Anaheim, CA Office Spaces for Rent

Find your best Anaheim, CA office space among 113 for rent listings, which average an asking price of $29.23 per square foot.

-

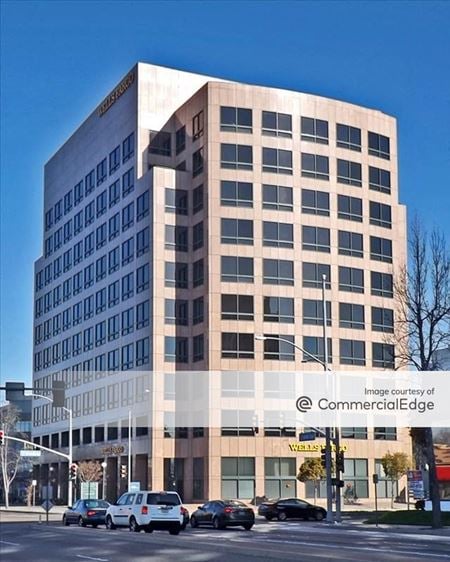

300 S Harbor Blvd, The Colony, Anaheim, CAProperty

300 S Harbor Blvd, The Colony, Anaheim, CAProperty- Office

- 121,825 SF

Availability- 8 Spaces

- 33,844 SF

Year Built- 1971

For Lease- $2.45 - $2.85/SF/MO

-

180 North Riverview Drive, Anaheim Hills, Anaheim, CAProperty

180 North Riverview Drive, Anaheim Hills, Anaheim, CAProperty- Office

- 60,000 SF

Availability- 1 Space

- 6,036 SF

Year Built- 1988

For Lease- $2.59/SF/MO

-

2400 E. Katella Ave., Platinum Triangle, Anaheim, CAProperty

2400 E. Katella Ave., Platinum Triangle, Anaheim, CAProperty- Office

- 261,858 SF

Availability- 11 Spaces

- 36,871 SF

Year Built- 1988

For Lease Contact for pricing -

3340 W Ball Road, West Anaheim, Anaheim, CAProperty

3340 W Ball Road, West Anaheim, Anaheim, CAProperty- Office

- 15,706 SF

Availability- 1 Space

- 2,221 SF

Year Built- 1972

For Lease- $1.75/SF/MO

-

2401 East Katella Avenue, Platinum Triangle, Anaheim, CAProperty

2401 East Katella Avenue, Platinum Triangle, Anaheim, CAProperty- Office

- 107,687 SF

Availability- 1 Space

- 3,667 SF

Year Built- 1986

For Lease- $2.65/SF/MO

-

1575 South State College Blvd, Platinum Triangle, Anaheim, CAProperty

1575 South State College Blvd, Platinum Triangle, Anaheim, CAProperty- Industrial

- 215,637 SF

Availability- 1 Space

- 12,000 SF

Year Built- 1968

For Lease- $0.55/SF/MO

-

888 South Disneyland Drive, West Anaheim, Anaheim, CAProperty

888 South Disneyland Drive, West Anaheim, Anaheim, CAProperty- Office

- 99,800 SF

Availability- 4 Spaces

- 52,344 SF

Year Built- 1982

For Lease Contact for pricing -

2121 South Towne Centre Place, Platinum Triangle, Anaheim, CAProperty

2121 South Towne Centre Place, Platinum Triangle, Anaheim, CAProperty- Office

- 96,878 SF

Availability- 3 Spaces

- 40,054 SF

Year Built- 1981

For Lease Contact for pricing -

1240 South State College Blvd, Platinum Triangle, Anaheim, CAProperty

1240 South State College Blvd, Platinum Triangle, Anaheim, CAProperty- Office

- 66,609 SF

Availability- 7 Spaces

- 41,186 SF

Year Built- 1979

For Lease Contact for pricing -

8030 E Crystal Dr # 5609, Anaheim Hills, Anaheim, CAProperty

8030 E Crystal Dr # 5609, Anaheim Hills, Anaheim, CAProperty- Industrial

- 24,000 SF

Availability- 1 Space

- 4,600 SF

For Lease- $1.50/SF/MO

-

2300 E. Katella Ave, Platinum Triangle, Anaheim, CAProperty

2300 E. Katella Ave, Platinum Triangle, Anaheim, CAProperty- Office

- 68,000 SF

Availability- 5 Spaces

- 21,160 SF

Year Built- 1986

For Lease- $35.40/SF/YR

-

