Boston, MA Commercial Real Estate for Lease and Sale

Explore 458 listings of Boston commercial real estate to find the best space for your business.

-

150 Staniford St, West End Boston, Boston, MA

150 Staniford St, West End Boston, Boston, MA -

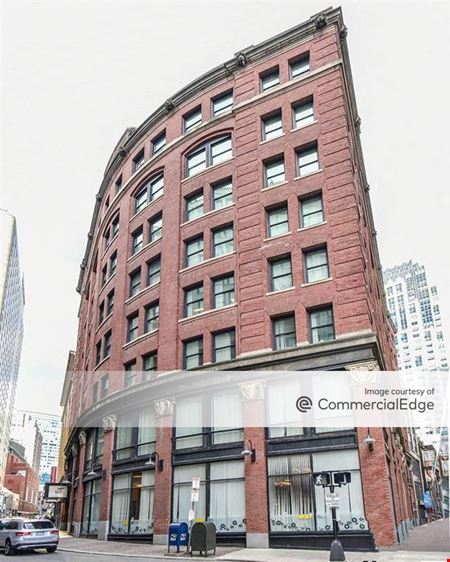

308 Congress Street, Downtown - Financial District, Boston, MA

308 Congress Street, Downtown - Financial District, Boston, MA -

2 Newbury Street, Back Bay, Boston, MAProperty

2 Newbury Street, Back Bay, Boston, MAProperty- Office

- 13,500 SF

Availability- 3 Spaces

- 6,841 SF

Year Built- 1823

For Lease Contact for pricing -

7 Water Street, Downtown - Financial District, Boston, MAProperty

7 Water Street, Downtown - Financial District, Boston, MAProperty- Office

- 45,000 SF

Availability- 1 Space

- 1,665 SF

Year Built- 1894

For Lease Contact for pricing -

What type of listing property are you looking for?

-

285 Summer Street, South Boston, Boston, MAProperty

285 Summer Street, South Boston, Boston, MAProperty- Office

- 53,790 SF

Availability- 2 Spaces

- 16,952 SF

Year Built- 1897

For Lease Contact for pricing -

9-45 Vale Street, Roxbury, Boston, MAProperty

9-45 Vale Street, Roxbury, Boston, MAProperty- VacantLand

For Sale- Subject To Offer

-

167 Devon Street, Roxbury, Boston, MA

167 Devon Street, Roxbury, Boston, MA -

395 Western Avenue, Allston - Brighton, Brighton, MAProperty

395 Western Avenue, Allston - Brighton, Brighton, MAProperty- Office

- 36,383 SF

Availability- 1 Space

- 14,260 SF

Year Built- 1940

For Lease Contact for pricing -

45 Milk Street, Downtown - Financial District, Boston, MAProperty

45 Milk Street, Downtown - Financial District, Boston, MAProperty- Office

- 68,995 SF

Availability- 3 Spaces

- 9,072 SF

Year Built- 1893

For Lease Contact for pricing -

1 Washington Street, Downtown - Financial District, Boston, MAProperty

1 Washington Street, Downtown - Financial District, Boston, MAProperty- Office

- 161,173 SF

Availability- 2 Spaces

- 16,207 SF

Year Built- 1971

For Lease Contact for pricing -

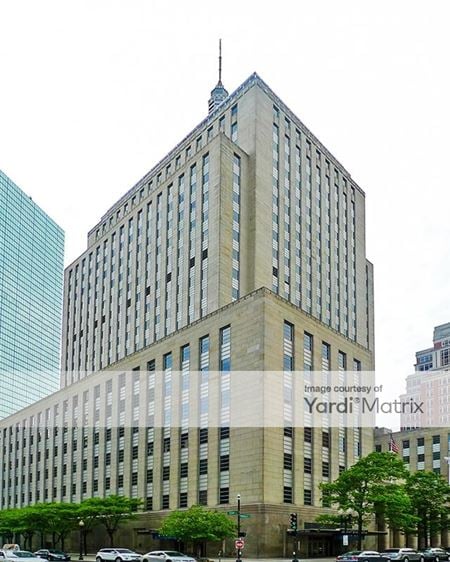

200 Berkeley Street, Back Bay, Boston, MAProperty

200 Berkeley Street, Back Bay, Boston, MAProperty- Office

- 762,572 SF

Availability- 17 Spaces

- 540,293 SF

Year Built- 1947

For Lease Contact for pricing -

24 Farnsworth Street, South Boston, Boston, MAProperty

24 Farnsworth Street, South Boston, Boston, MAProperty- Office

- 74,554 SF

Availability- 1 Space

- 13,505 SF

Year Built- 1915

For Lease Contact for pricing -

1-4 S Faneuil Hall Market Pl, Downtown - Financial District, Boston, MAProperty

1-4 S Faneuil Hall Market Pl, Downtown - Financial District, Boston, MAProperty- Office

