Cities rise and fall based on the decisions they make regarding the best use of their resources — whether that’s the local talent pool, housing stock or business environment. And, contributing to all of these is the fundamental issue of how to manage and optimize the allocation of unused or underutilized land that can sustain housing needs and various economic activities.

To that end — and as a follow-up to a previous study on urban development and vacant parcels located in central business districts — CommercialCafe created an updated, city-wide analysis of vacant land availability and construction activity throughout 20 of the most populous urban centers in the U.S.

Specifically, by using the most recently available data from Property Shark and online government records, we estimated the total acreage and number of parcels, as well as the average lot size of undeveloped land within the cities in the ranking.

We also used CommercialEdge data to look at both planned and ongoing projects in the pipeline, highlighting specific local initiatives that seek to maximize the use of undeveloped parcels within cities. Additionally, where relevant, we provided a 10-year overview of industrial, office and residential construction activity at the city level.

Key Highlights:

- Cities across the Texas Triangle have tens of thousands of acres of undeveloped land.

- Densely built up areas such as New York City still have plenty of land for development

- Charlotte and San Francisco have less than 1,000 acres of undeveloped land between them.

- Industrial construction has been a vital component of all major cities’ pipelines since 2012, with the trend set to continue.

Before reading on, please consult our methodology section for a better understanding of the constraints that might have affected or influenced the interpretation of the findings within this analysis.

Cities Across the Texas Triangle Have Tens of Thousands of Acres of Undeveloped Land

Across the 20 most populous cities in the U.S. there are 516,980 acres of land currently still awaiting development – with the average lot size resting at roughly 1.22 acres.

Unsurprisingly for those familiar with the map of urban spawl across the U.S., cities across the South and Southwest boast tens of thousands of acres of undeveloped lots each.

Namely, Texas remained the home of urban sprawl with the highest number of entries on our list. In fact, with the exception of Phoenix — which landed in third place — the top five cities in terms of vacant land were all from the Lone Star state.

More precisely, Dallas led with a whopping 90,739 acres across more than 30,000 parcels with an average size of 2.72 acres. Since 2012, the city has added more than 40 million square feet of new office and industrial space to its inventory, spurred by an influx of businesses opting to relocate to Texas in recent years. Residential construction activity was also robust during the same period, with roughly 46,000 units developed throughout Dallas.

Then, this year, the city witnessed one of the biggest land sales in its recent history as 460 acres in the Mountain Creek development in southwest Dallas changed hands. The new owners will focus on residential construction in the area, with plans for new homes and apartments.

Not to be outdone, Dallas’ sister city, Fort Worth, Texas, boasted 74,835 acres of undeveloped land with average lot sizes around the 2.66-acre mark. Here, the city’s pipeline tilts heavily toward industrial development. In fact, no less than 51 million square feet of warehousing and manufacturing space were built between 2012 and 2022. And, the trend is set to continue in the near future as Fort Worth has 22 million square feet of new industrial space in the pipeline, either planned or under construction.

Notably, one of these planned developments is at the site of the former North Hills Mall along Boulevard 26 near Northeast Loop 820. The lot had been vacant since 2007 when the mall was razed, but city leaders are planning a three-phase construction project for the area, which includes single family homes and apartments, as well as some 60,000 square feet of commercial space. There’s also a proposal by Kairoi Residential to build an 825-unit apartment complex in the heart of the Fort Worth Stockyards. Moreover, a 24-acre tract in south Fort Worth is also up for grabs and marketed as the ideal location to fit some 572 newly built housing units.

Nestled between entries from Texas, Phoenix landed in third place with a grand total of 53,022 acres of vacant land. The city also boasted the third-highest average lot size on the list at 3.34 acres, behind only Oklahoma City and San Jose, Calif.

Notably, with a majority of the undeveloped land in Phoenix being government-owned, the City Council recently approved a list of 150 parcels to build new affordable housing in a push to create 50,000 homes by 2030. The project would consist of both single family homes and apartment complexes, depending on the varying sizes of the parcels at hand.