2390 East Orangewood Avenue, Platinum Triangle, Anaheim, CAProperty

2390 East Orangewood Avenue, Platinum Triangle, Anaheim, CAProperty- Office

- 107,029 SF

Availability- 8 Spaces

- 44,299 SF

Year Built- 1982

For Lease Contact for pricing -

100 South Chaparral Court, Anaheim Hills, Anaheim, CAProperty

100 South Chaparral Court, Anaheim Hills, Anaheim, CAProperty- Office

- 103,926 SF

Availability- 9 Spaces

- 16,275 SF

Year Built- 1988

For Lease- $1.65 - $1.90/SF/MO

-

2170 South Towne Centre Place, Platinum Triangle, Anaheim, CAProperty

2170 South Towne Centre Place, Platinum Triangle, Anaheim, CAProperty- Office

- 97,854 SF

Availability- 5 Spaces

- 17,383 SF

Year Built- 1982

For Lease Contact for pricing -

5481 E Santa Ana Canyon Road, Anaheim Hills, CAProperty

5481 E Santa Ana Canyon Road, Anaheim Hills, CAProperty- Office

- 4,665 SF

Availability- 1 Space

- 4,665 SF

Year Built- 1998

For Lease- $1.00/SF/MO

-

520 N. Brookhurst Street, West Anaheim, Anaheim, CAProperty

520 N. Brookhurst Street, West Anaheim, Anaheim, CAProperty- Office

- 28,627 SF

Availability- 3 Spaces

- 1,613 SF

Year Built- 1977

For Lease- $750.00 - $1,420.80/MO

-

4123 East La Palma Avenue, Canyon District, Anaheim, CAProperty

4123 East La Palma Avenue, Canyon District, Anaheim, CAProperty- Office

- 70,863 SF

Availability- 1 Space

- 14,495 SF

Year Built- 1985

For Lease Contact for pricing -

1240 North Lakeview Avenue, Canyon District, Anaheim, CAProperty

1240 North Lakeview Avenue, Canyon District, Anaheim, CAProperty- Office

- 80,288 SF

Availability- 3 Spaces

- 8,479 SF

Year Built- 1986

For Lease- $1.99/SF/MO

-

4501 E La Palma Avenue, Canyon District, Anaheim, CAProperty

4501 E La Palma Avenue, Canyon District, Anaheim, CAProperty- Office

- 22,889 SF

Availability- 1 Space

- 5,538 SF

For Lease- $1.25/SF/MO

-

155 North Riverview Drive, Anaheim Hills, CAProperty

155 North Riverview Drive, Anaheim Hills, CAProperty- Office

- 26,511 SF

Availability- 5 Spaces

- 2,650 SF

Year Built- 1986

For Lease Contact for pricing -

222 S. Harbor Blvd., The Colony, Anaheim, CAProperty

222 S. Harbor Blvd., The Colony, Anaheim, CAProperty- Office

- 194,892 SF

Availability- 2 Spaces

- 3,195 SF

Year Built- 1986

For Lease- $30.60/SF/YR

-

175 North Riverview Drive, Anaheim Hills, Anaheim, CAProperty

175 North Riverview Drive, Anaheim Hills, Anaheim, CAProperty- Office

- 41,148 SF

Availability- 1 Space

- 40,066 SF

Year Built- 1989

For Lease- $2.50/SF/MO

-

1900 South State College Blvd, Platinum Triangle, Anaheim, CAProperty

1900 South State College Blvd, Platinum Triangle, Anaheim, CAProperty- Office

- 272,826 SF

Availability- 2 Spaces

- 24,191 SF

Year Built- 2001

For Lease Contact for pricing -

