Glendale, CA Office Spaces for Rent

Find your best Glendale, CA office space among 139 for rent listings, which average an asking price of $39.97 per square foot.

-

450 North Brand Boulevard Suite 600, Glendale, CA

450 North Brand Boulevard Suite 600, Glendale, CABrand Boulevard

RegusServices- Virtual Office

- Open Workspace

- Private Office

- Dedicated Desk

Amenities -

207 Goode Avenue, Glendale City Center, Glendale, CAProperty

207 Goode Avenue, Glendale City Center, Glendale, CAProperty- Office

- 189,109 SF

Availability- 1 Space

- 27,244 SF

Year Built- 2009

For Lease- $0.99/SF/MO

-

425 West Broadway, Vineyard, Glendale, CAProperty

425 West Broadway, Vineyard, Glendale, CAProperty- Office

- 72,610 SF

Availability- 1 Space

- 1,667 SF

Year Built- 1984

For Lease- $2.70/SF/MO

-

1510 South Central Avenue, Tropico, Glendale, CAProperty

1510 South Central Avenue, Tropico, Glendale, CAProperty- Office

- 70,773 SF

Availability- 6 Spaces

- 9,231 SF

Year Built- 1988

For Lease- $3.45/SF/MO

-

1560 East Chevy Chase Drive, Woodbury, Glendale, CAProperty

1560 East Chevy Chase Drive, Woodbury, Glendale, CAProperty- Office

- 59,392 SF

Availability- 3 Spaces

- 3,137 SF

Year Built- 1977

For Lease Contact for pricing -

1220 S Central Ave, Tropico, Glendale, CAProperty

1220 S Central Ave, Tropico, Glendale, CAProperty- Retail

- 13,107 SF

Availability- 3 Spaces

- 2,759 SF

Year Built- 1992

For Lease- $2.24 - $3.50/SF/MO

-

-

611 North Brand Boulevard, Glendale, CA

611 North Brand Boulevard, Glendale, CA611 North Brand Boulevard

WeWorkServices- Virtual Office

- Event Space

- Meeting Room

- Private Office

- Dedicated Desk

Amenities -

700 North Central Avenue, Glendale City Center, Glendale, CAProperty

700 North Central Avenue, Glendale City Center, Glendale, CAProperty- Office

- 136,253 SF

Availability- 9 Spaces

- 42,230 SF

Year Built- 1979

For Lease- $2.85 - $2.95/SF/MO

-

1808 Verdugo Blvd, San Rafael Hills, Glendale, CAProperty

1808 Verdugo Blvd, San Rafael Hills, Glendale, CAProperty- Office

- 106,962 SF

Availability- 3 Spaces

- 5,428 SF

Year Built- 1972

For Lease Contact for pricing -

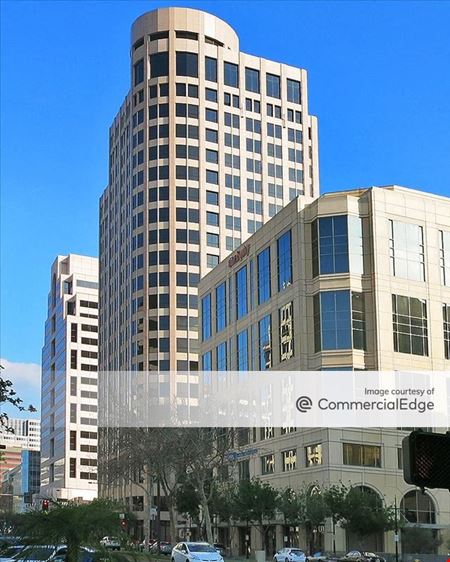

801 North Brand Blvd, Glendale City Center, Glendale, CAProperty

801 North Brand Blvd, Glendale City Center, Glendale, CAProperty- Office

- 282,698 SF

Availability- 14 Spaces

- 107,560 SF

Year Built- 1986

For Lease- $3.35/SF/MO

-

225 West Broadway, Glendale City Center, Glendale, CAProperty

225 West Broadway, Glendale City Center, Glendale, CAProperty- Office

- 122,358 SF

Availability- 6 Spaces

- 19,229 SF

Year Built- 1980

For Lease- $2.85/SF/MO

-

655 North Central Avenue Suite 1700, Glendale, CA

655 North Central Avenue Suite 1700, Glendale, CACentral Avenue

RegusServices- Virtual Office

- Open Workspace

- Private Office

- Dedicated Desk

Amenities -

330 North Brand Blvd, Glendale City Center, Glendale, CAProperty

330 North Brand Blvd, Glendale City Center, Glendale, CAProperty- Office

- 330,943 SF

Availability- 1 Space

- 360 SF

Year Built- 1982

For Lease Contact for pricing -

207 Goode Avenue, Glendale City Center, Glendale, CAProperty

- Office

- 189,109 SF

Availability- 1 Space

- 7,892 SF

Year Built- 2009

For Lease- $2.70/SF/MO

-

655 North Central Avenue, Vineyard, Glendale, CAProperty

- Office

- 591,958 SF

Availability- 5 Spaces

- 2,650 SF

Year Built- 1998

For Lease Contact for pricing -

800 North Brand Blvd, Glendale City Center, Glendale, CAProperty

800 North Brand Blvd, Glendale City Center, Glendale, CAProperty- Office

- 518,302 SF

Availability- 2 Spaces

- 53,364 SF

Year Built- 1990