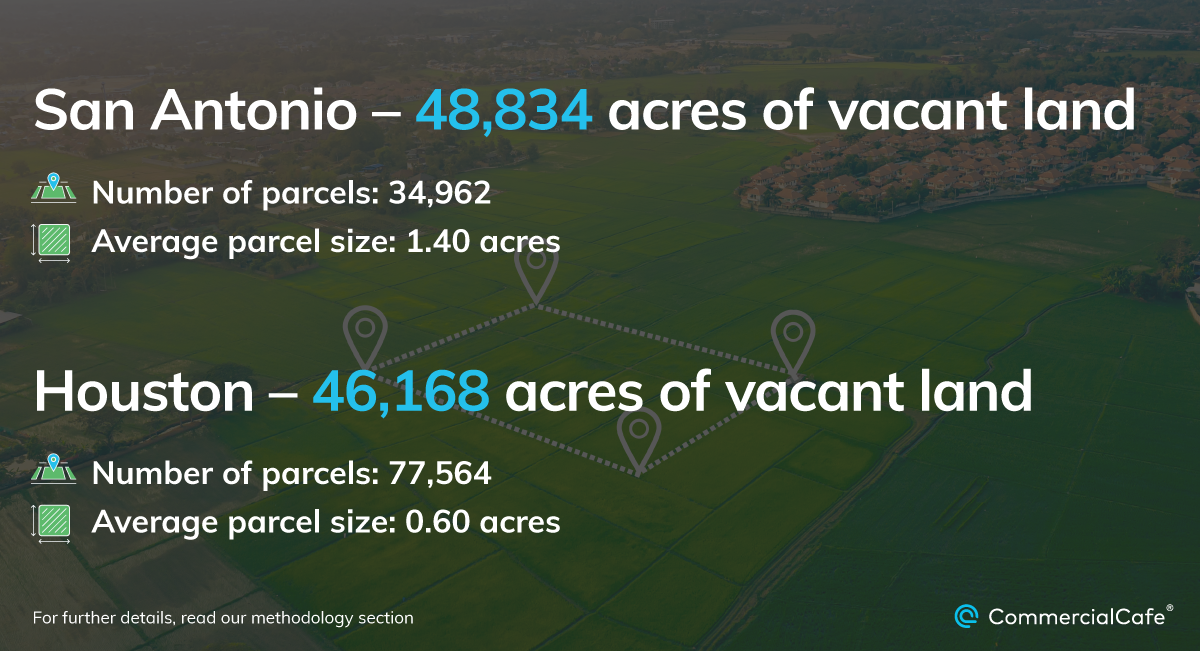

The other two Texas cities in the top five were San Antonio with roughly 35,000 parcels totaling 48,834 acres and Houston, which had more than double the number of parcels as San Antonio to total 46,168 acres. Accordingly, the average lot size in San Antonio was more than double that of its eastern neighbor.

Of course, both cities have witnessed strong construction activity in their respective commercial real estate markets since 2012, albeit at different scales. That said, Houston stood out among the cities on our list for adding the most industrial and office space to its inventory with 86.4 million, outranking even New York City in this regard. Houston also added the second-largest number of housing units (76,543).

Meanwhile, San Antonio’s decade-long focus on warehousing and industrial space development seems to be holding steady, as the city added 20.6 million square feet of new space since 2012. It’s also expected to add another 7 million in the following years.

Among the California entries in our ranking, Los Angeles placed the highest (sixth) with 42,228 acres of undeveloped land and an average lot size of 1.25 acres. Here, development remains focused on adding office space to the city’s inventory with roughly 11 million square feet in the pipeline (either planned or under construction).

Additionally, in January, a 260-acre plot of undeveloped land in Senderos Canyon came up for auction, opening up a host of development opportunities for interested parties. One of the major selling points of this plot — which cuts through the middle of Bel-Air — is that it has not yet been designated for a specific use. However, prospective buyers have already put forth proposals for a variety of projects for everything from a retirement community to a sprawling campus or an extensive wellness retreat.

Moving to seventh place, there’s a noticeable drop-off in terms of the overall vacant land acreage: Undeveloped tracts in Indianapolis added up to 26,604 acres — roughly half of the amount available in Los Angeles. What’s more, Indy also had the second-lowest number of housing units and office spaces built (within our ranking) throughout the decade, with the bulk of the construction activity in the market focusing on industrial properties (13 million square feet).

Granted, with only 13,471 units of housing built since 2012, attempts to increase Indianapolis’ residential inventory have also been underway. Most recently, the Department of Metropolitan Development drew up plans to take about 100 abandoned properties from the city land bank and offer them up for redevelopment, with special attention given to neighborhoods such as the Near Eastside, Martindale-Brightwood and Near Northwest.