155 North Riverview Drive, Anaheim, CA

155 North Riverview Drive, Anaheim, CAANA - Anaheim Hills

Premier WorkspacesServices- Meeting Room

Amenities -

5100 East La Palma Avenue, Canyon District, Anaheim, CAProperty

5100 East La Palma Avenue, Canyon District, Anaheim, CAProperty- Industrial

- 143,850 SF

Availability- 6 Spaces

- 7,732 SF

Year Built- 1988

For Lease- $1.45 - $1.86/SF/MO

-

3400 W Ball Road, West Anaheim, Anaheim, CAProperty

3400 W Ball Road, West Anaheim, Anaheim, CAProperty- Office

- 29,668 SF

Availability- 3 Spaces

- 4,207 SF

Year Built- 1982

For Lease- $1.75 - $1.95/SF/MO

-

8141 East Kaiser Blvd, Anaheim Hills, CAProperty

8141 East Kaiser Blvd, Anaheim Hills, CAProperty- Office

- 37,987 SF

Availability- 2 Spaces

- 2,864 SF

Year Built- 1986

For Lease- $2.49/SF/MO

-

5101 East La Palma Avenue, Anaheim, CA

5101 East La Palma Avenue, Anaheim, CA5101 East La Palma Avenue

SuitesproServices- Virtual Office

- Meeting Room

- Private Office

Amenities -

617 S Harbor Blvd, The Colony, Anaheim, CA

617 S Harbor Blvd, The Colony, Anaheim, CA -

1301 E Orangewood Ave, Platinum Triangle, Anaheim, CAProperty

1301 E Orangewood Ave, Platinum Triangle, Anaheim, CAProperty- Office

- 18,706 SF

Availability- 1 Space

- 18,706 SF

Year Built- 1980

For Lease- $2.75/SF/MO

-

1035 N. Magnolia Ave, West Anaheim, Anaheim, CA

1035 N. Magnolia Ave, West Anaheim, Anaheim, CA -

2390 E Orangewood Avenue, Platinum Triangle, Anaheim, CAProperty

2390 E Orangewood Avenue, Platinum Triangle, Anaheim, CAProperty- Office

- 108,226 SF

Availability- 1 Space

- 1,400 SF

Year Built- 1982

For Lease Contact for pricing -

500 S Anaheim Hills Road, Anaheim Hills, Anaheim, CAProperty

500 S Anaheim Hills Road, Anaheim Hills, Anaheim, CAProperty- Office

- 43,679 SF

Availability- 6 Spaces

- 6,814 SF

Year Built- 1982

For Lease Contact for pricing -

E. Katella & River Rd. , Platinum Triangle, Anaheim, CAProperty

E. Katella & River Rd. , Platinum Triangle, Anaheim, CAProperty- Office

- 168,137 SF

Availability- 6 Spaces

- 168,137 SF

Year Built- 2026

For Lease Contact for pricing -

3400 West Ball Road, West Anaheim, Anaheim, CAProperty

3400 West Ball Road, West Anaheim, Anaheim, CAProperty- Office

- 29,668 SF

Availability- 1 Space

- 1,646 SF

Year Built- 1982

For Lease- $1.75/SF/MO

-

125 Chaparral Ct, Anaheim Hills, Anaheim, CAProperty

125 Chaparral Ct, Anaheim Hills, Anaheim, CAProperty- Office

- 8,000 SF

Availability- 1 Space

- 750 SF

Year Built- 1994

For Lease- $2.35/SF/YR

-

8175 East Kaiser Boulevard #209, Anaheim, CA

8175 East Kaiser Boulevard #209, Anaheim, CA8175 East Kaiser Boulevard

SuitesproServices- Virtual Office

- Meeting Room

- Private Office

Amenities