The key to capitalizing on today’s ever-growing apartment rental market? It’s simple: build more units.

According to the National Multifamily Housing Council, demand for rental units is so high in the U.S. that we would need a whopping 4.6 million new units by 2030 just to keep up. Couple that demand with rising rents across the nation, and the apartment market is rife with opportunities for financial growth.

Construction Tries to Keep Up with Demand

It seems many have recognized the potential in today’s growing market, as apartment construction has now hit a 20-year high. Between 1997 and 2006, the U.S. was only adding about 212,000 new units per year on average, apartment search website RENTCafé reports. It jumped slightly after the recession, hitting around 237,000 in 2014, and by the end of 2017 apartment completions are expected to clock in at 345,000 or higher—a 21 percent jump over 2016.

Still, despite the notable uptick, these numbers are below the annual 373,000 we need to hit the 4.6 million mark by 2030. And that means plenty of opportunity for commercial developers, multifamily property owners and real estate investors.

Rent Growth Stalls in SF, Portland, Houston

So where is this construction needed most? And in what areas can developers and investors see the biggest ROI? According to Yardi Matrix data, rent growth is actually slowing in some of the nation’s biggest cities, like San Francisco, for example, where rents have slowed to their lowest rate of growth since 2015. The city gained nearly 12,000 units since last year, and about 9,500 more are currently under construction. This influx of new construction has dampened prices for apartments for rent in San Francisco significantly.

Other pricey markets have also seen rent growth stall as of late, with Portland, Houston, Austin, Boston and Manhattan all experiencing deceleration. Still, there are plenty of areas where rents are solid, demand is up, and supply just isn’t there to meet it. With red-hot job markets and significant gains in local income, Denver and Seattle are two attractive markets for developers as of late, as is the Minneapolis–St. Paul area, which is seeing big demand thanks to rising rents in nearby Chicago.

Head South, and California’s Sacramento and Riverside are top options—with low supply and even worse levels of construction. Sacramento is projected to only gain about 700 new units this year, and its rents have risen a shocking 8.2 percent over just the last 12 months. Riverside is in the same boat, gaining just 1,100 units with rent growth in the same range. St. Louis, Cleveland, New Orleans, and Buffalo, NY also have meager construction on the books, and all could use an infusion of new units to keep up with local demand. St. Louis will gain fewer than 2,000 new units this year.

NYC, Dallas and Houston – Busiest Apartment Markets in 2017

Overall, multifamily construction is up in the U.S., but it’s largely concentrated in a few big metro areas. Naturally, these areas have been buzzing with new investment or construction activity, though the overabundance of supply is likely to dampen rents (and subsequently investor ROI) in the long run.

Some areas that are getting their fair share of new units this year? That’d be NYC (gaining nearly 27,000), Dallas-Fort Worth (gaining about 25,000), Houston (about 18,000), Los Angeles (15,000) and Miami–Fort Lauderdale–West Palm Beach (13,000).

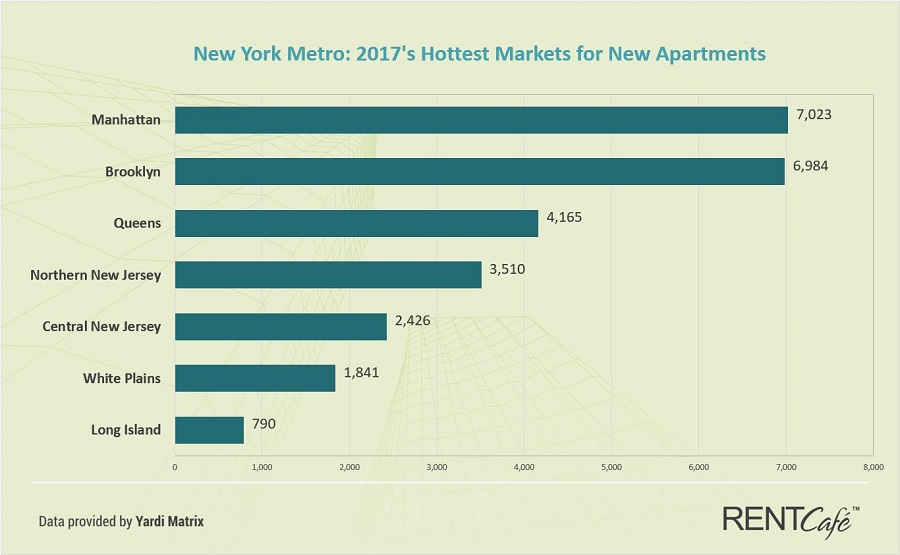

First in the country, NYC gained more than 17,000 new units last year, and the 27,000 on the books this year will give local supply an even bigger boost. Broken down by borough, not surprisingly Manhattan takes first place, as it is set to see more than 7,000 new units hit the scene just this year alone. Brooklyn isn’t far behind, with 6,900 units on its radar.

The Dallas-Fort Worth metro area is also seeing a serious influx of new units in recent years, with 25,000 expected by the end of 2017, second largest volume in the U.S. Fort Worth will gain about 3,500 units this year, while suburbs McKinney and Richardson will add 2,450 and 1,406, respectively.

A little further South in Texas, Houston metro is 3rd in the nation with close to 18,000 new apartments expected this year. The city has actually seen negative rent growth over the last year, due in large part to an overabundance of units, rents have dropped 1.1 percent since 2016.

Rental Apartments Continue to Be a Solid Bet

Regardless of supply levels or rates of rent growth, one thing is for certain: renting is on the rise. Millennials have the lowest levels of homeownership out of any recent generation, and to many young adults, the flexibility of renting just can’t be beat. Baby Boomers are increasingly leaning toward renting as well, choosing to cash out their home equity or just enjoy a lower-upkeep living arrangement as they age. One can only assume rental rates will continue to rally as these demographic preferences take hold.

Methodology:

RENTCafé is a nationwide apartment search website that enables renters to easily find apartments and houses for rent throughout the United States.

To compile this report, RENTCafé’s research team analyzed new apartment construction data across 134 U.S. Metropolitan Statistical Areas. The study is exclusively based on apartment data related to buildings containing 50 or more units. New supply refers to 50+ unit properties which have a completion date projected for 2017.

Building and rent data was provided by our sister company, Yardi Matrix, a business development and asset management tool for brokers, sponsors, banks and equity sources underwriting investments in the multifamily, office, industrial and self-storage sectors.

Data on population changes from 2015 to 2016 comes from the U.S. Census Bureau. Job growth data was provided by the U.S. Bureau of Labor Statistics and refers to 12-month percent changes in metropolitan area nonfarm payroll employment from May 2016 to May 2017.