For Lease Contact for pricing -

315 Arden Avenue, Fremont Park, Glendale, CAProperty

315 Arden Avenue, Fremont Park, Glendale, CAProperty- Office

- 26,560 SF

Availability- 1 Space

- 3,635 SF

Year Built- 1974

For Lease- $2.35/SF/MO

-

340 Arden Avenue, Glendale, CAServices

340 Arden Avenue, Glendale, CAServices- Virtual Office

- Open Workspace

- Private Office

- Dedicated Desk

Amenities -

335 North Brand Boulevard, Suite 230, Glendale City Center, Glendale, CAProperty

335 North Brand Boulevard, Suite 230, Glendale City Center, Glendale, CAProperty- Office

- 20,520 SF

Availability- 1 Space

- 962 SF

Year Built- 1923

For Lease- $2.10/SF/MO

-

201 North Brand Blvd, Glendale City Center, Glendale, CAProperty

201 North Brand Blvd, Glendale City Center, Glendale, CAProperty- Office

- 31,880 SF

Availability- 5 Spaces

- 2,650 SF

Year Built- 1945

For Lease Contact for pricing -

1500 South Central Avenue, Tropico, Glendale, CAProperty

1500 South Central Avenue, Tropico, Glendale, CAProperty- Office

- 36,959 SF

Availability- 4 Spaces

- 6,072 SF

Year Built- 1980

For Lease Contact for pricing -

500 North Brand Blvd, Glendale City Center, Glendale, CAProperty

500 North Brand Blvd, Glendale City Center, Glendale, CAProperty- Office

- 420,151 SF

Availability- 1 Space

- 3,914 SF

Year Built- 1990

For Lease- $2.95/SF/MO

-

222 West Eulalia Street, Tropico, Glendale, CAProperty

222 West Eulalia Street, Tropico, Glendale, CAProperty- Office

- 59,927 SF

Availability- 3 Spaces

- 4,986 SF

Year Built- 2002

For Lease- $3.95/SF/MO

-

201 N. Brand Blvd. Suite 200, Glendale, CA

201 N. Brand Blvd. Suite 200, Glendale, CADowntown Glendale

RegusServices- Virtual Office

- Open Workspace

- Private Office

- Dedicated Desk

Amenities -

611 North Brand Blvd, Glendale City Center, Glendale, CAProperty

611 North Brand Blvd, Glendale City Center, Glendale, CAProperty- Office

- 382,230 SF

Availability- 11 Spaces

- 182,533 SF

Year Built- 1972

For Lease- $2.50 - $3.15/SF/MO

-

222 W Eulalia Street, Tropico, Glendale, CAProperty

222 W Eulalia Street, Tropico, Glendale, CAProperty- Office

- 57,600 SF

Availability- 3 Spaces

- 4,986 SF

Year Built- 2002

For Lease Contact for pricing -

1500 East Chevy Chase Drive, Woodbury, Glendale, CAProperty

1500 East Chevy Chase Drive, Woodbury, Glendale, CAProperty- Office

- 76,197 SF

Availability- 1 Space

- 3,197 SF

Year Built- 2008

For Lease- $4.75/SF/MO

-

550 North Brand Blvd, Glendale City Center, Glendale, CAProperty

550 North Brand Blvd, Glendale City Center, Glendale, CAProperty- Office

- 302,119 SF

Availability- 1 Space

- 3,264 SF

Year Built- 1986

For Lease- $2.45/SF/MO

-

601 East Glenoaks Boulevard, Rossmoyne, Glendale, CAProperty

601 East Glenoaks Boulevard, Rossmoyne, Glendale, CAProperty- Office

- 19,018 SF

Availability- 2 Spaces

- 4,465 SF

For Lease- $2.50/SF/MO

-

3501 Ocean View Boulevard, Glendale, CA

Voivoda Office Building

Kukery LLCServices- Private Office

Amenities -

100 West Broadway, Glendale City Center, Glendale, CAProperty

100 West Broadway, Glendale City Center, Glendale, CAProperty- Office

- 138,177 SF

Availability- 5 Spaces

- 6,866 SF

Year Built- 1983

For Lease- $2.24 - $6.02/SF/MO

-

535 North Brand Blvd, Glendale City Center, Glendale, CAProperty

535 North Brand Blvd, Glendale City Center, Glendale, CAProperty- Office

- 119,323 SF

Availability- 1 Space

- 2,445 SF

Year Built- 1972

For Lease- $2.40/SF/MO

-

101 North Brand Blvd, Glendale City Center, Glendale, CAProperty

101 North Brand Blvd, Glendale City Center, Glendale, CAProperty- Office

- 408,034 SF

Availability- 7 Spaces