Finally, Austin closed out the list of Texas entries on our list for vacant land availability in the top 20 most populous U.S. cities. Landing in eighth place, it had almost half of the acreage of undeveloped parcels at its disposal (25,117) as Houston.

Following an intense decade of commercial and residential development, Austin added some 38.4 million square feet of office and industrial properties to its stock, along with the third-highest number of housing units among our top 20 cities. Furthermore, when we considered ongoing or planned residential projects, Austin was second with 56,434 units to be built, behind only New York City.

Further south, the most populous city in Florida took the ninth position in this ranking with 24,396 acres of undeveloped land to its name and average lot sizes just under one acre: Jacksonville, Fla., had nearly 12.5 million square feet of industrial space in the pipeline, having already added some 15.6 million throughout the course of a decade.

Finding the right industrial, flex or office space has never been easier. With CommercialCafe.com you can browse the latest commercial real estate listings in your preferred location and filter results by space type, size or asking price:

As a matter of fact, according to a recent study by Cushman & Wakefield, Jacksonville has been one of the Florida markets that has witnessed not only rapid growth in warehousing and industrial construction, but also remarkable property stabilization rates with more than 90% of buildings’ rentable square footage leased.

As is often the case, Florida prepared for its current success long before the current industrial boom with infrastructure growth projects at the ports and by investing in rail. The COVID-19 pandemic then turbocharged the expansion of e-commerce and the need for warehousing facilities.

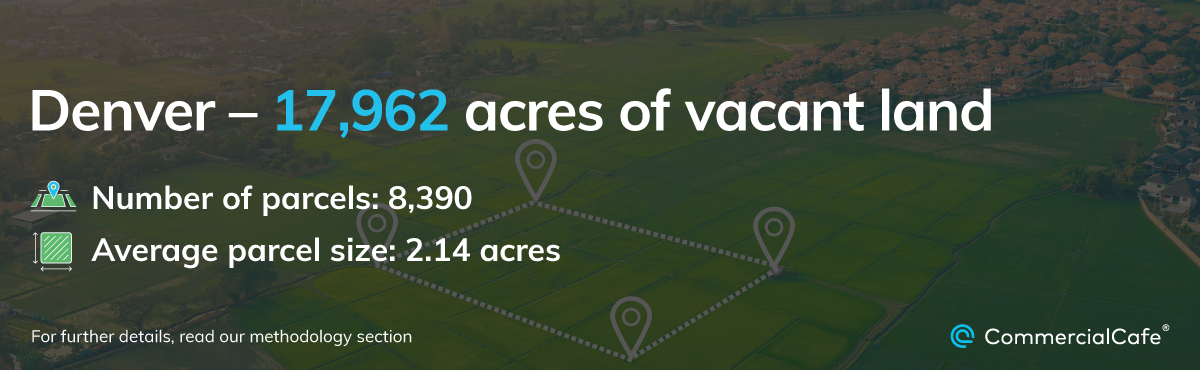

Last, but not least, Denver closed out the top 10 with 8,390 parcels of vacant land totaling 17,962 acres and ranking just ahead of New York City. Average lot size stood at 2.14 acres.

In the Mile High City, residential construction contributed the largest share to overall construction activity in Denver since 2012. Yet, despite adding 48,260 new housing units in the last decade — with 28,958 more to be added in the near future — the city is still looking for ways to bring down its cost of living by increasing the number of affordable homes. Among the suggested solutions are a series of regulatory rollbacks, a rethinking of the restrictive zoning codes in place and subsidization of housing costs. A better use of government-owned undeveloped parcels has also been on the agenda, with land near parking lots, Regional Transportation District stops and other infrastructure hubs being highlighted.

Plenty of Opportunities for Development in NYC, Whereas Charlotte & San Francisco Have Less Than 1,000 Acres of Undeveloped Land Between Them

Interestingly, the drop-offs between entries in the second half of our list were much steeper: While New York City — which fell just outside of the top 10 — was close to Denver’s total, cities like Charlotte, N.C., and San Francisco had only a few hundred acres’ worth of undeveloped land at their disposal.

Despite a decade of intense commercial and residential construction (which saw the addition of 68.5 million square feet of new office space and 80,142 units of housing to the city’s stock), there’s plenty of room for development in New York City. Specifically, there are 17,393 acres of vacant land with an average lot size of 0.62 acres.

