, DCProperty

555 13th Street NW, Penn Quarter, Washington, DCProperty- Office

- 601,003 SF

Availability- 1 Space

- 5,698 SF

Year Built- 1987

For Lease- $55.00/SF/YR

-

2450 N Street NW, West End Washington, Washington, DCProperty

2450 N Street NW, West End Washington, Washington, DCProperty- Office

- 88,011 SF

Availability- 5 Spaces

- 38,001 SF

Year Built- 1988

For Lease- $38.50 - $43.00/SF/YR

-

2220 14th St NW, U Street Washington, Washington, DCProperty

2220 14th St NW, U Street Washington, Washington, DCProperty- Retail

- 1,572 SF

Availability- 1 Space

- 1,572 SF

Year Built- 1931

For Lease- $55.00/SF/YR

-

14 F St NW, Judiciary Square, Washington, DC

14 F St NW, Judiciary Square, Washington, DC -

4200 Wisconsin Avenue NW, American University Park, Washington, DCProperty

4200 Wisconsin Avenue NW, American University Park, Washington, DCProperty- Office

- 150,000 SF

Availability- 4 Spaces

- 26,535 SF

Year Built- 1963

For Lease- $44.00 - $46.00/SF/YR

-

1500 K Street NW, Downtown Washington, Washington, DCProperty

1500 K Street NW, Downtown Washington, Washington, DCProperty- Office

- 243,066 SF

Availability- 2 Spaces

- 29,509 SF

Year Built- 1929

For Lease Contact for pricing -

1701 Pennsylvania Avenue NW, Downtown Washington, Washington, DCProperty

1701 Pennsylvania Avenue NW, Downtown Washington, Washington, DCProperty- Office

- 175,000 SF

Availability- 2 Spaces

- 5,378 SF

Year Built- 1962

For Lease- $59.75/SF/YR

-

1701 K Street NW, Downtown Washington, Washington, DCProperty

1701 K Street NW, Downtown Washington, Washington, DCProperty- Office

- 62,251 SF

Availability- 4 Spaces

- 10,561 SF

Year Built- 1954

For Lease Contact for pricing -

1201 15th Street NW, Logan Circle, Washington, DCProperty

1201 15th Street NW, Logan Circle, Washington, DCProperty- Office

- 231,433 SF

Availability- 11 Spaces

- 64,177 SF

Year Built- 1973

For Lease- $32.50 - $45.00/SF/YR

-

1101 16th Street NW, Downtown Washington, Washington, DCProperty

1101 16th Street NW, Downtown Washington, Washington, DCProperty- Office

- 102,000 SF

Availability- 1 Space

- 2,070 SF

Year Built- 2019

For Lease Contact for pricing -

1015 15th Street NW, Downtown Washington, Washington, DCProperty

1015 15th Street NW, Downtown Washington, Washington, DCProperty- Office

- 196,651 SF

Availability- 6 Spaces

- 38,863 SF

Year Built- 1978

For Lease Contact for pricing -

3300-3390 V Street NE, Gateway, Washington, DC

3300-3390 V Street NE, Gateway, Washington, DC -

600 14th Street NW, Penn Quarter, Washington, DCProperty

600 14th Street NW, Penn Quarter, Washington, DCProperty- Office

- 250,000 SF

Availability- 1 Space

- 26,600 SF

Year Built- 1929

For Lease Contact for pricing -

777 North Capitol Street NE, Near Northeast, Washington, DCProperty

777 North Capitol Street NE, Near Northeast, Washington, DCProperty- Office

- 262,314 SF

Availability- 4 Spaces

- 35,601 SF

Year Built- 1989

For Lease Contact for pricing -

5100 Wisconsin Avenue NW, Friendship Heights, Washington, DCProperty

5100 Wisconsin Avenue NW, Friendship Heights, Washington, DCProperty- Office

- 99,790 SF

Availability- 4 Spaces

- 19,157 SF

Year Built- 1964

For Lease- $39.75/SF/YR

-

1100 H Street North West, Penn Quarter, Washington, DCProperty

1100 H Street North West, Penn Quarter, Washington, DCProperty- Office

- 114,000 SF

Availability- 28 Spaces