- 149,646 SF

Availability- 22 Spaces

- 69,173 SF

Year Built- 1826

For Lease- $35.00/SF/YR

-

32 Warren Street, Roxbury, Boston, MAProperty

32 Warren Street, Roxbury, Boston, MAProperty- Retail

- 4,800 SF

Availability- 1 Space

- 4,800 SF

For Lease- $40.00/SF/YR

-

-

729 Boylston St, Back Bay, Boston, MA

729 Boylston St, Back Bay, Boston, MA -

45 Milk Street, Downtown - Financial District, Boston, MAProperty

45 Milk Street, Downtown - Financial District, Boston, MAProperty- Office

- 68,995 SF

Availability- 2 Spaces

- 15,810 SF

Year Built- 1893

For Lease Contact for pricing -

10 Post Office Square, Downtown - Financial District, Boston, MAProperty

10 Post Office Square, Downtown - Financial District, Boston, MAProperty- Office

- 451,947 SF

Availability- 1 Space

- 8,286 SF

Year Built- 1920

For Lease Contact for pricing -

70 Franklin Street, Downtown - Financial District, Boston, MAProperty

70 Franklin Street, Downtown - Financial District, Boston, MAProperty- Office

- 85,212 SF

Availability- 2 Spaces

- 23,175 SF

Year Built- 1894

For Lease Contact for pricing -

144 Harvard Avenue, Allston - Brighton, Boston, MA

144 Harvard Avenue, Allston - Brighton, Boston, MA -

116 Huntington Avenue, Back Bay, Boston, MAProperty

116 Huntington Avenue, Back Bay, Boston, MAProperty- Office

- 272,850 SF

Availability- 1 Space

- 8,022 SF

Year Built- 1990

For Lease Contact for pricing -

170 W Broadway # 101, South Boston, MAProperty

170 W Broadway # 101, South Boston, MAProperty- Retail

- 5,219 SF

For Sale- Subject To Offer

-

501 Boylston Street, Back Bay, Boston, MAProperty

501 Boylston Street, Back Bay, Boston, MAProperty- Office

- 609,750 SF

Availability- 1 Space

- 40,000 SF

Year Built- 1941

For Lease- $63.00 - $66.00/SF/YR

-

142 Berkeley Street, Back Bay, Boston, MAProperty

142 Berkeley Street, Back Bay, Boston, MAProperty- Office

- 100,000 SF

Availability- 1 Space

- 8,924 SF

Year Built- 1892

For Lease Contact for pricing -

31 Saint James Avenue, Back Bay, Boston, MAProperty

31 Saint James Avenue, Back Bay, Boston, MAProperty- Office

- 420,000 SF

Availability- 1 Space

- 26,077 SF

Year Built- 1922

For Lease- $54.00 - $60.00/SF/YR

-

660 Beacon Street, Fenway - Kenmore, Boston, MAProperty

660 Beacon Street, Fenway - Kenmore, Boston, MAProperty- Office

- 209,500 SF

Availability- 4 Spaces

- 109,000 SF

Year Built- 1910

For Lease Contact for pricing -

1804 Centre Street, West Roxbury, Boston, MA

1804 Centre Street, West Roxbury, Boston, MA -

732 East Broadway, Boston, MA

732 East Broadway, Boston, MA732 East Broadway

Offices @ The BroadwayServices- Meeting Room

- Private Office

Amenities -

110 Chauncy Street, Downtown - Financial District, Boston, MAProperty

110 Chauncy Street, Downtown - Financial District, Boston, MAProperty- Office

- 73,610 SF

Availability- 2 Spaces

- 9,935 SF

Year Built- 1899

For Lease Contact for pricing -

26 Exeter Street, Back Bay, Boston, MAProperty

26 Exeter Street, Back Bay, Boston, MAProperty- Office

- 47,388 SF

Availability- 1 Space

- 6,400 SF

Year Built- 1984

For Lease Contact for pricing -

757 Gallivan Boulevard, Dorchester, Boston, MA

757 Gallivan Boulevard, Dorchester, Boston, MA -

50 Congress Street, Downtown - Financial District, Boston, MAProperty

50 Congress Street, Downtown - Financial District, Boston, MAProperty- Office

- 179,872 SF

Availability- 2 Spaces

- 2,417 SF

Year Built- 1912

For Lease- $39.00/SF/YR

-

30 Leo M Birmingham Pkwy, Allston - Brighton, Boston, MA

30 Leo M Birmingham Pkwy, Allston - Brighton, Boston, MA -