Plus, in a recent report, the East New York Community Land Trust identified 255 city-owned parcels of undeveloped land in Brooklyn alone. Some of these parcels are currently either vacant or act as parking lots. But, as is often the case in a dense, urban area such as New York, some of these parcels house abandoned or neglected structures that would need to be razed before building anew.

On the opposite coast, San Diego and San Jose, Calif., were the last cities in our ranking to feature more than 10,000 acres of undeveloped land with11,607 and 11,527 acres, respectively. Otherwise, the only two Midwestern entries were Columbus, Ohio, and Chicago in 15th and 16th places, respectively.

However, as we moved further down the ranking, there was a significant drop in the amount of undeveloped land as Philadelphia and Oklahoma City had less than 2,500 acres at their disposal. It’s worth noting here, though, that the two cities had very different breakdowns of their available land. For example, Philadelphia had the lowest average lot size at 0.08 acres, while Oklahoma had the largest average lot size among the top 20 (12.83 acres).

Finally, Charlotte, N.C., and San Francisco had the least amounts of vacant land among the top 20 most populous U.S. cities: The North Carolina city had 512 acres of undeveloped tracts with an average size of roughly six acres, while San Francisco had 473 acres for an average size of just 0.21 acres.

The Challenges of Urban Development in a Post-Pandemic World

The relentless growth of the tech industry throughout the last decade — which had spurred a chase for talent and drove much of the construction boom since 2012 — prompted many local governments to seize on any opportunity to attract such companies to their cities.

To that end, state and city officials competed to bring Silicon Valley giants’ offices, data centers, and warehouses to their cities to create high-earning jobs that would stimulate the local economy and communities. As a result, zoning restrictions were eased and tax rebates handed out in some cities, while vacant parcels of land were inventoried and allotted to entice developers by reducing building costs.

Then, the pandemic marked a series of concurrent shifts in the trends that shape our lives. In particular, industrial construction — especially that of warehousing spaces — was turbocharged by the exponential rise of online shopping. Consequently, for the first time, tech companies were facing layoffs rather than expansions, with many switching to hybrid work schedules and reducing their office footprints. This, in turn, made many office developers reconsider the preferred location and nature of our workspaces, with an increased emphasis on health and safety measures; flexible layouts; and lease options.

Of course, many of the fastest-growing cities in the U.S. have yet to fully address their ongoing housing shortages. Even so, as noted in our analysis, local authorities have been trying to boost the construction of new homes. The hope is that the lower costs that come from making vacant land parcels available for single family, multifamily or apartment complexes will encourage developers to build more affordable houses to address one of the most vital human needs.

Methodology

This analysis compiles PropertyShark data and online government records to calculate the total acreage and number of parcels of undeveloped land throughout the 20 most populous American cities (ordered alphabetically): Austin, Texas; Charlotte, N.C.; Chicago; Columbus, Ohio; Dallas; Denver; Fort Worth, Texas; Houston, Texas; Indianapolis; Jacksonville, Fla.; Los Angeles; New York City, N.Y.; Oklahoma City; Philadelphia; Phoenix; San Antonio; San Diego; San Francisco; San Jose, Calif.; and Seattle.

Only parcels located within the city limits were included, contiguous and non-contiguous, regardless of size, as defined by U.S. Census Bureau’s 2022 TIGER/Line® Shapefiles: Places. We then further filtered these results to highlight any parcels labeled as undeveloped property at the time of our query. The inconsistencies and limits of any analysis on this topic have been addressed in our previous endeavor and they remain in place. The definition of “vacant land” varies from one urban area to another, and the frequency at which records are being updated is also dependent upon location. For the purposes of this study, we included lots that were mainly designated as “vacant lots-no improvements,” and carried a sub-designation matching “vacant commercial,” “vacant government-owned,” “vacant industrial,” “vacant residential” or “other vacant.”

Information on recently completed construction projects was compiled with the help of CommercialEdge data and is expressed as of December 2022, going back to January 2012. However, this data includes only buildings of at least 25,000 square feet.

Details on prospective, planned, or current construction were drawn from CommercialEdge data, highlighting the total office square footage and total residential units as of February 2023. We considered the property status as follows: “property status: under construction” reflects property on which construction is actively being carried out, whereas “property status: planned” project plans have approval, but construction is not yet being actively carried out.