- 58,410 SF

Year Built- 1942

For Lease- $18.00 - $41.00/SF/YR

-

4435 Wisconsin Avenue NW, Tenleytown, Washington, DCProperty

4435 Wisconsin Avenue NW, Tenleytown, Washington, DCProperty- Office

- 34,016 SF

Availability- 13 Spaces

- 8,666 SF

Year Built- 1956

For Lease Contact for pricing -

999 North Capitol Street NE, Near Northeast, Washington, DCProperty

999 North Capitol Street NE, Near Northeast, Washington, DCProperty- Office

- 320,966 SF

Availability- 4 Spaces

- 64,544 SF

Year Built- 1972

For Lease- $44.00 - $50.00/SF/YR

-

1901 Pennsylvania Avenue NW, Downtown Washington, Washington, DCProperty

1901 Pennsylvania Avenue NW, Downtown Washington, Washington, DCProperty- Office

- 80,000 SF

Availability- 11 Spaces

- 51,507 SF

Year Built- 1959

For Lease Contact for pricing -

25 Massachusetts Avenue NW, North Capitol Street, Washington, DCProperty

25 Massachusetts Avenue NW, North Capitol Street, Washington, DCProperty- Office

- 384,427 SF

Availability- 1 Space

- 2,725 SF

Year Built- 2006

For Lease- $43.00/SF/YR

-

1330 Connecticut Avenue NW, Dupont Circle, Washington, DCProperty

1330 Connecticut Avenue NW, Dupont Circle, Washington, DCProperty- Office

- 253,190 SF

Availability- 3 Spaces

- 14,110 SF

Year Built- 1984

For Lease- $56.00/SF/YR

-

2900 K Street, NW, Georgetown, Washington, DCProperty

2900 K Street, NW, Georgetown, Washington, DCProperty- Office

- 108,072 SF

Availability- 5 Spaces

- 122,361 SF

Year Built- 2006

For Lease Contact for pricing -

901 New York Avenue NW, Downtown Washington, Washington, DCProperty

901 New York Avenue NW, Downtown Washington, Washington, DCProperty- Office

- 507,150 SF

Availability- 8 Spaces

- 107,662 SF

Year Built- 2004

For Lease Contact for pricing -

1717 H Street NW, Downtown Washington, Washington, DCProperty

1717 H Street NW, Downtown Washington, Washington, DCProperty- Office

- 320,032 SF

Availability- 1 Space

- 320,000 SF

Year Built- 1990

For Lease Contact for pricing -

2033 K Street NW, Downtown Washington, Washington, DCProperty

2033 K Street NW, Downtown Washington, Washington, DCProperty- Office

- 128,767 SF

Availability- 7 Spaces

- 92,443 SF

Year Built- 1975

For Lease- $57.50 - $65.00/SF/YR

-

2301 M Street NW, West End Washington, Washington, DCProperty

2301 M Street NW, West End Washington, Washington, DCProperty- Office

- 68,405 SF

Availability- 2 Spaces

- 13,315 SF

Year Built- 1981

For Lease- $35.00 - $44.00/SF/YR

-

1400 16th Street NW, Dupont Circle, Washington, DCProperty

1400 16th Street NW, Dupont Circle, Washington, DCProperty- Office

- 195,596 SF

Availability- 10 Spaces

- 51,165 SF

Year Built- 1988

For Lease- $28.00 - $49.75/SF/YR

-

409 7th Street NW, Penn Quarter, Washington, DCProperty

409 7th Street NW, Penn Quarter, Washington, DCProperty- Office

- 44,445 SF

Availability- 3 Spaces

- 12,390 SF

Year Built- 1887

For Lease- $40.00/SF/YR

-

1201 Pennsylvania Avenue NW, Penn Quarter, Washington, DCProperty

1201 Pennsylvania Avenue NW, Penn Quarter, Washington, DCProperty- Office

- 444,860 SF

Availability- 3 Spaces

- 29,732 SF

Year Built- 1980

For Lease Contact for pricing -

1900 L Street NW, Downtown Washington, Washington, DCProperty

1900 L Street NW, Downtown Washington, Washington, DCProperty- Office

- 104,394 SF

Availability- 15 Spaces

- 44,960 SF

Year Built- 1964

For Lease- $29.50/SF/YR