- 71,423 SF

Year Built- 1990

For Lease- $3.45 - $3.50/SF/MO

-

700 North Brand Blvd, Glendale City Center, Glendale, CAProperty

700 North Brand Blvd, Glendale City Center, Glendale, CAProperty- Office

- 212,206 SF

Availability- 10 Spaces

- 61,922 SF

Year Built- 1981

For Lease- $36.00/SF/YR

-

1110 North Brand Boulevard, Suite 304, Rossmoyne, Glendale, CAProperty

1110 North Brand Boulevard, Suite 304, Rossmoyne, Glendale, CAProperty- Office

- 10,800 SF

Availability- 1 Space

- 739 SF

Year Built- 1987

For Lease- $2.65/SF/MO

-

1505 Wilson Terrace, Woodbury, Glendale, CAProperty

1505 Wilson Terrace, Woodbury, Glendale, CAProperty- Office

- 138,495 SF

Availability- 1 Space

- 1,190 SF

Year Built- 1992

For Lease Contact for pricing -

.jpg?width=450) 1500 E Chevy Chase Drive, Woodbury, Glendale, CAProperty

1500 E Chevy Chase Drive, Woodbury, Glendale, CAProperty- Office

- 76,197 SF

Availability- 1 Space

- 3,197 SF

Year Built- 2008

For Lease Contact for pricing -

101 N. Brand Blvd., Glendale City Center, Glendale, CAProperty

101 N. Brand Blvd., Glendale City Center, Glendale, CAProperty- Office

- 367,867 SF

Availability- 2 Spaces

- 33,549 SF

Year Built- 1991

For Lease Contact for pricing -

620 N Brand Blvd, Glendale City Center, Glendale, CAProperty

620 N Brand Blvd, Glendale City Center, Glendale, CAProperty- Office

- 44,952 SF

Availability- 2 Spaces

- 13,404 SF

Year Built- 1969

For Lease- $2.25/SF/MO

-

500 East Colorado Street, Mariposa, Glendale, CAProperty

500 East Colorado Street, Mariposa, Glendale, CAProperty- Office

- 39,067 SF

Availability- 1 Space

- 10,000 SF

Year Built- 2020

For Lease Contact for pricing -

500 North Brand Boulevard #2000, Glendale, CA

500 North Brand Boulevard #2000, Glendale, CA500 North Brand Boulevard

IndustriousServices- Virtual Office

- Meeting Room

- Private Office

Amenities -

100 North Brand Boulevard #200, Glendale, CA

100 North Brand Boulevard #200, Glendale, CA100 North Brand

100 North BrandServices- Event Space

- Meeting Room

- Private Office

Amenities -

500 North Central Avenue, Glendale City Center, Glendale, CAProperty

500 North Central Avenue, Glendale City Center, Glendale, CAProperty- Office

- 122,224 SF

Availability- 1 Space

- 2,208 SF

Year Built- 1990

For Lease Contact for pricing -

512 East Wilson Avenue, Glendale City Center, Glendale, CAProperty

512 East Wilson Avenue, Glendale City Center, Glendale, CAProperty- Office

- 20,727 SF

Availability- 4 Spaces

- 4,175 SF

For Lease- $2.25 - $2.75/SF/MO

-

801 S Chevy Chase Dr, Mariposa, Glendale, CAProperty

801 S Chevy Chase Dr, Mariposa, Glendale, CAProperty- Office

- 105,793 SF

Availability- 1 Space

- 13,713 SF

Year Built- 1976

For Lease- $3.25/SF/MO

-

313 East Broadway, Glendale City Center, Glendale, CA

313 East Broadway, Glendale City Center, Glendale, CA -

121 West Lexington Drive, Glendale, CA

121 West Lexington Drive, Glendale, CA121 West Lexington Drive

Hollywood Production CenterServices- Meeting Room

- Private Office

Amenities -

505 N Brand Blvd, Glendale City Center, Glendale, CA

505 N Brand Blvd, Glendale City Center, Glendale, CA -

330 N Brand Blvd, Glendale City Center, Glendale, CA

330 N Brand Blvd, Glendale City Center, Glendale, CA -

225 East Broadway, Glendale, CA

225 East Broadway, Glendale, CA225 East Broadway

Hollywood Production CenterServices- Meeting Room

- Private Office

Amenities -

1530 East Chevy Chase Drive, Woodbury, Glendale, CAProperty

1530 East Chevy Chase Drive, Woodbury, Glendale, CAProperty- Office

- 20,880 SF

Availability- 2 Spaces

- 4,755 SF

Year Built- 1960

For Lease Contact for pricing