200 High Street, Downtown - Financial District, Boston, MAProperty

200 High Street, Downtown - Financial District, Boston, MAProperty- Office

- 96,113 SF

Availability- 1 Space

- 5,696 SF

Year Built- 1860

For Lease Contact for pricing -

25 Court Street, Downtown - Financial District, Boston, MA

25 Court Street, Downtown - Financial District, Boston, MA -

28 State Street, Downtown - Financial District, Boston, MAProperty

28 State Street, Downtown - Financial District, Boston, MAProperty- Office

- 570,040 SF

Availability- 11 Spaces

- 110,445 SF

Year Built- 1968

For Lease Contact for pricing -

367 West Broadway, South Boston, Boston, MAProperty

367 West Broadway, South Boston, Boston, MAProperty- Retail

- 16,728 SF

Availability- 1 Space

- 1,000 SF

Year Built- 1920

For Lease Contact for pricing -

273 Summer Street, South Boston, Boston, MAProperty

273 Summer Street, South Boston, Boston, MAProperty- Office

- 150,361 SF

Availability- 3 Spaces

- 47,185 SF

Year Built- 1904

For Lease Contact for pricing -

100 City Square, Charlestown, MAProperty

100 City Square, Charlestown, MAProperty- Office

- 172 SF

Availability- 2 Spaces

- 33,685 SF

Year Built- 2002

For Lease Contact for pricing -

100 Causeway Street, West End Boston, Boston, MAProperty

100 Causeway Street, West End Boston, Boston, MAProperty- Office

- 826,000 SF

Availability- 1 Space

- 163,181 SF

Year Built- 2021

For Lease- $60.00/SF/YR

-

411 D Street, South Boston, Boston, MAProperty

411 D Street, South Boston, Boston, MAProperty- Retail

- 160,509 SF

Availability- 1 Space

- 690 SF

Year Built- 2012

For Lease Contact for pricing -

294 Washington Street, Downtown - Financial District, Boston, MAProperty

294 Washington Street, Downtown - Financial District, Boston, MAProperty- Office

- 229,810 SF

Availability- 3 Spaces

- 51,813 SF

Year Built- 1903

For Lease Contact for pricing -

120 Charles Street, Beacon Hill, Boston, MAProperty

120 Charles Street, Beacon Hill, Boston, MAProperty- Multi-Family

- 4,140 SF

Year Built- 1899

For Sale- Subject to Offer

-

11-15 Farnsworth Street, South Boston, Boston, MAProperty

11-15 Farnsworth Street, South Boston, Boston, MAProperty- Office

- 45,280 SF

Availability- 5 Spaces

- 41,565 SF

Year Built- 1910

For Lease Contact for pricing -

20 Park Plaza, Bay Village, Boston, MAProperty

20 Park Plaza, Bay Village, Boston, MAProperty- Office

- 259,562 SF

Availability- 1 Space

- 36,600 SF

Year Built- 1927

For Lease Contact for pricing -

141 Tremont Street, Downtown - Financial District, Boston, MA

141 Tremont Street, Downtown - Financial District, Boston, MA -

547 Columbus Avenue, South End Boston, Boston, MA

547 Columbus Avenue, South End Boston, Boston, MA -

547 Columbus Avenue, South End Boston, Boston, MAProperty

547 Columbus Avenue, South End Boston, Boston, MAProperty- Retail

- 2,370 SF

For Sale- Subject To Offer

-

24 Federal Street, Downtown - Financial District, Boston, MAProperty

24 Federal Street, Downtown - Financial District, Boston, MAProperty- Office

- 139,526 SF

Availability- 1 Space

- 5,967 SF

Year Built- 1905

For Lease Contact for pricing -

152 Bowdoin Street, Downtown - Financial District, Boston, MA

152 Bowdoin Street, Downtown - Financial District, Boston, MA -

10 Tremont Street, Downtown - Financial District, Boston, MAProperty

10 Tremont Street, Downtown - Financial District, Boston, MAProperty- Office

- 35,000 SF

Availability- 3 Spaces

- 10,880 SF

Year Built- 1900

For Lease- $42.00/SF/YR

-

152 Brighton Avenue, Allston - Brighton, Boston, MA

152 Brighton Avenue, Allston - Brighton, Boston, MA